Top Cryptos to Buy Now as El Salvador’s Bitcoin Banking Revolution Begins

El Salvador just kicked open the doors to Bitcoin banking—here's what it means for your portfolio.

The Lightning Network Effect

With BTC now institutionalized in El Salvador, altcoins are lining up for their moment. Ethereum's smart contracts? Solana's speed? Both are primed to ride this regulatory tailwind.

The Dark Horse Play

Don't sleep on privacy coins. As traditional banks scramble to 'comply' with crypto, Monero and Zcash could become the underground favorites.

The Cynic's Corner

Wall Street will 'discover' Bitcoin banking right after they finish shorting it. Buy the rumor, sell the news—and maybe keep some dry powder for when the suits 'innovate' with 2% yield savings accounts.

The country has just passed its new Investment Banking Law, which allows private investment banks to hold $BTC and other digital assets.

The catch? They need a $50M minimum capital requirement.

Once licensed, these banks can serve accredited investors – known locally as ‘sophisticated investors’ – with crypto services that include custody, trading, and even running as fully fledged Bitcoin banks.

It’s a bold move that makes El Salvador even more appealing to institutional money. For crypto investors, it creates a Ripple effect that could benefit certain projects tied to Bitcoin’s growth or riding on the larger wave of crypto adoption.

Whether you’re into meme coins or chasing the best crypto projects with utility, now is the time to pay attention.

El Salvador’s Banking Revolution in Context

This law change is structural and designed to have a practical impact. By separating the rules for investment banks from commercial banks, El Salvador has made it easier for these institutions to hold and manage Bitcoin.

The country’s Commission of Digital Assets (CNAD) has stated that with a Digital Asset Service Provider (PSAD) license, a bank can operate entirely in bitcoin if it chooses.

President Nayib Bukele continues to expand Bitcoin’s role in the country. His administration is building partnerships with other nations, including signing crypto cooperation deals with Bolivia and discussing mining policy with Pakistan.

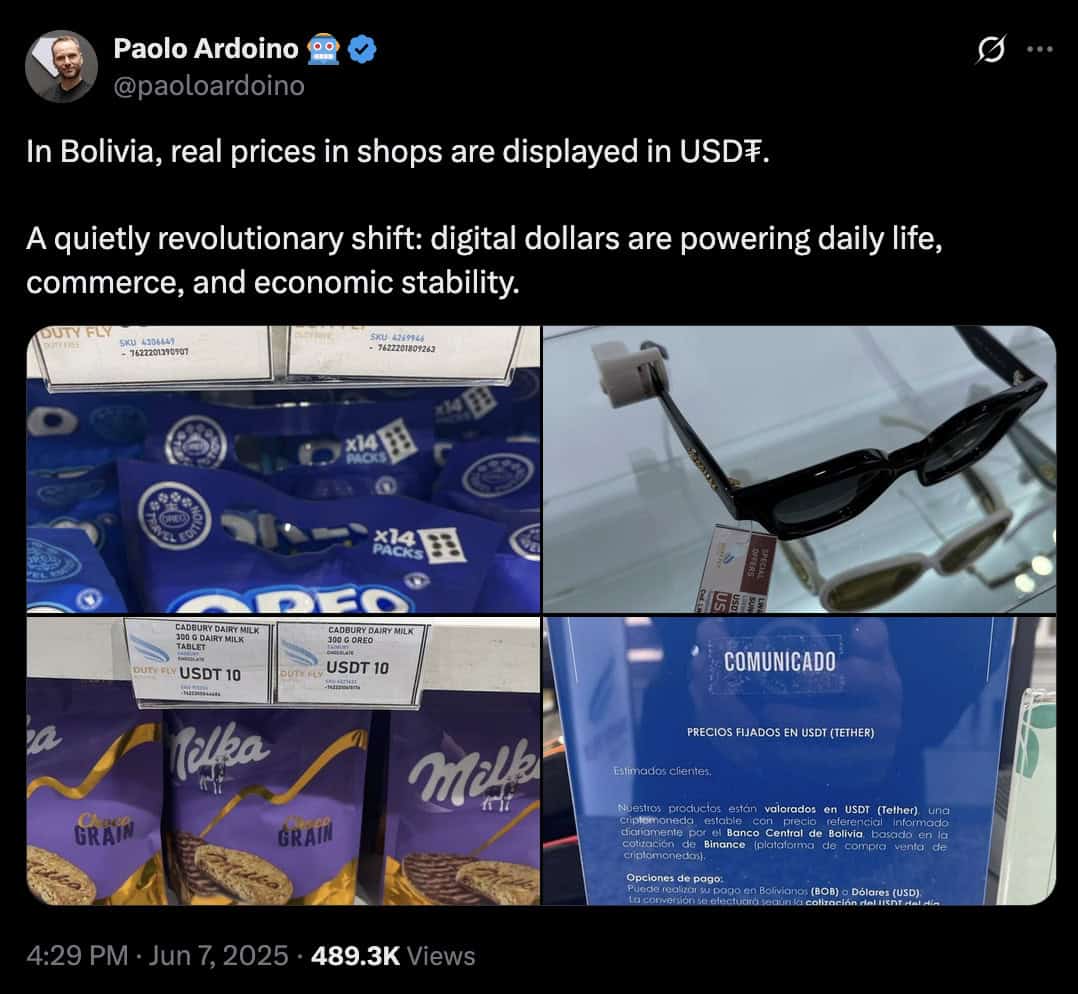

Bolivia, facing economic turmoil, is already seeing grassroots adoption of crypto – most strikingly, stores in Bolivian airports are displaying prices in Tether ($USDT), a move that Tether CEO Paolo Ardoino described as a ‘quietly revolutionary shift’.

El Salvador is positioning itself as a crypto-friendly financial hub, creating conditions where large Bitcoin investments could lead to new opportunities for altcoins and emerging crypto projects.

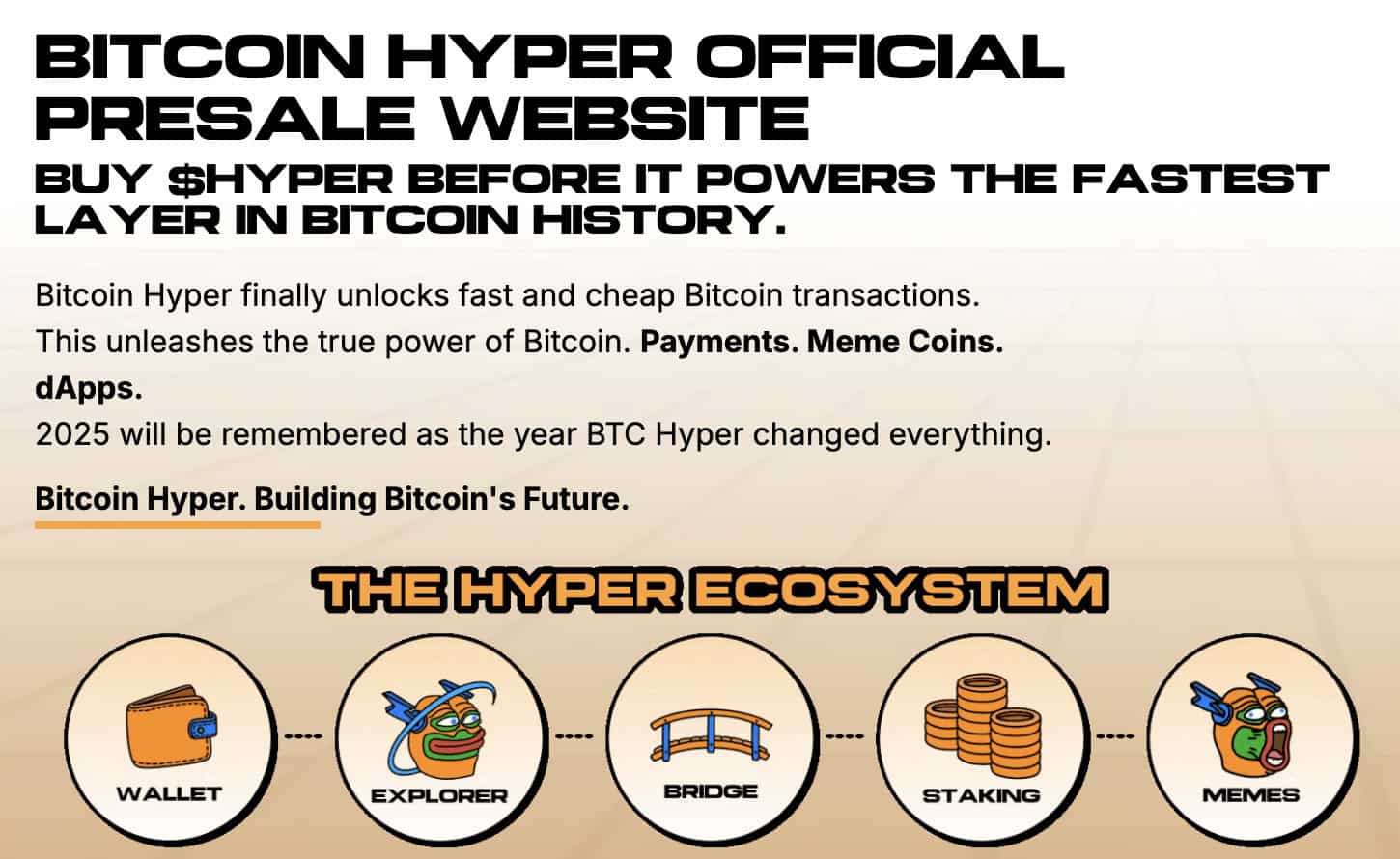

1. Bitcoin Hyper ($HYPER) – Scaling Bitcoin for El Salvador’s New Era

With El Salvador opening the door for investment banks to run entirely in Bitcoin, the need for real scalability has never been greater.

Bitcoin Hyper ($HYPER) is built for exactly this moment. It’s not a sidechain or a compromise – it’s the fastest real Bitcoin Layer-2 in existence, designed to make $BTC more than just a store of value.

On the Hyper Layer-2, Bitcoin gains sub-second transactions, near-zero gas fees, and full cross-chain compatibility. Meme coins, DeFi protocols, dApps – all the things Bitcoin couldn’t do before – now become possible.

It’s powered by the Solana VIRTUAL Machine (SVM), giving it the speed and efficiency of Solana while remaining deeply connected to Bitcoin’s security.

From day one, Bitcoin Hyper is interoperable with Ethereum, Solana, and more, creating a true execution LAYER where payments, trading, and community projects can thrive.

Everything in the ecosystem runs on $HYPER, from staking to governance.

At $0.0126 per token and over $7.8M already raised in presale, Bitcoin Hyper is positioning itself as the infrastructure play for a Bitcoin-powered financial hub like El Salvador.

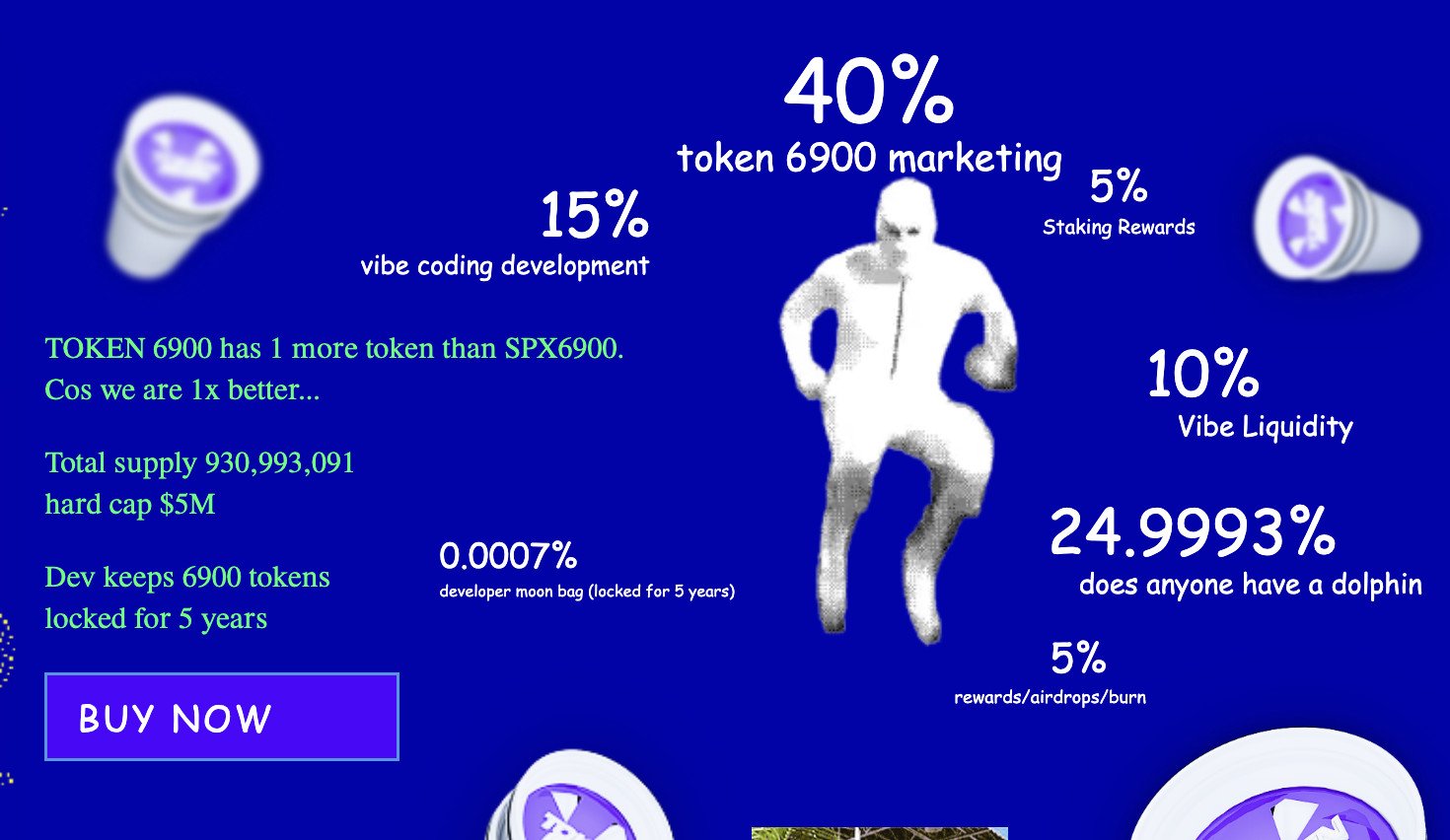

2. TOKEN6900 ($T6900) – The Meme Coin That Prints Only Memes

As El Salvador prepares to welcome investment banks into the Bitcoin arena, the stage is set for new liquidity to flood the market.

History shows that when fresh capital enters crypto, meme coins are often among the biggest winners. TOKEN6900 ($T6900) is ready to be one of them – a self-aware, zero-utility token that thrives purely on collective internet energy.

Priced at $0.0069 (yes, on purpose) and having raised over $1.7M in its presale, TOKEN6900 proudly offers nothing except pure meme-fuelled chaos.

It’s inspired by the SPX6900 internet joke and early-2000s web nostalgia, but improves on the gag with one extra token in supply – objectively superior.

It doesn’t track GDP, corporate earnings, or inflation. It doesn’t pretend to have AI utility or an elaborate roadmap. The only thing it mints is memes.

Its tokenomics are simple and fair: 80% of supply sold in presale, capped at $5M, no hidden mint button.

This ‘first NCT’ (Non-Corrupt Token) turns honesty into a brand.

If El Salvador’s banking reforms boost mainstream $BTC exposure, coins like $T6900 could see their communities explode as fresh retail money hunts for the next cultural phenomenon.

3. The Graph ($GRT) – The Data Layer for Bitcoin-Driven Banks

As El Salvador’s investment banks gear up to hold Bitcoin and deliver full-scale crypto services, they’ll need rock-solid access to on-chain data that is fast, reliable, and works across multiple blockchains.

The Graph ($GRT) provides exactly that. It is a decentralized indexing protocol designed to organize and query blockchain data.

Developers build subgraphs – open APIs that define how data is structured and retrieved via GraphQL.

The protocol also delivers substreams for real-time data pipelines, a token API for live token metrics, and supports a broad range of networks including Ethereum, Solana, Arbitrum, Polygon, and more.

Licensed banks in El Salvador will need to run trading tools, compliance monitoring, reporting dashboards, and decentralized applications, all of which depend on accurate and quickly accessible on-chain data.

The Graph offers 99.99% uptime and significant cost savings compared to building indexing infrastructure from scratch, making it a practical choice for institutions.

Source: CoinMarketCap

At roughly $0.09764 per token today, $GRT is affordable and already proven in production.

How El Salvador’s Banking Shift Could Boost These Projects

Institutional adoption tends to spark demand across the crypto spectrum.

As El Salvador’s investment banks roll out Bitcoin services, Bitcoin Hyper can boost speed, TOKEN6900 can draw retail buzz, and The Graph can power their data systems.

With more capital and attention flowing into the market, many traders are searching for the best crypto to buy, and these three stand out for meeting very different needs in the evolving Bitcoin economy.

Remember that this is not financial advice. Always do your own research (DYOR) before investing in crypto.