🚀 Uniswap Soars Past $11 as Bulls Obliterate Resistance—Here’s What’s Next

Uniswap's native token just punched through a critical barrier—traders are scrambling as the DeFi blue-chip rallies.

Why the breakout matters: That $11 resistance had been a brick wall for months. Today's surge signals a potential regime shift.

Market mechanics at play: Spot volumes spiked 40% ahead of the move—classic accumulation before liftoff. Meanwhile, perpetual funding rates stayed negative (because Wall Street still thinks retail's wrong).

What's next: Watch the $12.50 zone. Flip that to support, and we're likely staring at a liquidity vacuum toward $15. Fail here? Enjoy the 'we told you so' from permabears.

*Bonus cynicism*: TradFi analysts will credit 'institutional adoption' if this holds—never mind that the same institutions called it a 'scam' at $2.

Breaking above a local downtrend resistance has added momentum to its recent performance.

Price action has been supported by steady trading volume and several successful technical breaks over the past weeks. These developments place the asset closer to challenging higher resistance points last tested months ago.

Uniswap Breakout from Local Downtrend Resistance

In a recent X post, analyst crypto Rand highlighted that UNI has surpassed several resistance barriers, with the latest move clearing a local downtrend line. The 3-day chart reveals a reversal from the extended decline earlier this year, with price action reclaiming the $9.00 and $10.00 zones. Consolidation above $11.00 is now taking place near a historically contested price area.

Source: X

Key support levels remain visible, including zones NEAR $8.00 and $6.20, which could offer stability in case of retracements. The breakout from the descending channel indicates renewed upward control from buyers.

If buying pressure continues, $13.00 could emerge as the next upside target. This transition from corrective movement to structural recovery reflects improving chart conditions for Uniswap.

Market Data and Trading Activity

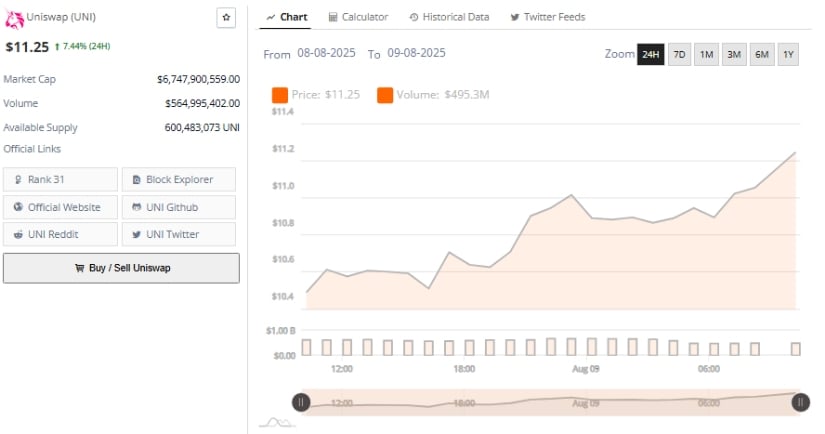

According to BraveNewCoin, UNI is valued at $11.25, reflecting a 7.44% rise over the past 24 hours. Its market capitalization stands at approximately $6.74 billion, ranking it 31st among cryptocurrencies.

Trading volume over the same period reached $564.99 million, with a circulating supply of about 600.48 million tokens. These figures indicate robust liquidity and active market participation.

Source: BraveNewCoin

The 24-hour chart shows a climb from below $10.80 to above $11.40 before stabilizing. Volume peaked during early trading and stayed elevated throughout the session, demonstrating continued interest from market participants. The gains were achieved without sharp pullbacks, indicating a gradual build-up of positions rather than aggressive speculative surges.

The absence of strong selling pressure suggests that the current momentum could be sustained in the near term. Gradual upward movements tend to provide a stable base for extended rallies, especially when accompanied by consistent volume. Should liquidity levels remain steady, the price could continue to trend higher within a controlled structure.

Technical Indicators Support Upward Momentum

At the time of writing, according to TradingView, Uniswap is trading at $11.255, marking a 3.63% daily increase. Price is positioned near the upper Bollinger Band at $11.487, showing firm buying activity.

The middle band, at $10.136, serves as immediate dynamic support, while the lower band at $8.785 remains the distant downside level. The Relative Strength Index (RSI) is at 65.28, moving close to overbought territory but not yet signaling market strain.

Source: TradingView

Candlestick patterns point to steady gains since early August, with consistent closes above the 20-day moving average. The break beyond $11.00 has shifted attention to the next resistance at $11.686, a previous swing high.

Volume trend and RSI levels indicate healthy momentum, though the RSI’s proximity to 70 warrants observation. Sustaining a price above the mid-Bollinger Band could preserve the bullish structure, while a drop below it may lead to short-term consolidation.

If the present trend holds, UNI’s breach of key resistance and consistent buyer presence could keep it well-positioned for further tests of upper resistance levels in the coming sessions.