Solana (SOL) Primed for $260 Surge as Cup-and-Handle Breakout Signals Bullish Momentum

Solana's chart flashes a textbook buy signal—just as traders finish their third espresso.

The Pattern That Won't Quit

That cup-and-handle formation isn't just surviving the crypto chop—it's thriving. SOL's consolidation phase now looks like a coiled spring.

Price Targets: Beyond Hopium?

The $260 marker isn't just some round number plucked from thin air. It's where the 2021 bulls got their horns stuck—and this time, there's actual network activity backing the move.

Traders vs. Fundamentals

Meanwhile, developers keep shipping while degens keep flipping. At least the blockchain's uptime lately outlasts most crypto Twitter attention spans.

Watch those volume spikes. This breakout either moons or becomes another 'rugpull Wednesday' in Solana's ongoing telenovela.

Solana price is now pressing up against one of its most important resistance zones, with the $185 level once again acting as a key battleground for buyers and sellers. A breakout here could trigger momentum, opening the path towards key Fibonacci targets.

Solana Price Prediction Points to Potential Macro Breakout

Crypto analyst Chris has highlighted a notable higher-timeframe setup for Solana, showing a well-defined cup-and-handle pattern stretching back to 2021. The neckline resistance lies just below the $260 zone, a level that has historically capped major rallies. At present, the Solana price is moving within the handle formation, gradually edging higher towards this key breakout level.

Solana price forms a multi-year cup-and-handle pattern, edging closer to its $260 neckline resistance. Source: Chris via X

A decisive move above the neckline on strong volume could open the door to a significant macro rally. The steady structure and clear pattern symmetry suggest that buyers have been quietly regaining control, keeping the broader outlook tilted towards a constructive solana price prediction.

$185 Resistance in Focus as Weekly Rally Extends

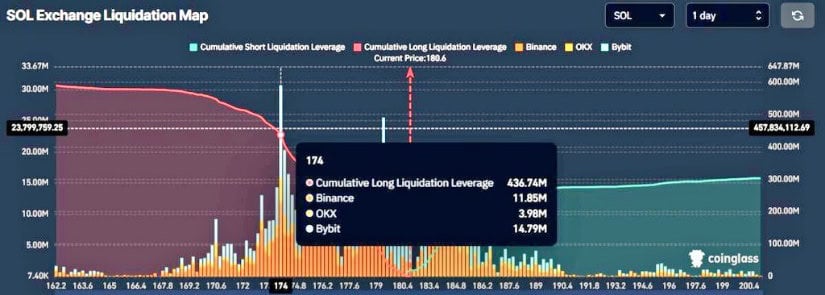

Solana price has posted an 18% gain over the past week and is now testing the $185 resistance level on the lower-time frame. This area has historically acted as a decisive breakout zone, and current market positioning suggests a cluster of short positions may be sitting just above. A clean break through $185 could trigger a short squeeze, forcing sellers to buy back at higher prices and adding momentum to the upside.

Solana tests the pivotal $185 resistance, with a breakout potentially triggering a MOVE towards $256. Source: Jack via X

Jack projects the next upside target near $256, a move that WOULD represent roughly 40% gains from current levels. Notably, this target sits just under Solana’s higher time-frame neckline resistance around $260, making it a potential inflection point where a successful breakout could align short-term momentum with the larger macro setup.

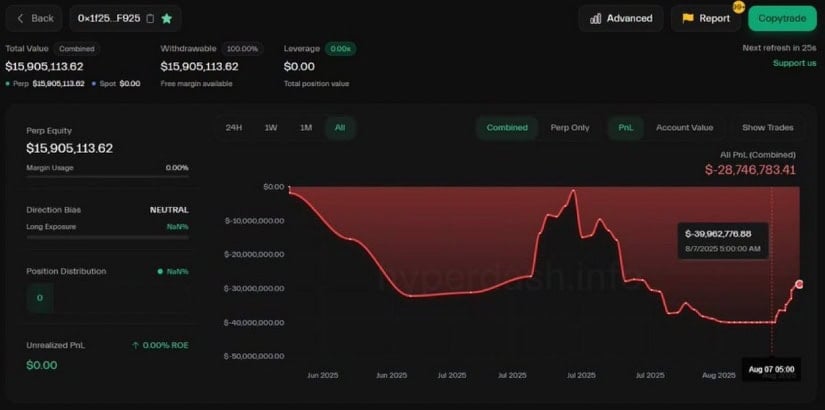

Whale’s $190M Loss Adds Fuel to Solana Short Squeeze Potential

Adding to the growing short-liquidation narrative, Crypto Rover has flagged a whale who shorted ETH, BTC, SOL, and HYPE, and is now sitting on unrealized losses exceeding $190 million. With solana already pressing against the $185 resistance, any breakout could further pressure on heavily shorted positions like this. If key resistance levels give way, forced covers from such large positions could act as a secondary momentum driver, aligning with the broader technical setups.

Whale faces $190M in unrealized losses across major shorts, adding fuel to Solana’s potential breakout above $185. Source: crypto Rover via X

Solana Technical Outlook: Eyes on $219–$245 Fibonacci Zone

Continuing from the recent breakouts and short-squeeze potential, analyst Jesse Peralta has outlined a clean Fibonacci-based projection for Solana, with the 61.8% retracement level at $219 acting as the next immediate checkpoint. A measured push through this zone could set up a move toward the 75% retracement level at $245, aligning with the broader bullish narrative.

Solana targets the $219–$245 Fibonacci zone, aligning short-term gains with its larger cup-and-handle breakout setup. Source: Jesse Peralta via X

This technical pathway also complements the higher-timeframe cup-and-handle breakout scenario and the potential squeeze scenario. Once the Solana price clears $219, the market would likely see an acceleration toward $245, placing it one step closer to the macro neckline at $260.

Final Thoughts

With a long-term cup-and-handle formation nearing completion and key Fibonacci targets at $219 and $245 in sight, the Solana price is positioned for a potential macro breakout. Clearing the $185 resistance could be the spark that aligns short-term bullish pressure with the larger multi-year setup, putting the $260 neckline within striking distance.

Still, the path higher depends on momentum holding and support levels staying intact during pullbacks. If the current structure remains unbroken, SOL’s next move could mark the transition from months of consolidation to a decisive trend expansion.