🚀 Bitcoin Targets New All-Time High as BTC Hyper Surges Past $9.5M to Turbocharge Transactions

Bitcoin's relentless bull run shows no signs of slowing—now flirting with record highs as its scaling solution, BTC Hyper, locks in over $9.5 million in throughput. Faster, leaner, and leaving legacy finance in the dust.

### The Need for Speed

BTC Hyper isn't just another layer-2 bandage. It's a nitro boost for the Bitcoin network, slashing confirmation times while traditional banks still process checks like it's 1985. The $9.5M milestone proves institutional money is betting on crypto's infrastructure—not just the price speculation.

### Wall Street's FOMO Moment

Hedge funds that dismissed Bitcoin as 'digital tulips' are now scrambling to front-run this liquidity wave. Meanwhile, the SEC debates whether to classify satoshis as securities—because nothing screams 'investor protection' like bureaucratic speed bumps during a breakout.

### The Bottom Line

Bitcoin's tech stack is evolving faster than its critics' playbooks. Whether this pumps the price to new ATHs or not, one thing's clear: the financial dinosaurs either adapt or watch their lunch get eaten.

$BTC, as always, is driving the sector’s rally. As the world’s largest crypto, it’s currently valued at ~$121K – just ~1.65% shy of its ~$123K ATH.

However, as the popularity of $ BTC grows, its network struggles with slow speeds and high fees. Fortunately, the Bitcoin Hyper ($HYPER) Layer 2 solution is getting set to fix this.

$BTC, as always, is driving the sector’s rally. As the world’s largest crypto, it’s currently valued at ~$121K – just ~1.65% shy of its ~$123K ATH.

However, as the popularity of $ BTC grows, its network struggles with slow speeds and high fees. Fortunately, the Bitcoin Hyper ($HYPER) Layer 2 solution is getting set to fix this.

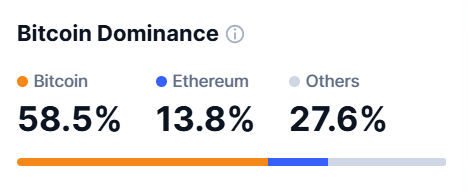

The USA Strengthens $BTC’s 58.5% Market Dominance

Demonstrating $BTC’s market dominance, it takes up a whopping 58.5% of the entire crypto market, followed by $ETH at 13.8%.

Source: CoinMarketCap

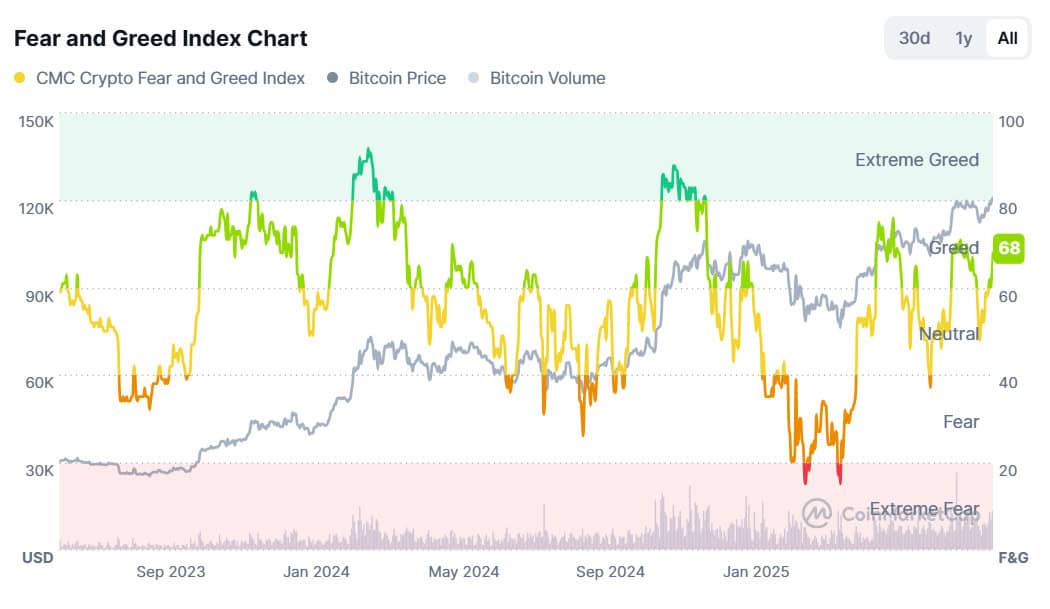

The Crypto Fear and Greed Index is currently in the ‘Greed’ zone, which reflects a bull market.

And it’s no surprise – $BTC is just a stone’s throw away from breaking its ATH, after all.

Source: CoinMarketCap

Hype for $BTC, and thus the entire market as a whole, is being lifted by a mix of powerful drivers. Chief among them is a more crypto-friendly political environment in the US.

One of the most notable changes to US crypto regulations includes the ‘GENIUS Act.’ As the first federal framework for stablecoins, it requires 1:1 reserves in high-quality assets, plus regular audits and disclosures.

This MOVE aligns with Donald Trump’s Working Group, calling for the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) to collaborate on clearer crypto classifications.

The SEC’s ‘Project Crypto’ reinforces this effort. It aims to modernize securities rules and establish clear criteria for classifying digital assets as securities, commodities, and stablecoins.

Given that the SEC previously sued major crypto firms (Ripple Labs, Coinbase, Binance) over alleged unregistered securities offerings, such clarity has never been more pivotal for the market’s trajectory.Then, there are exchange-traded funds (ETFs). Approved in early 2024, bitcoin ETFs allow institutions and retail investors to gain $BTC exposure without directly holding the asset. By removing technical barriers, they drive new capital into the crypto market.

And they’re thriving. Over the past two weeks, US-listed Bitcoin ETFs have accumulated a whopping 54,739 $BTC in net inflows (worth around $6.62B).

Source: Farside Investors

These sizable Bitcoin ETF acquisitions tighten $BTC’s supply, push its price to greater heights, and show that finance bigwigs are taking notice.

Think of it like when a trending concert sells out quickly; tickets become harder to get, and people are willing to pay more.Partly owing to this, Bitwise CIO Matt Hougan forecasts that $BTC could hit $200K by the end of 2025.

But as more capital floods in, can the crypto king handle the royal workload?

Bitcoin Handles Just 7 TPS – Can It Handle More Demand?

The Bitcoin network’s throughput is low, sitting at roughly 7 transactions per second (tps).

By comparison, Ethereum processes around 15–30 tps, while high-performance networks like Solana and Internet Computer Protocol (ICP) handle over 1K tps.

And Bitcoin’s performance gap is no stranger to facing serious consequences. When demand spikes, limited throughput causes congestion and higher fees.

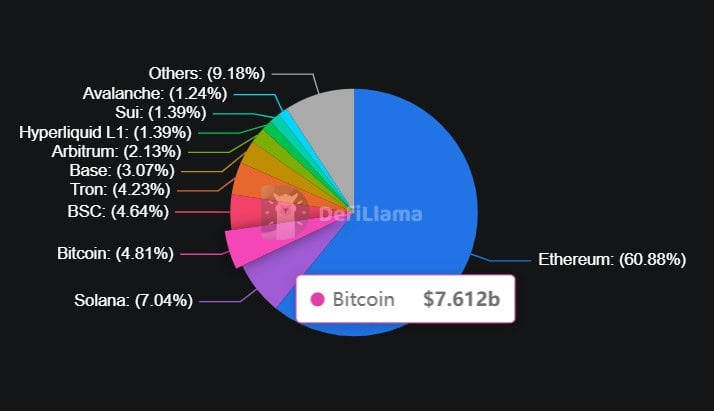

A great example of this is when the April 2024 Bitcoin halving event took place and the Runes protocol launched, Bitcoin’s fees exceeded $128.But even with its sluggish pace, Bitcoin still holds a fair share of total value locked (TVL) at roughly $7.06B, placing it third among all chains. It trails behind Ethereum’s eye-boggling $84.1B TVL and Solana’s $9.86B.

Source: DeFiLlama

Bitcoin’s TVL highlights that, even though it’s slower than other blockchains, it’s still a trusted network for holding and transferring significant value – the majority of which is through custodial holdings, payment channels like Lightning, sidechains, and wrapped $BTC.

In stark contrast, most of Ethereum’s TVL is locked in smart contracts and dApps, which has propelled the network to take up 60.88% of the entire DeFi market.

Bitcoin Hyper aims to change all of this.

Bitcoin Hyper to Make Bitcoin Faster, Cheaper & DeFi-Ready

Set to launch this quarter, Bitcoin Hyper ($HYPER) has many ambitious goals – to make Bitcoin more scalable, faster, cheaper, and dApp-friendly (much like Ethereum).

It aims to achieve this by batching transactions off-chain before settling them on the Bitcoin base layer. In turn, it’ll reduce competition for block space and enable lower fees with speedier confirmations.By integrating with the Solana VIRTUAL Machine (SVM), Bitcoin Hyper will also bring smart contract capabilities to Bitcoin. Consequently, the network will be able to facilitate DeFi protocols, dApps, and even meme coins.

Source: Bitcoin Hyper

Behind it all is a Canonical Bridge, verifying that SVM smart contracts and minting wrapped $BTC on the LAYER 2 to be used across DeFi platforms.

If you want to return to the mainnet, don’t worry. The bridge will securely release your original $BTC to the network.

To ensure scaling doesn’t come at the cost of security, you can also rest easy knowing that Bitcoin Hyper utilizes Zero-Knowledge Proofs (ZKPs). Doing so means the Layer 2 can power fast, trustless transaction verification without clogging up the main chain.

$HYPER Raises $9.5M to Upgrade Bitcoin

With $BTC on the heels of hitting a new ATH, partly spurred by US crypto clarity improving and Bitcoin ETF inflows, a bull run is in full swing.

But as $BTC continues to attract attention at a swift pace, the network is bound to face pressure to keep up with the growing demand.

To carry it into its next phase, Layer 2 solutions like Bitcoin Hyper have never been more vital. And investors are already taking notice. Since its presale debut on May 16, 2025, its native token – $HYPER – has already scooped up $9.4M.

Given that a whopping 30% of its total token supply is earmarked for development, buying in is a great way to help strengthen the network’s capabilities.

$HYPER also facilitates cheaper gas fees on the Layer 2, opens governance rights, and can be staked at an eye-popping 115%.You can get involved by purchasing $HYPER for just $0.012725. But don’t wait around: its price is anticipated to reach $0.5 this year, and the staking yield will drop when more Bitcoin lovers catch on.