Pudgy Penguins (PENGU) Primed for $0.11 Breakout: Bull Flag & Whale Moves Signal Rally

Pudgy Penguins (PENGU) is flashing textbook bullish signals—and whales are loading up. Here’s why traders are betting on a run to $0.11.

The Bull Flag Setup: PENGU’s consolidation mimics a classic continuation pattern. Tight range, shrinking volume—it’s coiled for a breakout.

Whale Watch: On-chain data shows big wallets accumulating quietly. When institutions move, retail usually follows (and overpays).

Key Level: A decisive close above $0.11 could trigger algorithmic buying. Below? Even crypto’s cutest project isn’t immune to a ‘buy high, sell low’ crowd.

Pudgy Penguins is holding its ground NEAR the yearly open after a strong mid-year rally, refusing to give in to the broader market correction. Fresh back-to-back exchange listings on Bitstamp by Robinhood and Arkham Exchange have expanded its accessibility, drawing both retail and institutional eyes back to the chart.

Pudgy Penguins Secures Back-to-Back Exchange Listings

Pudgy Penguins’ exchange presence just got a notable boost, with two fresh listings landing back-to-back. Bitstamp by Robinhood has rolled out support for PENGU across Europe, while Arkham Exchange has added both spot and perpetual trading pairs.

Pudgy Penguins expands its reach with back-to-back listings on Bitstamp by Robinhood and Arkham Exchange, boosting market accessibility.

These listings arrive as market interest in PENGU continues, giving both retail and institutional participants more avenues to engage. While price action will ultimately depend on broader market conditions, the improved accessibility could help support trading volumes and foster more stable market participation.

Pudgy Penguins Hold Yearly Open as Price Structure Stays Intact

PENGU Pudgy Penguins price is currently holding near its yearly open, a level that often acts as a psychological mark. The latest chart from Pick shows the price consolidating above this line after a strong mid-year rally, suggesting that buyers are still defending key territory. Volume remains steady rather than fading out, which can be a sign that the market is quietly absorbing supply before attempting the next leg higher.

PENGU defends its yearly open with steady volume, hinting at quiet accumulation and potential for a push towards recent highs. Source: Pick via X

This positioning comes right after the twin exchange listings, creating a scenario where technical structure and fresh liquidity could work together. If PENGU continues to respect this yearly open while building higher lows, the path towards retesting recent highs becomes technically possible. Meanwhile, a decisive MOVE above the immediate resistance zone could set the stage for a more extended push without the need for deep retracements.

PENGU Eyes Break Above $0.038 Resistance

With the yearly open still acting as a firm base, PENGU’s price action is now pressing against a short-term resistance near $0.038. Scott’s chart outlines a clean structure where the market recently formed a local bottom, followed by higher lows pointing towards renewed momentum.

PENGU compresses under $0.038 resistance, with higher lows signaling a potential breakout toward recent highs. Source: Scott via X

This kind of compression just below resistance often signals an imminent test, and a daily close above $0.038 could shift sentiment towards a retest of the highs set earlier this year.

The setup aligns with the broader narrative around Pudgy Penguins. If buyers can convert this resistance into support, the technical path toward all-time highs becomes clearer, with minimal overhead supply zones until the $0.046 to $0.048 region.

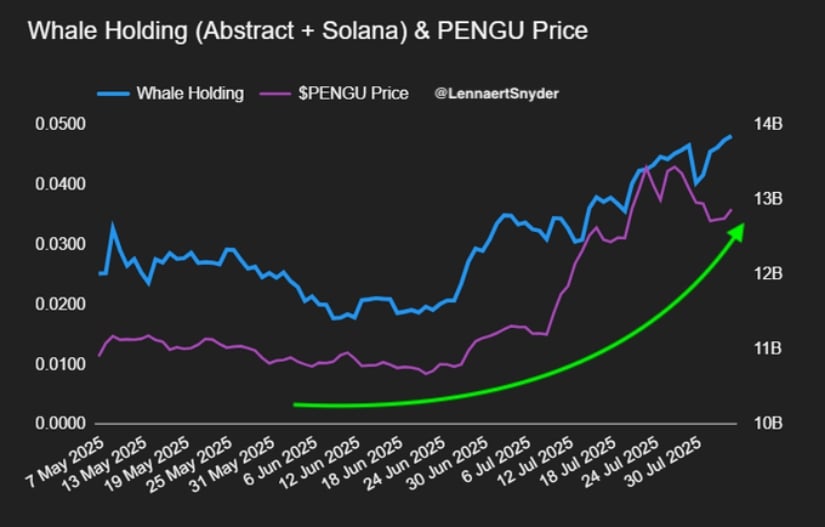

Whale Accumulation Adds Depth to PENGU’s Market Structure

Alongside the steady technical setup near $0.038, on-chain data is painting an equally constructive picture. Lennaert Snyder’s highlights a clear rise in whale holdings for PENGU.

This accumulation trend has been building in tandem with price appreciation, suggesting that larger players are steadily positioning rather than chasing short-term moves. Such behavior often reflects a conviction-based approach, which can provide stability to the order book during volatile phases.

Whale holdings in PENGU continue to rise. Source: Lennaert Snyder via X

When viewed in the context of other triggers, the whale activity adds another supportive LAYER to the bullish case. If this accumulation persists while technicals continue to compress under resistance, the market could be primed for a more decisive breakout.

Pudgy Penguins Price Prediction: Bullish Flag Builds Foundation for $0.11 Move

Famous crypto analyst Ali Martinez places Pudgy Penguins within a well-defined bullish flag, a continuation pattern that often emerges after strong impulsive runs. The lower trendline is acting as dynamic support, catching each pullback while price compresses toward the upper boundary. This controlled consolidation, paired with the measured move projection, aligns with a potential breakout target near $0.11, assuming the flag resolves upward. The presence of multiple Fibonacci extension confluences between $0.095 and $0.11 adds further weight to this technical zone as a realistic objective.

Pudgy Penguins forms a bullish flag pattern, with analysts eyeing a potential breakout toward $0.11 if key resistance levels give way. Source: Ali Martinez via X

Positioning-wise, this setup follows the recent accumulation trend from whales and the resilience shown at the yearly open. If buyers can hold the rising support and push through interim resistance near $0.046 to $0.048, momentum could accelerate quickly into thin overhead supply.

Final Thoughts

Pudgy Penguins’ mix of fresh exchange listings, steady whale accumulation, and a firm hold near the yearly open paints a constructive picture heading into the next trading phase. If buyers can finally flip the $0.038 resistance into support, the door opens for a move towards the $0.046 to $0.048 zone, with the bullish flag structure hinting at even bigger upside towards $0.11.