Avalanche (AVAX) Soars: $35 in Sight as Network Activity Shatters Records

Avalanche isn't just climbing—it's scaling Everest without oxygen. Network activity just punched through its all-time high, and bulls are already pricing in a $35 target. Forget 'slow and steady'—this is crypto's version of a moonshot with afterburners engaged.

Why the frenzy? The chain's firing on all cylinders—developers are deploying, users are transacting, and even the skeptics are sneaking glances at the charts. No one wants to miss the next leg up.

Of course, Wall Street's still calling it a 'speculative asset' between yacht payments. But when has traditional finance ever timed a crypto rally right? Avalanche's momentum suggests the smart money's already onboard—even if they won't admit it over martinis.

AVAX price is trading near $23 after a long accumulation phase, holding firm above key support at $20 to $22. Recent strength above short-term moving averages, combined with record network activity, is sparking fresh optimism. This AVAX price prediction now focuses on whether bulls can break the $28 barrier, opening the path towards the $32 to $35 range.

AVAX Price Positions for a Potential Macro Reversal

AVAX price is trading NEAR $23 after a prolonged accumulation phase, a level that sits deep below its all-time high of $146. The chart from bigmanrj shows a market that has spent months compressing in a tight range.

Structurally, AVAX has maintained a broad base of support around $20 to $22, with recent price action pushing above short-term moving averages, hinting at early trend recovery signs.

AVAX holds near $23 after months of tight consolidation, hinting at an early-stage reversal toward higher resistance. Source: bigmanrj via X

From a technical standpoint, the macro chart suggests AVAX is still in the early stages of attempting a reversal. The long period of sideways movement has allowed prior selling pressure to thin out, leaving room for expansion if volume steps in. With ecosystem growth and new projects emerging, any shift in broader market sentiment, especially during a strong altcoin season, could give AVAX the momentum needed to test higher resistance zones in the $35 to $40 range.

AVAX Network Activity Hits Record High

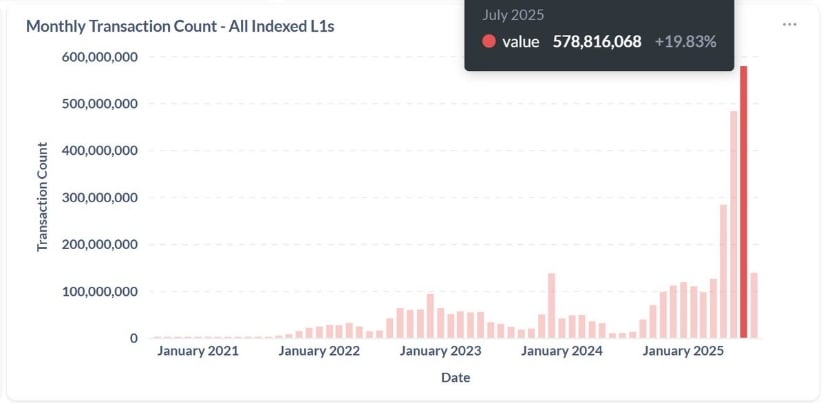

Avalanche’s on-chain momentum just reached a major milestone as shown by Trendfi, with July closing at an all-time high of 578.8 million transactions, marking a 19.8% increase from the previous month. This surge in activity stands out against the broader LAYER 1 landscape, showing that while the price has remained in accumulation, network usage is quietly expanding at an unprecedented pace. Such growth in on-chains leads to a strong price narrative.

Avalanche records an all-time high of 578.8M transactions in July. Source: Trendfi via X

This spike in activity adds a layer of strength to the macro reversal. Sustained network demand can act as a foundation for price recovery, as it indicates consistent real-world utility. If this elevated transaction pace continues, it could help absorb selling pressure and provide the momentum needed for AVAX to push toward its next resistance targets in the mid-$30s.

AVAX Eyes Key Breakout Level at $28

AVAX Avalanche price is attempting to build momentum after bouncing from the $22 support zone, reclaiming short-term moving averages in the process. The chart from rektbuildr shows price pressing back toward the $24 area, with the 50-day MA now acting as the first hurdle. A decisive break above $28 would invalidate the local double-top structure formed in July, shifting the bias toward a broader recovery phase.

AVAX price tests momentum above $24, with a breakout over $28 set to unlock the $32–$35 resistance zone. Source: rektbuildr via X

In the context of its recent record-breaking network activity, such a move could align both technical and fundamental momentum. Above $28, the next key liquidity pocket sits in the $32 to $35 range, where prior selling pressure previously capped advances. Clearing that area would not only strengthen the macro reversal thesis but also open the path for AVAX price to challenge higher timeframe resistance levels established earlier in the cycle.

AVAX Price Prediction: Long-Term Channel Structure Signals Potential Upside

AVAX price is rebounding from the lower boundary of a well-defined ascending channel, a level that also aligns with horizontal support around $20.70. The monthly chart shared by Abitak shows this confluence acting as a strong technical floor, allowing the price to maintain its broader bullish channel structure despite prolonged consolidation. As long as the AVAX Avalanche price continues to respect this channel base, the medium-to-long-term bias remains tilted toward gradual upside movement.

AVAX rebounds from a key channel base near $20.70, eyeing $38.40 resistance. Source: Abitak via X

From a structural perspective, the next key resistance sits near $38.40, aligning with the channel’s midline, before the upper boundary comes into play closer to the $74 to $110 range. Breaking through these levels WOULD not only confirm the channel’s momentum but also set the stage for a potential retest of the $147 all-time high zone.

Fundamental Buildup Adds to Bullish Case

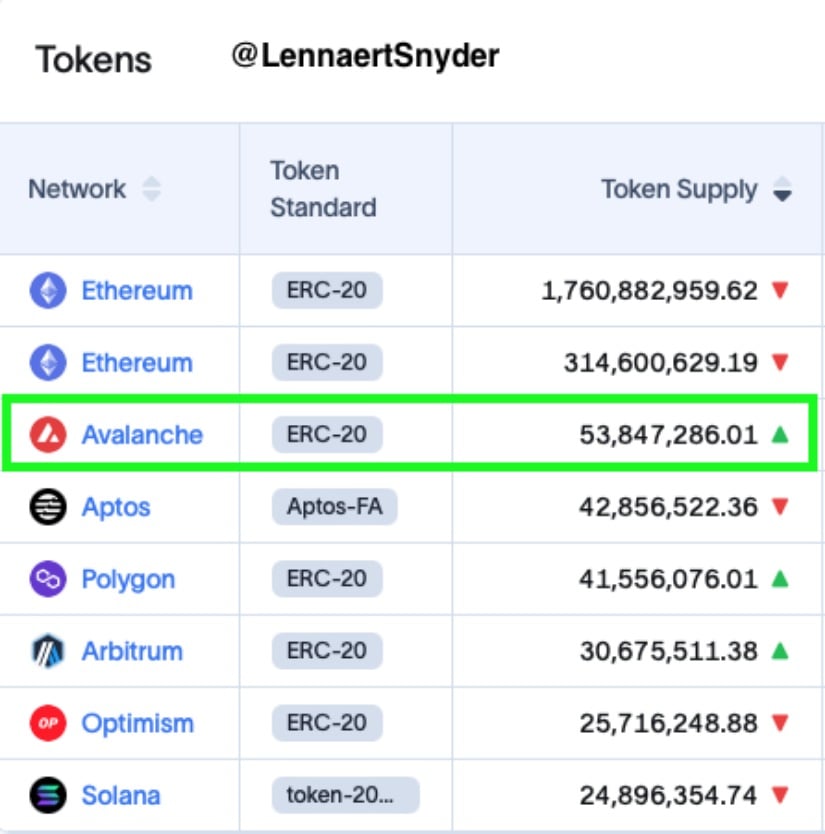

Avalanche’s fundamentals continue to strengthen alongside its technical setup. Lennnaert Snyder’s data highlights Avalanche now ranking as the second-largest blockchain for BlackRock’s BUIDL Fund by assets under management, trailing only Ethereum. This position not only boosts AVAX’s credibility in the real-world asset (RWA) narrative but also signals increasing institutional alignment.

AVAX secures the second spot in BlackRock’s BUIDL Fund rankings, reinforcing its position in the growing real-world asset narrative. Source: Lennnaert Snyder via X

On top of that, Blackstars crypto News reports daily trading volume has exceeded $785 million, underscoring active market participation even as the price remains in an early-stage reversal zone.

Key takeaways from these developments include:

-

Institutional traction: AVAX is now firmly positioned in BlackRock’s RWA ecosystem.

-

Liquidity boost: $785M+ in trading volume reinforces active demand.

-

Strategic positioning: Ranking just behind Ethereum strengthens AVAX’s Layer 1 presence.

This combination of institutional adoption and high liquidity could serve as the missing catalyst for the AVAX price macro reversal.

Final Thoughts: Will AVAX Break the $28 Barrier?

With record network activity, strong institutional traction, and a resilient support base, AVAX is showing signs of a potential macro turnaround. The key question for this avax price prediction is whether bulls can clear the $28 resistance, which could unlock a run towards $32 to $35 and set the stage for higher targets later in the cycle.

Still, holding above the $20 to $22 zone remains critical to keep the bullish structure intact. A sustained close above $28 would shift momentum firmly in favor of buyers.