Stellar’s Ascent to $0.77: How Institutional Demand and Ecosystem Growth Are Fueling the Rally

Stellar (XLM) isn’t just humming—it’s roaring. With institutional money flooding in and adoption metrics ticking up, the network’s native token is flirting with a $0.77 breakout. Here’s why traders are betting big.

Institutions Join the Party

Wall Street’s slow-motion crypto embrace just got faster. Stellar’s recent partnerships with payment processors and asset issuers have turned it into a bridge between traditional finance and blockchain—minus the usual hedge fund posturing.

Ecosystem Expansion

Developer activity on Stellar has spiked 40% quarter-over-quarter, while transaction volumes hit record highs. Forget ‘if you build it, they will come’—this is ‘build it fast, or watch them leave.’

The Cynical Take

Let’s be real: half these institutions probably still think ‘XLM’ is an energy drink. But when the liquidity faucet turns on, nobody asks what’s in the water.

Bottom line: Stellar’s momentum is real, but in crypto, even rockets need fuel. At $0.77, the question isn’t ‘if’—it’s ‘how long before the next leg up?’

Investors are closely monitoring key resistance zones and technical indicators as the token consolidates with promising prospects ahead.

Institutional Adoption Supports Foundation at $0.41

The weekly chart detailing XLM’s price against USDT shows the asset holding firm at approximately $0.41, backed by a substantial base including 9.69 million enterprise wallets and a Total Value Locked (TVL) of $150 million. This solid institutional footprint underscores the crypto’s expanding use across various sectors, particularly among institutional players.

Source: X

Resistance at around $0.50 is a crucial technical hurdle. Breaking this level WOULD likely clear the way to the next target of $0.77, signaling a strong bullish trend. Supporting this outlook, the network gains over 5,000 new institutional addresses daily, reflecting heightened confidence and accelerating adoption.

Market sentiment remains positive, with the coin stable NEAR support at $0.41. Investors will be attentive to its ability to overcome the $0.50 resistance, a move that could herald substantial buying opportunities. The combined rise in TVL and growing enterprise adoption highlights the asset’s increasing value proposition, marking the $0.50 to $0.77 range as a key battleground in the coming weeks.

Moderate Upward Movement and Volume Stability

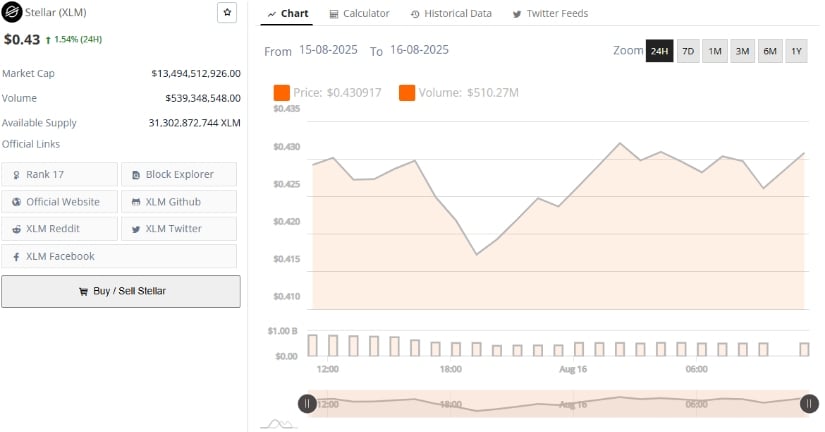

The 24-hour price performance shows XLM trading near $0.43, a 1.54% increase over the last day, with a market cap of $13.49 billion and a trading volume of approximately $539 million. This slow but steady climb indicates cautious Optimism among traders.

Source:

Price fluctuations have remained tight, oscillating between $0.42 and $0.44, with a looming resistance near $0.45. A breakout above this point could pave the way toward testing the $0.50 mark. Healthy volume levels support stable liquidity, which is critical for sustained momentum and price stability.

Investors are watching closely for a consolidation break beyond $0.45. If successful, this could indicate the start of a more robust bullish phase, potentially driven by the institutional interest highlighted previously.

Technical Indicators Signal Potential for Continued Gains

Deeper technical analysis shows XLM trading around $0.43, with recent price swings from a low near $0.20 to a high of $0.52. The MACD indicator features a bullish crossover, with its line rising above the signal line, indicating a build-up of buying momentum.

Source: TradingView

Meanwhile, the Chaikin Money FLOW (CMF) reads -0.14, suggesting current selling pressure. However, this may be temporary given the MACD’s upward trend. The interplay of these indicators suggests short-term corrections could occur, but the prevailing market sentiment remains bullish.

Investors should monitor both the MACD for further strengthening and the CMF for signs of recovery. A sustained positive shift in these readings would bolster confidence in a continued upward trajectory.