Ethena (ENA) Price Prediction 2025: Transak’s USDe Integration Fuels Rally—Will ENA Smash $1 on Mainstream Adoption?

Transak just handed Ethena a rocket booster. By adding USDe to its fiat on-ramp, the gateway for normies to enter crypto just got a whole lot smoother. ENA bulls are already licking their chops.

Adoption wave or hype tsunami?

The move lets users swap dirty fiat for USDe—Ethena's synthetic dollar—without touching a DEX. Fewer steps, fewer headaches. Traders win. Liquidity wins. And ENA? It’s sitting pretty as the governance token for the whole operation.

Can it hit $1? The charts whisper 'maybe.' The crowd screams 'LFG.' Meanwhile, Wall Street still thinks stablecoins are for buying black-market alpaca sweaters. Priorities.

One thing’s clear: In a world where 'yield' means 0.5% at your local bank, Ethena’s play for frictionless dollar alternatives just got real. Buckle up.

This move expands access to the third-largest stablecoin by market cap, allowing users outside the United States to directly purchase USDe through local payment methods such as bank transfers, Apple Pay, Google Pay, and credit or debit cards.

The seamless access to USDe is expected to significantly accelerate adoption, especially in emerging markets where traditional dollar access is limited. “Transak’s infrastructure unlocks fiat on-ramps for USDe at a global scale, furthering our mission to deliver the synthetic dollar to anyone, anywhere,” said Guy Young, Founder of Ethena Labs.

Ethena Crypto Prediction: The Synthetic Dollar Model Gains Traction

Ethena’s USDe differs markedly from traditional fiat-backed stablecoins like USDC or USDT. Rather than relying on fiat reserves held in banks, USDe maintains its dollar peg using a crypto-native delta-neutral strategy. This involves taking long positions in assets like ETH while hedging via short positions in perpetual futures. The design improves decentralization, censorship resistance, and accessibility—qualities that resonate with users in volatile or underbanked regions.

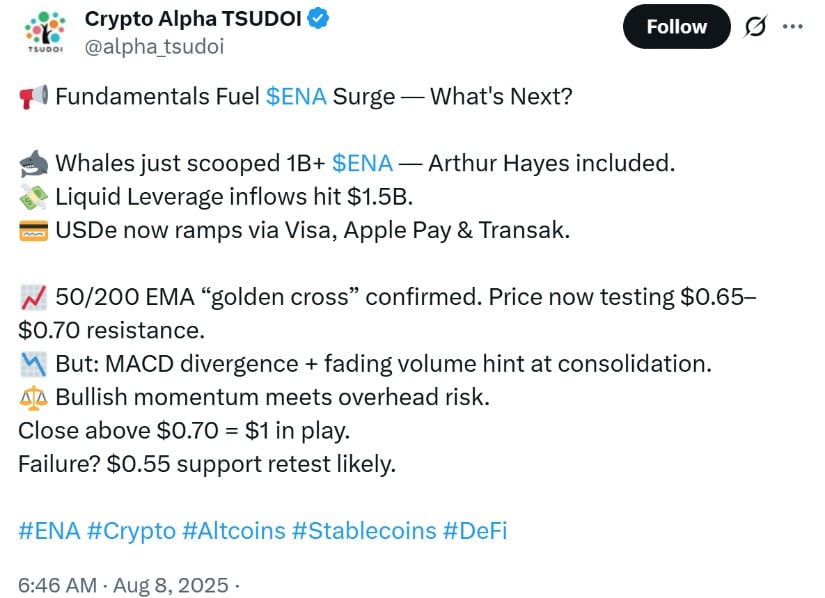

Ethena Labs’ USDe is now accessible through Transak’s fiat on-ramp, enabling direct purchases via Visa, Apple Pay, and other local payment methods. Source: @alpha_tsudoi via X

Additionally, staking USDe returns a yield-generating sUSDe, with an APY of approximately 10%. These Ethena staking rewards are funded by ETH staking returns, derivative basis spreads, and funding rate arbitrage. As a result, USDe has evolved beyond a simple stablecoin into an income-generating asset.

ENA Price Today Rises on Whale Accumulation and Market Optimism

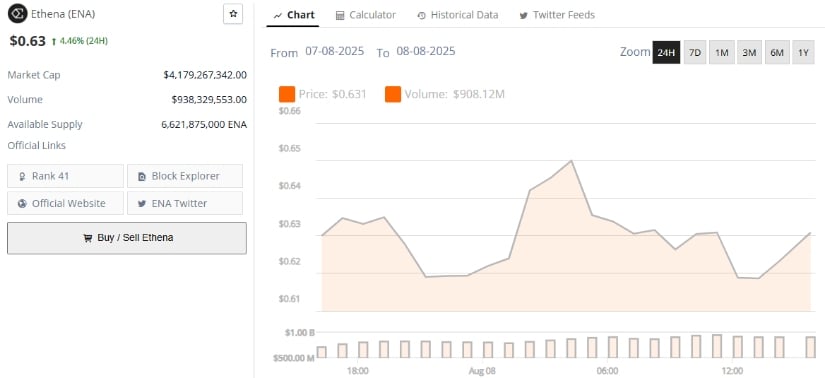

Ethena (ENA) has seen a strong price recovery in Q3 2025. ENA price today surged over 4%, trading near $0.63, driven by a mix of whale accumulation, growing USDe adoption, and bullish technical signals.

Ethena (ENA) was trading at around $0.63, up 4.46% in the last 24 hours at press time. Source: Brave New Coin

Data reveals that wallet addresses holding between 10 million and 1 billion ENA have collectively increased their holdings by over 1 billion tokens, pushing the total whale-held supply to 6.3 billion ENA. This bullish positioning supports the view that institutional confidence in the project remains high despite recent ENA token unlock events.

ENA Price Forecast: $1 in Sight?

The Ethena Price prediction is gaining traction as several technical indicators point to continued upward momentum. On the ENA/USD daily chart, the formation of a golden cross between the 50-day and 200-day exponential moving averages (EMAs) signals long-term bullish strength.

Other key indicators bolster this outlook:

- Ethena RSI analysis shows a reading of 63.95, suggesting room for more upside.

- MACD and Awesome Oscillator (AO) histograms both reflect strengthening bullish momentum.

- ENA support and resistance levels highlight $0.70 as the next key resistance. If broken, the price could target the $1 mark.

ENA Breakout Target: Riding the Transak Momentum

Ethena’s listing on Transak has coincided with a breakout from a falling wedge pattern—a historically bullish chart structure. The upward MOVE has brought ENA closer to its July high of $0.70. A flip above this level could confirm the ENA breakout target of $1.

Ethena (ENAUSDT) is forming a potential double bottom pattern, with price rebounding from key support and targeting the neckline resistance. Source: Weslad on TradingView

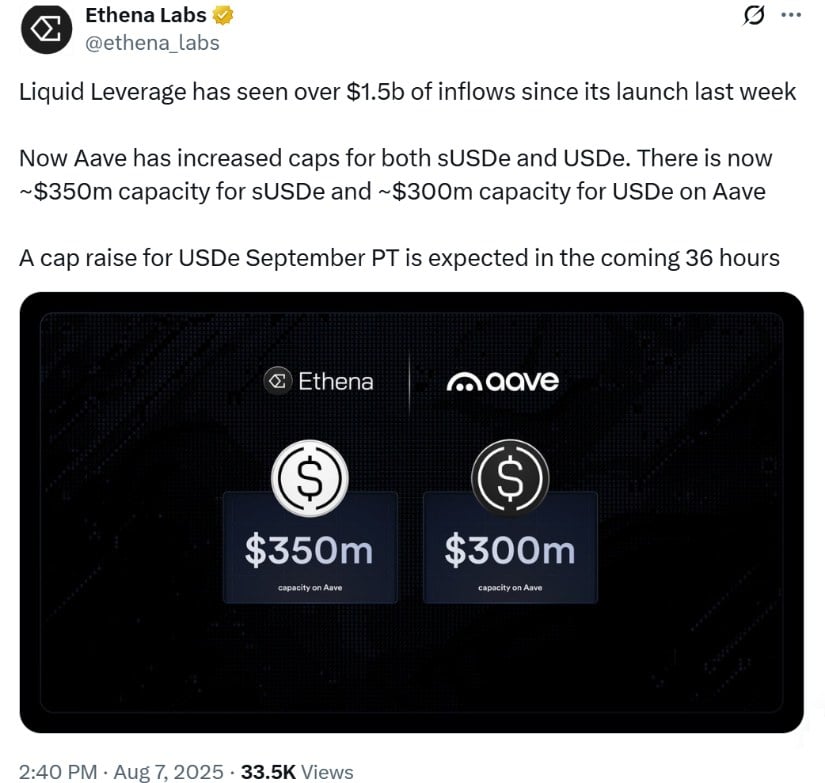

The broader demand for USDe also adds fuel to the fire. Per DeFiLlama, USDe’s market cap has surged from $5.3 billion to $9.66 billion in just three weeks. The growing user base and increasing institutional interest in Ethena’s synthetic dollar model are raising expectations that ENA may be on track for a significant price move.

Ethena Crypto News: Transak, Telegram & a Regulatory Tailwind

Transak isn’t the only platform integrating USDe. Telegram and other Web3 applications are tapping into Ethena’s stablecoin infrastructure to power global payments. Meanwhile, the recent passage of the GENIUS Act in the U.S. has introduced favorable stablecoin regulations, spurring both innovation and adoption.

Ethena’s Liquid Leverage drew $1.5B+ in inflows, leading Aave to raise sUSDe and USDe caps—with more USDe expansion expected in 36 hours. Source: Ethena Labs via X

“Stablecoin usage is at an all-time high,” said Transak CEO Sami Start. “As stablecoins evolve beyond just fiat wrappers, they need better infrastructure to reach users globally, and Transak powers that access layer.”

This sentiment echoes the Optimism across the industry, with several large U.S. banks now preparing their own tokenized dollar offerings, signaling what many call a “golden era for stablecoins.”

ENA Price Prediction 2025: Bullish Sentiment Prevails

While short-term volatility is likely to continue, the medium- to long-term ENA coin forecast remains bullish. With a growing market cap, a unique value proposition through USDe, rising staking yields, and integrations like Transak powering global access, ENA is increasingly seen as a serious contender in the altcoin space.

If the current trend holds and ENA breaks above the key $0.70 resistance, the psychological $1 target could become a near-term reality—reinforcing a confident Ethena token prediction for 2025 and beyond.