XRP Primed for $4 Surge as SEC Lawsuit Ends—Whales Move $1.9B in Bullish Bet

Ripple's legal nightmare finally over—and XRP's price is ready to roar.

Whales just dumped $1.9B into the token, signaling massive confidence in its post-lawsuit potential. Targets now set at $4, a level that would make even Bitcoin maximalists glance sideways.

Of course, Wall Street will still call it 'speculative'—right before quietly accumulating positions through over-the-counter desks.

The rally comes despite a substantial $1.9 billion whale sell-off, underscoring renewed investor confidence and heightened institutional interest in Ripple XRP.

Ripple vs SEC Case Officially Ends

After nearly five years of courtroom battles, Ripple Labs and the U.S. Securities and Exchange Commission have agreed to end their legal dispute. Both sides withdrew their appeals on August 8, 2025, finalizing a $125 million settlement and placing restrictions on Ripple’s institutional sales.

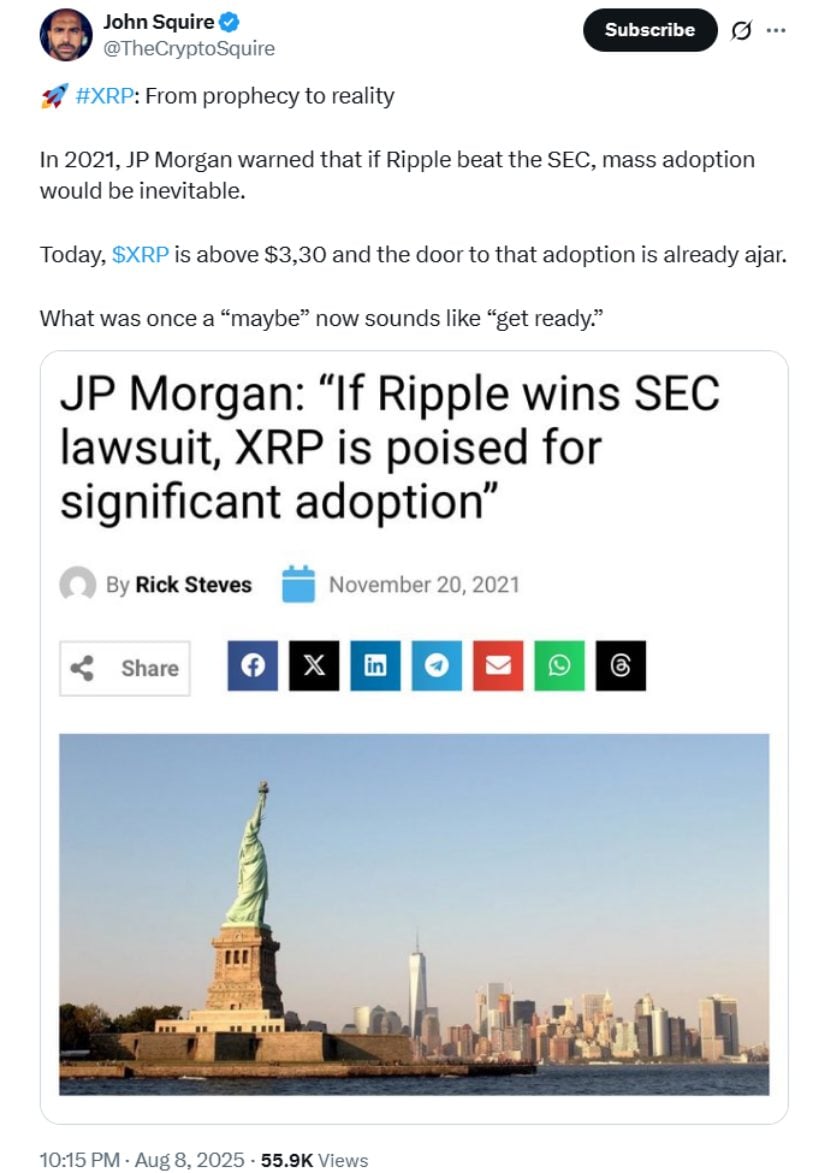

XRP’s legal victory over the SEC has transformed JP Morgan’s 2021 prediction of inevitable mass adoption into an emerging reality above $3.30. Source: John Squire via X

The lawsuit, filed in December 2020, alleged Ripple’s XRP sales to institutional investors were unregistered securities offerings. Multiple partial rulings in Ripple’s favor over the years created a complex legal path, but the final settlement now provides long-awaited regulatory clarity.

“This is a turning point for XRP,” market analysts noted, highlighting that legal certainty could accelerate adoption across financial institutions and payment networks.

Market Reaction: Surge in Price and Volume

The price of XRP today spiked from $2.99 to $3.30 within 24 hours of the announcement, marking an 11% daily gain and pushing market capitalization back above $180 billion. XRP futures volume surged over 200%, surpassing solana in derivatives trading activity, while open interest hit its highest level of 2025.

XRP was trading at around $3.31, up 0.01% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Spot markets mirrored the bullish sentiment, supported by strong technical momentum and increased retail participation. Analysts say the combination of legal clarity and heavy trading activity could fuel sustained upward pressure.

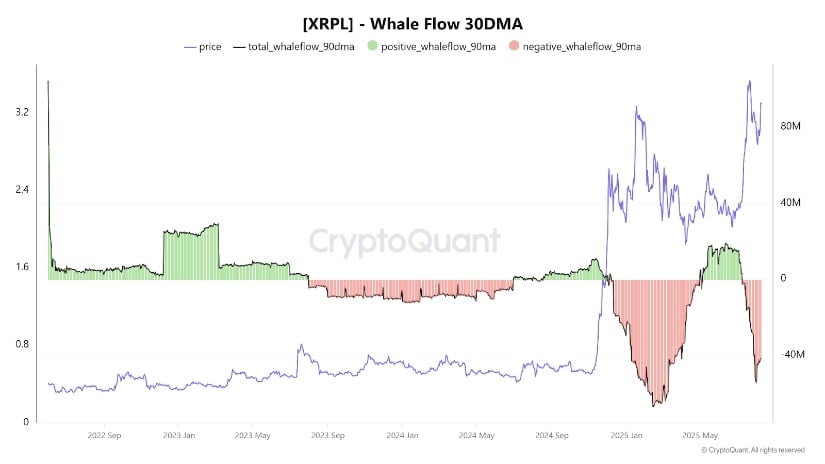

Whale Activity: $1.9B Sell-Off Absorbed

On-chain data revealed that whales moved approximately $1.9 billion worth of XRP in the 48 hours following the court decision. Historically, such large-scale sell-offs can slow rallies, but in this case, buy-side demand—likely from institutional players—absorbed much of the selling pressure, stabilizing the market NEAR the $3.30 level.

Since July 9, XRP whales have sold approximately 640 million tokens—over $1.91 billion at current prices—according to CryptoQuant data. Source: CryptoQuant

Galaxy Digital, led by Mike Novogratz, disclosed $34 million in XRP holdings in its Q2 SEC filing, signaling renewed institutional appetite. In Asia, South Korean custody provider BDACS has launched compliant XRP custody solutions for major exchanges like Upbit and Coinone, potentially boosting liquidity in one of the world’s busiest crypto markets.

Technical Outlook: Eyeing the $4 Level

Technical charts indicate that the xrp price is breaking out of a descending channel, reclaiming the ascending trendline from early July, and flipping multiple resistance levels into support. The EMA20 and EMA50 have crossed above the EMA100, a bullish alignment often seen in the early stages of extended uptrends.

XRP has broken out of a falling wedge, with price targets set at $3.56 and $3.74 following bullish momentum from the appeal withdrawal. Source: Rogue1trader on TradingView

Immediate support is now at $3.20, with near-term resistance at $3.38. A decisive breakout above this zone could pave the way to $3.55–$3.60, followed by the psychological $4 barrier. Beyond that, analysts see potential moves toward $5–$8 if market momentum continues, with some projecting double-digit targets in a strong bull case.

A potential ETF launch remains speculative but is now viewed as more likely, mirroring the regulatory pathway seen with Bitcoin and Ethereum.

Outlook: Can XRP Break $4?

With the lawsuit resolved, institutional players returning, and bullish technical setups in place, XRP has multiple catalysts to sustain its uptrend. The $3.50–$4 range will be the critical test in the coming sessions. A confirmed breakout could shift market psychology, attracting further capital inflows.

While short-term volatility is inevitable, the broader XRP price forecast 2025 remains positive, with legal clarity positioning Ripple XRP for wider adoption in global payments and financial markets.