Bitcoin (BTC) Plunge Alert: $117K Support Tested as Market Panic Spreads – Can Bulls Hold the Line?

Blood in the crypto streets as Bitcoin gets swept up in a brutal sell-off. The king of crypto just nosedived to $117K – and now everyone's watching those critical support levels like hawks.

Here's what's rattling traders:

• The $117K level isn't just psychological – it's a major technical battleground where buy orders typically cluster. Break this, and we could see cascading liquidations.

• Market makers are playing both sides – propping up prices just enough to trigger stop losses before the real move begins. Classic Wall Street playbook, just with more memes.

• Institutional traders are quietly accumulating while retail panics. The smart money knows these dips are buying opportunities in a long-term bull market.

Remember: Bitcoin doesn't die – it just takes prisoners. This might just be another shakeout before the next leg up. Or as traditional finance guys would say: 'A healthy correction in an overheated market' (translation: we missed the boat again).

The world’s largest cryptocurrency saw heightened volatility after briefly touching highs above $123,000 earlier this week. Analysts are closely watching key support zones to gauge whether BTC can maintain its broader bullish trend.

The 24-hour decline reflects a wider risk-off sentiment in crypto markets, with more than $1 billion in liquidations reported across major tokens, including ethereum and other top performers.

Market Overview: BTC Technical Analysis and Short-Term Pressure

Bitcoin price today traded between $116,953 and $119,198, down roughly 1.3% amid concerns that the Federal Reserve might delay rate cuts following stronger-than-expected July Producer Price Index (PPI) figures.

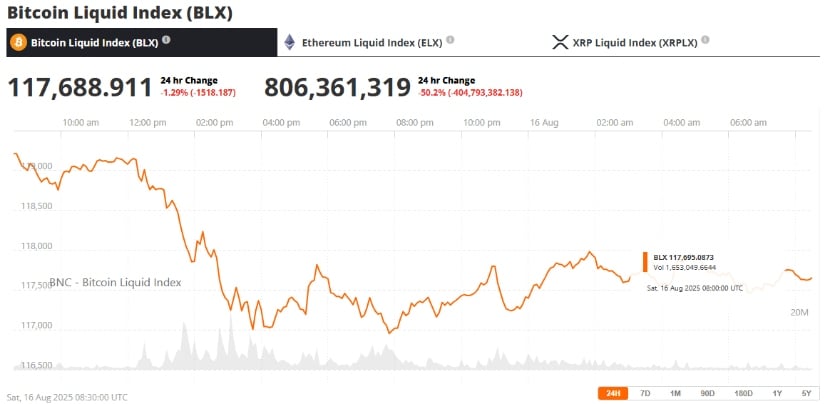

Bitcoin (BTC) was trading at around $117,688, down 1.29% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

Short-term charts show BTC forming its first lower low in weeks, signaling temporary bearish momentum. Analysts point to $116,300 as a critical support level, where a combination of the 200-day exponential moving average and Fibonacci retracement converges. Resistance is identified NEAR $120,000, aligning with the value area high and anchored VWAP.

Momentum indicators remain mixed. The four-hour RSI displays a hidden bullish divergence, suggesting a potential rebound, while daily indicators point to a bearish divergence, indicating the possibility of a longer corrective phase.

Broader Trend and Market Catalysts

Despite the recent dip, bitcoin continues to display strength on higher timeframes, forming consistent higher highs and higher lows. The trend remains bullish overall, but short-term risk has increased due to the liquidity-driven market correction.

Bitcoin may dip to $105K before rising, with key buying opportunities around $103K–$105K. Source: Xanax on TradingView

Market watchers are also monitoring the upcoming Bitcoin halving 2025 as a potential catalyst for renewed bullish momentum. Bitcoin whale activity, which has surged in recent weeks, could influence price swings further, particularly around key support and resistance levels.

Ethereum mirrored Bitcoin’s decline, falling 4.2% to $4,452 following intraday highs near $4,663. Over $351 million in ETH long positions were liquidated, highlighting the market-wide pressure triggered by inflation concerns.

Expert Insights: BTC as an Inflation Hedge and Outlook

Investors view Bitcoin as an inflation hedge, particularly during periods of uncertainty for U.S. monetary policy. Analysts believe that if BTC holds above $116,300, a rally back to $120,000—and even $128,000—is still in play. A breakdown below this level, however, WOULD trigger a bigger retracement, which would be a corrective wave after months of unbroken gains.

If BTC maintains support at $115K–$116K, a bullish reversal could target $118K and potentially $120K or higher. Source: Jos-ProTrader on TradingView

Crypto firms are handling the volatility well. eToro registered a 26% rise in net contributions to $210 million and a 23% surge in adjusted net income, despite an 8% drop in its share price on increased operating costs. American Bitcoin, backed by Donald TRUMP Jr. and Eric Trump, is planning to expand mining and reserve operations in Asia ahead of a September public offering.

Looking Ahead: BTC’s Future Direction and Prospects

Bitcoin remains at a pivot point. Its success in maintaining the $116,300–$117,000 support region is key to preserving the longer-term bullish momentum. Technical and sentiment signals are looking for short-term bounces, but corrective pressures on the bigger picture need to be monitored by traders.

As the market digests macroeconomic data, ETF news, and whale activity, Bitcoin price today will take direction from both the technicals and fundamentals. Key levels should be watched by analysts as they weigh the strength of BTC as an inflation hedge and as a support for the crypto asset class.