Optimism Price Prediction: Reversal & Volume Surge Hint at Explosive New Trend

Is Optimism (OP) gearing up for a breakout? A sudden price reversal paired with a volume spike suggests traders are betting big on this layer-2 contender.

Signs of Life in Layer-2

After months of sideways action, OP's chart just printed its first bullish signal since the 2024 bear market. Trading volume doubled in 48 hours—usually a sign institutions are moving in before retail catches on.

The Cynic's Corner

Of course, this could just be another 'dead cat bounce' before the next leg down. Remember when analysts called the last 20% pump 'the start of a new bull run'? (Spoiler: it wasn't.)

One thing's certain: when crypto markets sneeze, altcoins catch pneumonia. OP's fate still hinges on Bitcoin's next move—no matter what the 'technical indicators' claim.

This combination of price correction and increased market participation may point to increased volatility ahead and the possibility of a new directional MOVE for this digital asset.

Price Moves Reflect a Sharp Reversal Following an Extended Rally

Since early August, the coin displayed a strong and consistent uptrend, reaching a peak of approximately $0.82. The rise was marked by a series of higher highs and lows, supported by increasing market engagement as reflected in the growth of aggregated open interest in derivative contracts.

Recent price data shows a marked pullback from this peak, with a succession of red candles evidencing robust selling pressure. The current price rests NEAR $0.77, with the latest candle indicating a minor bounce or indecision, which suggests some traders may be taking profits or reacting cautiously after the steep decline.

Source: Open Interest

Aggregated open interest reveals that the volume of outstanding derivatives also increased in tandem with the price rise, confirming the rally’s underlying strength and participation by Leveraged traders. However, during the recent pullback, open interest has slightly decreased but remains elevated at around 99.5 billion.

This reduction implies that some leveraged positions might have been liquidated or closed out, possibly causing or accelerating the correction. These developments highlight the asset’s susceptibility to short-term fluctuations, particularly following strong, leveraged price advances.

Volume Spike Highlights Increased Market Participation

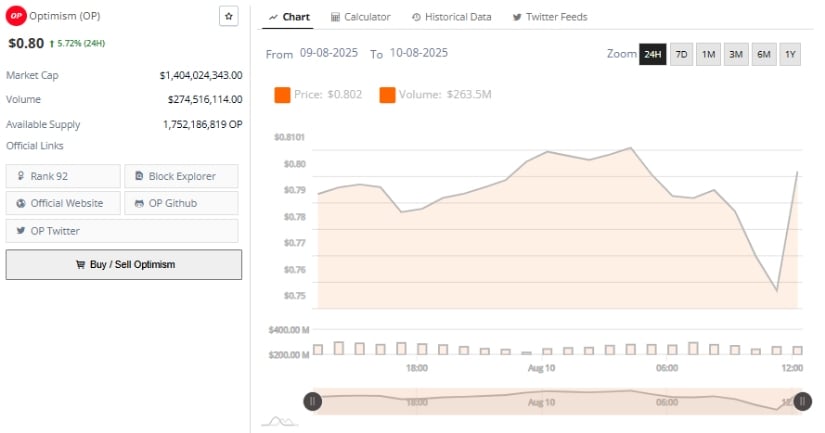

Additionally, the 24-hour trading volume has seen a significant surge, exceeding $274 million, correlating with the recent sharp price bounce. This substantial increase in volume confirms that the rapid recovery was supported by an influx of trading activity rather than isolated or low-liquidity events.

The large participation reflects strong buyer interest emerging at lower price levels, effectively counteracting earlier selling pressure and producing a pronounced V-shaped price recovery.

Source: BraveNewCoin

This volume surge demonstrates heightened engagement by market participants, which often precedes important trend decisions. The alignment of high trading volume with a sharp price bounce signals robust liquidity and increased confidence among traders that price levels around $0.75 to $0.80 represent key battlegrounds between bullish and bearish forces.

Technical Indicators Signal Consolidation Amid Market Uncertainty

On the other hand, examining the daily chart, the price recently ROSE above the mid-Bollinger Band and briefly touched the upper band before retreating to trade near the mid-band level.

This positioning often indicates a phase of consolidation after a pronounced move, implying that the asset is temporarily balancing between upward momentum and selling forces. The current red daily candle supports the view of a short-term retracement or indecision in the market.

Source: TradingView

The Relative Strength Index (RSI) remains moderately bullish, resting at approximately 58, above the neutral midpoint of 50 but well below overbought thresholds. The RSI’s recent decline from near-overbought conditions aligns with the price pullback, signaling a cooling of bullish momentum. Meanwhile, the RSI remains above its moving average, suggesting some underlying positive sentiment persists despite short-term volatility.

This interplay of price action and momentum indicators suggests that the crypto is navigating a consolidation phase, with traders monitoring critical support near the mid-Bollinger Band. Whether the price manages to hold this level and resume its upward trend or breaks below it to signal further correction will likely determine the near-term trajectory.