Ethena (ENA) Price Surges 18% to Break $0.70—Can Bulls Dominate August?

Ethena's ENA token just smashed through $0.70—riding an 18% rally as crypto traders pile in. Here’s what’s fueling the frenzy.

### The Breakout Moment

ENA’s leap past $0.70 wasn’t subtle. Bulls charged, liquidity followed, and suddenly every degen with a futures account is pretending they saw it coming.

### August’s Make-or-Break Levels

Key resistance now sits at $0.75—clear that, and we’re flirting with dollar territory. Fail? Hello, 20% retracement and a chorus of 'I told you so' from permabears.

### The Cynic’s Corner

Let’s be real: half these positions will unravel faster than a Terra stablecoin. But for now? Enjoy the hopium—just don’t mortgage your dog.

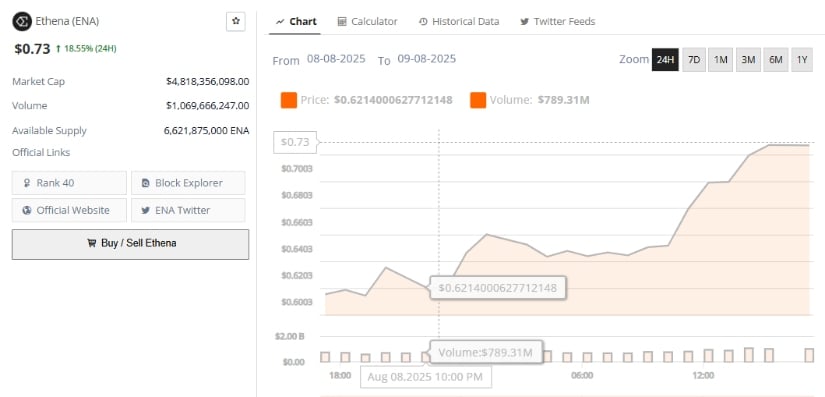

Following a steady start NEAR $0.61 earlier this month, ENA’s price shot upward, reflecting growing confidence in Ethena’s platform and its expanding ecosystem. The token’s market cap now approaches $4.8 billion, while daily trading volume has risen by over 33%, underscoring increased trader interest amid mixed market conditions.

The recent price jump occurs as the broader cryptocurrency market displays a neutral sentiment. Bitcoin and Ethereum work to regain their footing, while the fear and greed index remains balanced around 52. Against this backdrop, ENA’s breakout signals potential momentum shifts in the months ahead.

ENA Price Forecast: Technical Indicators Show Bullish Potential

From a technical analysis perspective, ENA exhibits promising signs. The Moving Average Convergence Divergence (MACD) line has crossed above the zero line, indicating early bullish momentum. Meanwhile, the Chaikin Money FLOW (CMF) indicator registers a strong buying pressure with a value of 0.24, supporting the notion of sustained demand for ENA tokens.

ENAUSDT shows a bullish breakout forming, targeting $0.80 if it breaks above $0.68 and holds $0.605 support. Source: AtresCryptoAcade on TradingView

Additional metrics such as the Bull Bear Power (BBP) at 0.0698 suggest moderate bullish dominance, although a full breakout is yet to be confirmed. The Relative Strength Index (RSI) currently rests around 60.5, hinting that buyers remain in control, but the asset is approaching an overbought territory. The immediate support level to watch lies near $0.616, with resistance forming just above $0.618.

If buyers maintain momentum, ENA could initiate a “golden cross” — a bullish crossover of moving averages — potentially pushing prices even higher this month. Conversely, bearish patterns such as a “death cross” might trigger short-term pullbacks, testing lower support levels near $0.615.

Ethena Crypto Prediction: Market Activity and Token Unlocks

Despite recent massive token unlock events, Ethena has maintained strong upward momentum. Over the past 24 hours, ENA experienced a price surge of over 18%, lifting its market cap close to $4.82 billion. Daily trading volumes expanded by more than 33%, suggesting robust investor interest despite potential sell pressures from unlocked tokens.

Athena (ENA) was trading at around $0.73, up 18.55% in the last 24 hours at press time. Source: Brave New Coin

Notably, data reveals an inflow of approximately 250 million ENA tokens to exchanges over the last two weeks, which often signals upcoming selling activity. However, the token has shown resilience, hinting at a confident market that expects continued gains.

ENA Token Price and USDe Stablecoin Growth

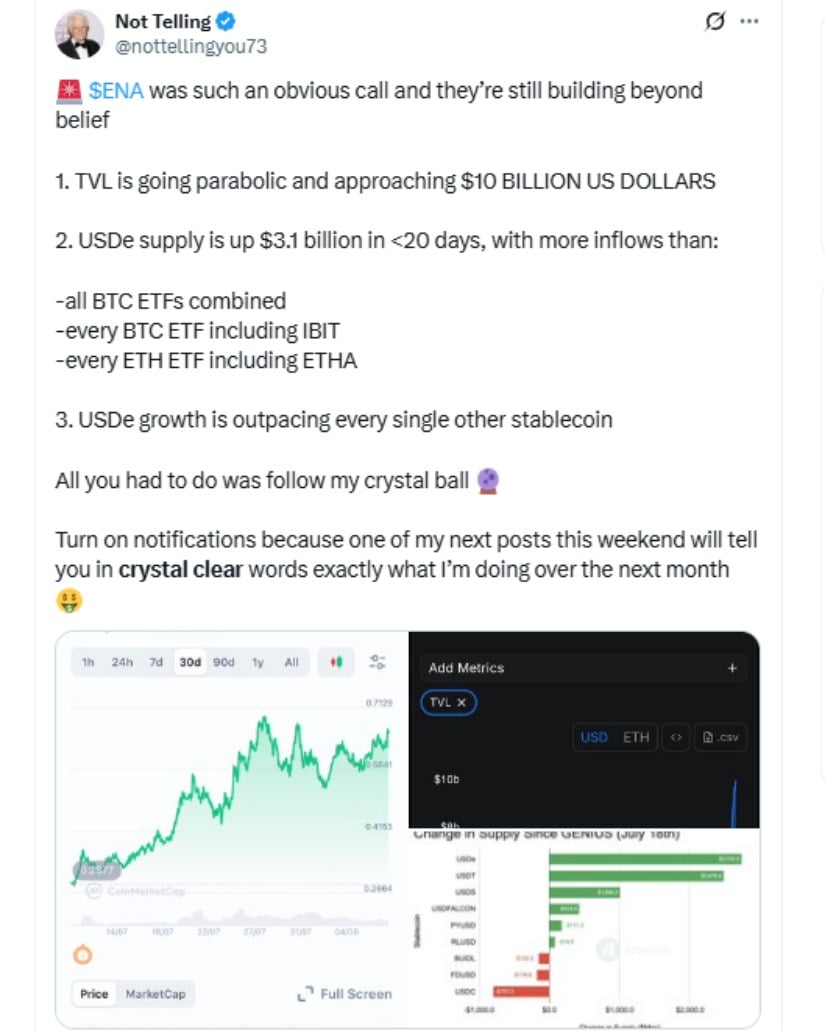

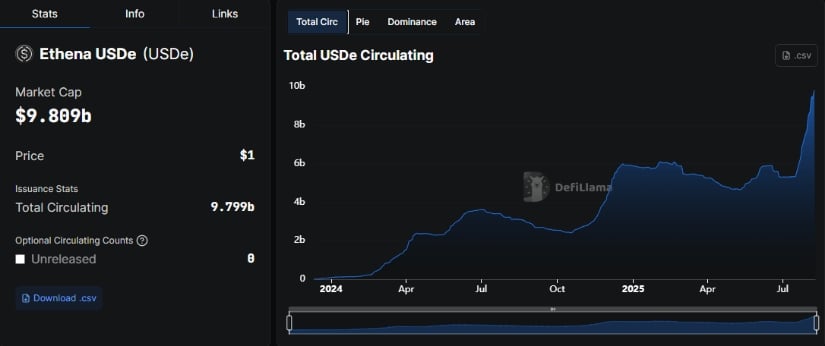

A crucial factor supporting Ethena’s growth is the surge of its synthetic dollar, USDe, which has expanded supply by an impressive 75% in July alone. This growth has propelled USDe to become the third-largest stablecoin by market capitalization, surpassing competitors such as Sky Dollar (USDS) and Binance’s FDUSD.

Ethena’s TVL nears $10B as USDe supply outpaces all major BTC and ETH ETFs combined. Source: Not Telling via X

USDe’s supply now exceeds $9.3 billion, bolstered by strong demand within the ethereum ecosystem and DeFi space. Its integration across major platforms like Curve Finance and trading venues such as Bybit and Uniswap underscores its growing adoption. Bybit alone accounts for over 30% of USDe’s trading volume, highlighting the stablecoin’s liquidity and appeal.

The Ethena DeFi protocol has also risen to sixth place in total value locked (TVL), currently holding more than $9.4 billion in assets. This surge reflects attractive yields and recent strategic partnerships that draw both risk-tolerant and conservative investors.

Ethena Price Analysis: Future Outlook and Partnership Developments

Looking ahead, Ethena aims to enhance its ecosystem further by developing a USD-compliant stablecoin in collaboration with Anchorage Digital — the first federally chartered crypto bank in the U.S. This move, aligned with recent regulatory developments like the GENIUS Act, could position Ethena as a leading player in compliant decentralized finance.

Ethena partners with Anchorage Digital to develop a USD-compliant stablecoin, boosting its DeFi compliance. Source:DeFi Llama

ETH’s bullish trend, with prices recently surpassing $3,800, strengthens Ethena’s earnings model, enabling the platform to sustain higher USDe supplies and reward stakers with average annual percentage yields (APYs) nearing 8.85%. This is a substantial increase compared to early July’s APY of 3.51%, correlating directly with Ethereum’s upward momentum.

Nonetheless, Ethena’s tokenomics and market dynamics suggest caution. The platform must manage supply carefully to avoid liquidity crunches or forced liquidations during potential ETH corrections. However, current trends support an optimistic ENA price forecast for the remainder of 2025.