XLM Primed for $1 Breakout: Strong Support Holds as Bullish Momentum Builds

Stellar (XLM) isn’t asking permission—it’s charging toward the psychological $1 mark after shrugging off sell pressure like a Wall Street trader dodging accountability.

Support becomes springboard

The digital asset cemented its footing at key levels, transforming what could’ve been a breakdown into a launchpad. No fancy derivatives here—just old-fashioned supply and demand painting a bullish chart.

Momentum shifts in bulls’ favor

Buy volume’s creeping up while shorts get squeezed. Traders eyeing the $1 target know it’s not just a round number—it’s the gateway to retesting all-time highs while legacy finance still struggles with wire transfers.

Will XLM deliver the knockout punch? The charts say maybe—but in crypto, ‘maybe’ is enough to send degens all-in.

The asset’s recent consolidation phase has allowed it to gather momentum, with analysts pointing to $1 as a potential milestone if current conditions persist.

Price action is now approaching a key resistance level that could determine the next significant move.

Analyst Identifies Breakout Levels for Long-Term Gains

In a recent X post, analyst crypto Patel projected that XLM could set its next targets at $1, provided the present momentum continues. The two-week chart shared by the analyst highlights the 0.618 Fibonacci retracement level at $0.20 as a strong demand zone.

Since holding this level, the asset has advanced toward the $0.58 resistance, regarded as the breakout point for further upward movement.

Source: X

Key support is identified between $0.25 and $0.20, with $0.58 as the critical threshold for a potential rally toward $1. The analysis also notes a 700% year-over-year gain, underscoring high volatility alongside a bullish market structure as long as the price remains above the $0.20 area.

The projection outlines a continuation of the bullish pattern if resistance is breached. Such a breakout could position the asset for a new all-time high, with sentiment supported by the resilience of the established support levels.

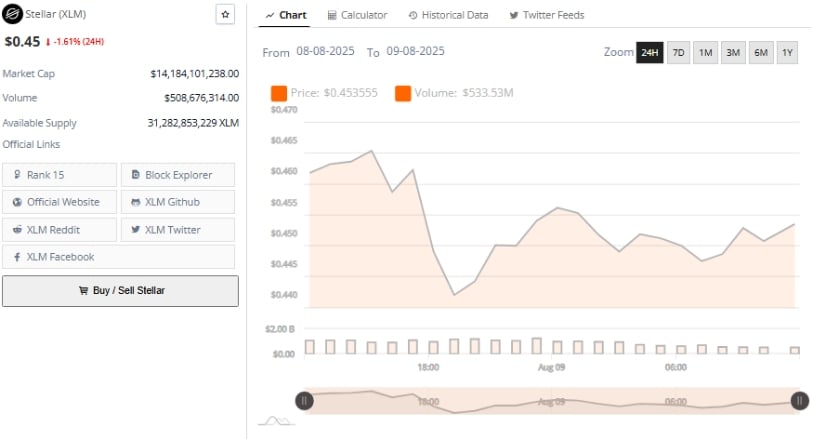

Market Data Reflects Stable Liquidity and Trading Range

Additionally, BraveNewCoin data shows the price at $0.4536, reflecting a 1.61% decline in the past 24 hours. Market capitalization is estimated at $14.18 billion, ranking stellar 15th among cryptocurrencies.

The daily trading volume is approximately $508.67 million, with a circulating supply of about 31.28 billion tokens, indicating healthy liquidity for active trading.

Source: BraveNewCoin

Over the past day, the price has traded between $0.44 and $0.47, with notable intraday fluctuations but no significant directional breakouts. The most active trading occurred during early sessions, when the price approached $0.46 before easing slightly.

This pattern of movement suggests a balance between buyers and sellers, with the market awaiting a decisive move. A push above $0.47 could lead to a retest of the $0.50–$0.52 range, while a drop below $0.44 may invite additional selling pressure in the short term.

Technical Indicators Point to Strength Above Key Support

At the time of writing, according to TradingView, Stellar is trading at $0.4542, marking a 0.92% gain in the last 24 hours. The daily chart shows the asset holding above the Bollinger Bands’ basis line at $0.4230, with the upper band at $0.4780 serving as immediate resistance.

The lower band at $0.3680 remains a key downside reference point. The Relative Strength Index (RSI) is currently at 62.09, indicating bullish momentum without reaching overbought territory.

Source: TradingView

Price action has shown a recovery from late July’s pullback, with stability above the basis line confirming continued buyer interest. A MOVE above $0.46 could bring the upper Bollinger Band into focus, potentially paving the way toward July’s high of $0.5206.

Trading volume has been consistent with the gradual price climb, signaling steady accumulation. If this trend continues, the asset may retest previous highs, while a drop below $0.42 could signal a period of consolidation before another upward attempt.