Bitcoin Surges Ahead of Tuesday’s Inflation Report – Will $HYPER Be the Next Rocket?

Bitcoin’s price is charging upward as traders brace for Tuesday’s inflation data—a potential spark for the next crypto rally. Eyes are now turning to $HYPER, the altcoin that’s defying gravity while Wall Street sweats over CPI numbers.

Market Movers: Inflation as a Catalyst

If history repeats itself, a softer CPI print could send risk assets—including crypto—into overdrive. Bitcoin’s recent breakout suggests bulls are already placing their bets.

$HYPER’s Silent Ascent

While Bitcoin dominates headlines, $HYPER has been quietly notching gains. The token’s low-profile surge has traders wondering if it’s the next hidden gem—or just another pump waiting for a dump.

The Bottom Line

Crypto markets thrive on macro drama, and Tuesday’s data could deliver just that. Whether this rally has legs or becomes another ‘buy the rumor, sell the news’ fiasco remains to be seen—after all, in crypto, even bad inflation is somehow ‘bullish.’

The push comes on the back of a 4.5% weekend rally, fueled by a spike in Leveraged long bets, rising interest, and renewed macro optimism ahead of Tuesday’s U.S. CPI release. With inflation data set to steer rate-cut expectations, traders are bracing for a potential breakout past July’s $123,234 peak.

And while all eyes are on $BTC, some are already scanning for projects primed to ride the momentum – including Bitcoin Hyper ($HYPER), a layer 2 design to bring speed, scalability, and DeFi to Bitcoin.

Bitcoin’s Weekend Rally and ATH Watch

Bitcoin’s latest surge has added 4.5% since Saturday’s open, wiping out last week’s pullback and putting the mid-July all-time high of $123,234 firmly in sight.

Derivatives data from Coinglass shows open interest climbing almost 6% in the past 24 hours to hit $83.59B. This is paired with spot volume being up 27.99% to reach $77.02B.

Source: CoinMarketCap

This momentum mirrors gains in tech stocks and is underpinned by a softer U.S. dollar, feeding expectations for Federal Reserve rate cuts in the months ahead. For many traders, the setup feels like the perfect storm for a fresh breakout.

Why Tuesday’s CPI Matters for Crypto

Markets are now fixated on Tuesday’s U.S. Consumer Price Index report, with economists expecting a 2.8% annual reading. A softer number could fuel bets on a September rate cut, a scenario that typically boosts risk assets like $BTC and high-beta altcoins.

The top crypto has been moving in lockstep with the NASDAQ, trading more like a ‘risk-on’ play than digital gold. But, traders are still hedging with puts in case inflation comes in hotter than expected, which could spark a sharp pullback.If bitcoin clears its all-time high, history suggests the next wave of capital could rotate into altcoins. Previous breakouts have triggered rallies in $ETH, meme coins, and Layer 2 plays.

This cycle’s bet is all about Bitcoin scalability, meme-fi, and cross-chain ecosystems. And one project sits right in the middle of all three narratives: Bitcoin Hyper.

Bitcoin Hyper ($HYPER) – Scaling Bitcoin the SVM Way for 21st Century Use-Cases

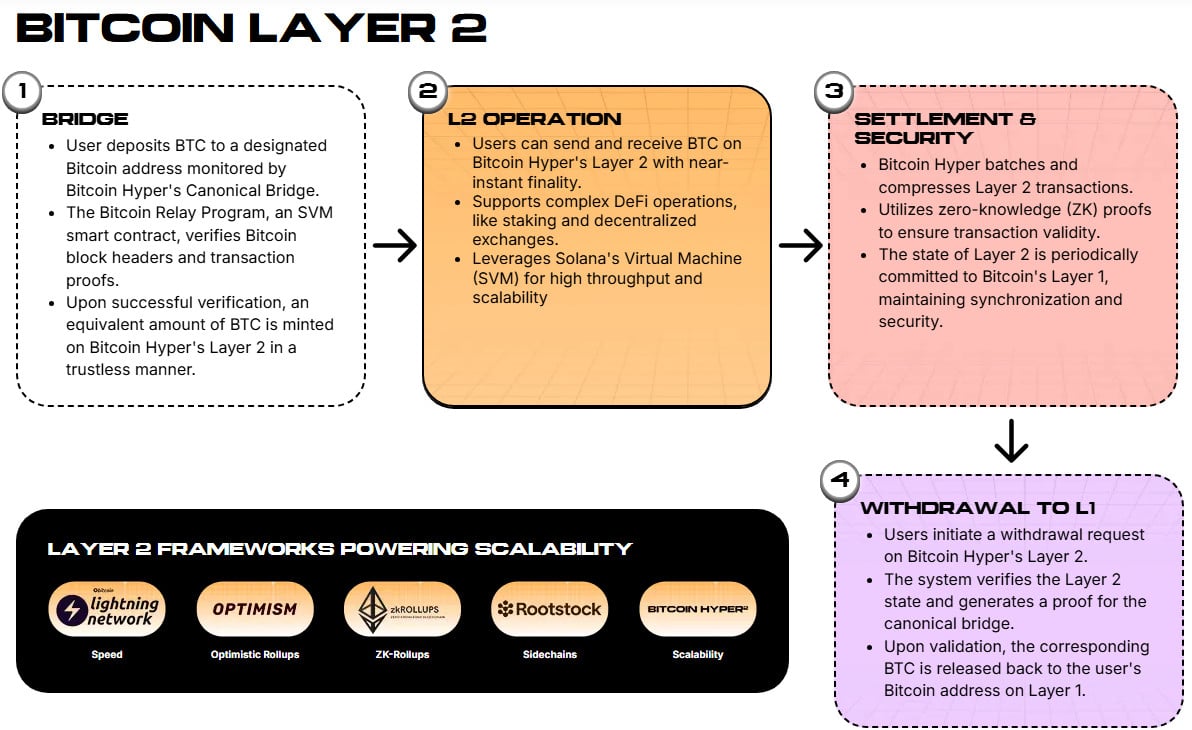

Bitcoin Hyper ($HYPER) is positioning itself as the first true Bitcoin Layer 2 utilizing the Solana VIRTUAL Machine SVM) – not a sidechain, but a fully scalable execution layer for Bitcoin.

The core problem it tackles is $BTC’s sluggish, expensive transactions and its limited reach in DeFi and meme culture. $HYPER’s trustless bridge lets you move $BTC into LAYER 2, send it instantly with near-zero fees, and settle back to Layer 1 using zero-knowledge proofs.

This opens the door to high-speed payments, staking, dApps, meme coins, and seamless cross-chain activity with ethereum and Solana. By leveraging SVM, Bitcoin Hyper offers sub-second settlement and direct compatibility with Solana’s thriving ecosystem.

Through the SVM’s roll-up system, $HYPER achieves three things:

1. Performs executions off-chain, decongesting Bitcoi’s Layer-1

2. Bundles up batches of transaction to settle on Bitcoin, benefiting from its native security

3. The transactions become Immutable and verifiable on-chain for transparency and accountability

Read the whitepaper to learn more about $HYPER’s solution to Bitcoin’s problems and what exactly it can do for the ageing blockchain.

The presale has already pulled in $8.34M, with tokens price at $0.012625 and staking yields of 130%. Early buyers get access to staking rewards, airdrops, and launchpad projects – a classic first-in advantage.With $BTC on the verge of an ATH, Bitcoin-related projects with both technical merit and meme appeal could see outsized attention, and $HYPER is ticking both boxes.

To get involved in the presale, visit our how to buy Bitcoin Hyper article for a step-by-step guide.

Final Thoughts – The Breakout Could Come Fast

Bitcoin’s charge toward a new all-time high, paired with the eagerly anticipated Tuesday CPI release, is priming the market for both breakout potential and sharp reversals.

In that environment, Bitcoin Hyper ($HYPER) stands out by offering a rare mix of Bitcoin scalability and degen-friendly culture.

If Bitcoin clears resistance, capital rotation into $BTC-linked altcoins could accelerate, putting $HYPER firmly on many trader watchlists.