🚀 Ethereum (ETH) Price Alert: Institutional Tsunami Fuels $10K Supercycle—Are You Positioned?

Wall Street's crypto love affair hits hyperdrive as Ethereum smashes institutional inflow records. The smart money's betting big—and retail's about to ride the wave.

The institutional FOMO is real

Forget dipping toes—whales are cannonballing into ETH pools. The last week saw capital inflows that'd make a VC blush, with crypto ETPs sucking up assets like a black hole.

Technical breakout incoming?

Charts scream 'bull flag' as ETH consolidates at levels that were pipe dreams last cycle. The $10K psychological barrier isn't just possible now—it's becoming probable. (Spoiler: Your boomer uncle will call it a bubble right until his bank starts offering ETH staking.)

The cynical take

Sure, institutions are 'excited about Web3'—just like they were 'excited about blockchain' in 2018 when all they wanted was to pump their stock prices. But this time? The numbers don't lie. The train's leaving the station—whether it's headed to Moon City or Valuetown depends who's holding the bag when the music stops.

Institutional demand, ETF inflows, and strengthening technical indicators are fueling speculation that ETH could target $10,000 in the coming market cycle.

ETH Price Today: Bulls Eye Key Resistance

Ethereum’s latest surge began after breaking the $4,092 resistance earlier this month, triggering a major bullish shift on the daily chart. ETH quickly advanced to $4,869, just shy of its all-time high of $4,878 set in November 2021. Short-term resistance remains at $4,750 and $4,869, while support zones are seen NEAR $4,540 and $4,386. A breakout above the $4,869 barrier could open the path toward $5,000 in the near term.

ETH eyes $5,000 as shorts are liquidated and long-term holders hold strong for the next explosive move. Source: @LordOfAlts via X

Prominent trader Henry (@LordOfAlts) commented on X that ethereum appears to be following a recurring “breakout, fake-out, reclaim, and then pump” pattern that has repeated several times in 2025. He suggested that this setup supports a $5,000 target, noting that short liquidations combined with a bullish news catalyst could trigger a sharp move higher.

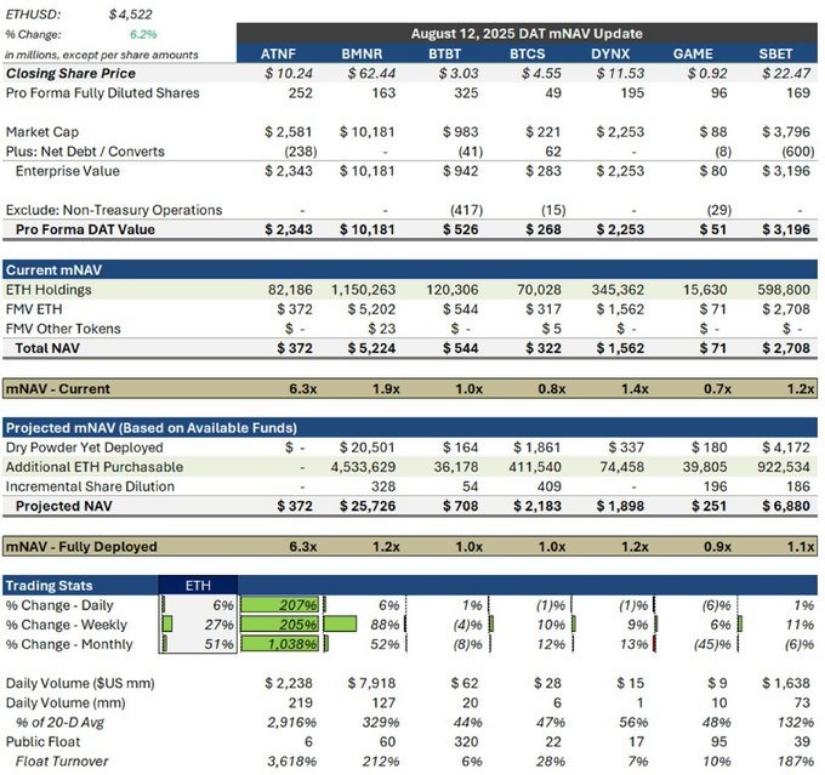

Institutional Inflows Hit Record Levels

Recent data shows institutional interest in Ethereum is surging to unprecedented heights. CME Ethereum futures posted an all-time high of $118 billion in monthly trading volume in July, while open interest now stands at a record $6.04 billion, according to The Block.

ETH surges to $4,700 as $27B in institutional purchases—40% of exchange supply—signal a massive upcoming supply shock. Source: @EvanLuthra via X

Spot Ethereum ETFs are also driving capital into the market. Monday marked a record $1.01 billion in net inflows, with BlackRock’s ETHA ETF capturing nearly 63% of all investments. Strategic reserves and ETFs now control about 8% of Ethereum’s circulating supply, up from just 3% in April. Treasury companies such as BitMine Immersion Technologies have even announced plans to raise $20 billion to further increase their ETH holdings.

Technical Outlook: Momentum Remains Strong

Ethereum’s MACD is near its second-highest level of the year, while the Relative Strength Index (RSI) remains above 60, indicating sustained buying pressure. On the 4-hour chart, ETH is trading above all major exponential moving averages (EMA20: $4,357; EMA50: $4,125; EMA100: $3,922; EMA200: $3,640), confirming a strong bullish structure.

ETH shows strong bullish momentum with MACD near yearly highs and RSI above 60, trading above all major EMAs as traders lock in profits. Source: itsvinayadav on TradingView

Market analyst Parshwa Turakhiya observed that the combination of a healthy trend structure, rising open interest, and bullish EMA alignment leaves the short-term outlook skewed to the upside, with $4,869 serving as the level to watch for a potential breakout.

Whale Activity and Profit-Taking

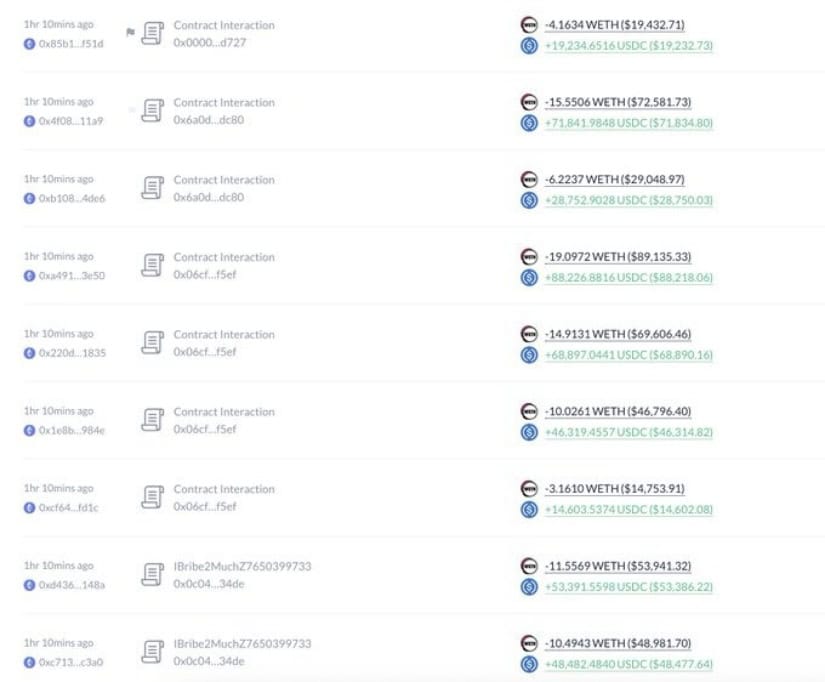

Not all market moves have been bullish. The Ethereum whale group known as the “7 Siblings” sold $88.2 million worth of ETH in the past 15 hours, while the Ethereum Foundation offloaded 2,795 ETH worth $12.7 million at yearly highs.

Mysterious whale group ‘7 Siblings’ sells 19,461 ETH ($88.2M) after earlier buying 103,543 ETH at $2,219, signaling major market moves. Source: @lookonchain via X

As even after all these sales, the long-term holders were found to be largely idle, as reflected from on-chain metrics, it WOULD be probable that current profit-taking is being driven by short-term traders.

Ethereum Price Prediction: $6K This Year, $10K in 2026

Ethereum’s price trajectory is attracting strong attention, with analysts projecting a rise to $6,000 by late 2025. Optimism is fueled by growing institutional interest, Ethereum ETFs, and upcoming network upgrades like Danksharding, which could improve scalability and reduce transaction costs. The narrowing gap between ETH’s current price and its all-time high also reflects robust bullish sentiment.

ETH eyes $10K as strong institutional inflows and bullish momentum set the stage for a major breakout. Source: Topu via X

Looking further ahead, some forecasts suggest Ethereum could reach $10,000 by 2026 if positive market conditions persist. This potential growth is tied to broader crypto adoption, tokenization of real-world assets, and expanding decentralized finance (DeFi) use. While speculative, these projections highlight Ethereum’s long-term upside and increasing relevance in the crypto ecosystem.

Final Thoughts

Ethereum’s confluence of record institutional inflows, ETF uptake, LAYER 2 expansion, and sound technical foundation presents a bullish scenario going into the last quarter of 2025. Nevertheless, market volatility and macroeconomic environments are still key determinants.

Ethereum (ETH) was trading at around $4,707, up 8.35% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

A break above $4,869 confirmation would mean a new wave of purchases, while inability to maintain $4,386 support might mean short-term retreat.