UNI Bulls Charge: Uniswap Smashes Through Support, Targets $11 Breakout

DeFi's favorite DEX token shakes off bearish pressure—liquidity pools brace for volatility.

Price Floor Becomes Springboard

UNI's rebound wasn't subtle. After testing lower bounds, the token ricocheted off support like a trader avoiding KYC—now eyeing that juicy $11 resistance level.

Liquidity Wars Heat Up

Market makers are playing chicken with limit orders as UNI's volume spikes. Textbook Wyckoff accumulation? Or just another 'vampire attack' on centralized exchanges' lunch money?

The Cynic's Corner

Wall Street still thinks 'DEX' is a detergent brand—meanwhile, Uniswap's doing more volume than some G7 stock exchanges. Wake us when the SEC figures out how to regulate a liquidity pool.

The current price action and volume trends indicate the formation of a strong base, pointing toward the possibility of a rally in the coming weeks.

As key resistance levels approach, traders are closely monitoring signals that the coin may break through to new highs, targeting the $11 resistance.

UNI Bullish Divergence and Key Resistance Levels

In a recent X post, analyst BullishBanter highlighted that the price of Uniswap is nearing a critical support zone, with signs of bullish divergence in the Relative Strength Index (RSI). This suggests that the momentum may be shifting to the upside.

The levels to watch are $0.959, $0.986, and $1.016, identified as breakout targets for the price. If the coin breaks above $0.959 and sustains its position, a potential rally toward $0.986 and $1.016 becomes increasingly likely. These levels align with key Fibonacci retracement points and prior resistance zones, making them significant for traders seeking to capitalize on upward movement.

Source: X

The price action on this chart suggests strong upward potential if it holds above the support level and breaks through the resistance at $0.959. With bullish signals from the RSI and a clearly defined trading channel, traders should be prepared to take advantage of the potential breakout.

Volume Trends and Consolidation Phase

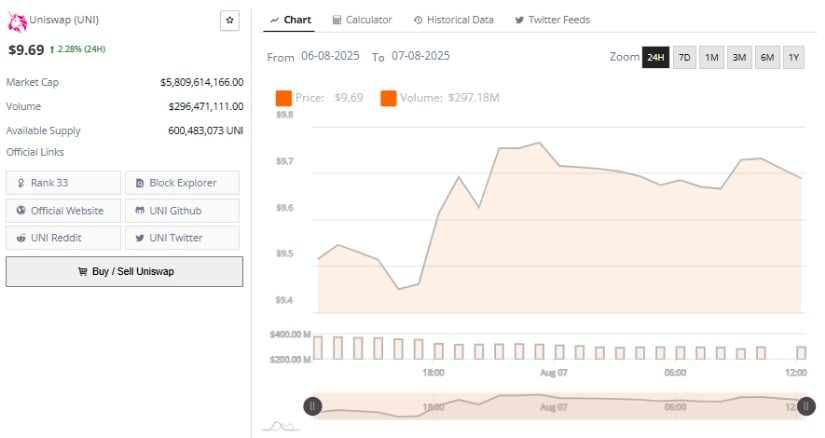

Market data indicates that Uniswap is holding steady at around $0.97, showing a 2.28% increase over the past 24 hours.

While the price action has been relatively stable, trading volume remains high at $296.47 million, which highlights active participation in the market. The crypto’s ability to stay above the $9.00 level remains crucial for the short-term outlook.

Source: BraveNewCoin

The coin’s performance suggests it is in a consolidation phase, with support levels established at $9.00 and resistance at $9.84. If UNI can break above the $9.84 resistance, it will likely push toward the $10.213 level, which has been an important target in recent analysis.

Traders should monitor for volume confirmation during any potential breakout to assess whether the momentum will continue toward the next resistance zone.

Bollinger Bands and RSI Indicate Upward Potential

At the time of writing, Uniswap price action on the 1-day chart shows volatility as it navigates between the upper and lower bands of the Bollinger Bands, with the upper band positioned at $11.263 and the lower band at $8.822.

The current price, hovering NEAR $9.84, indicates that the coin is experiencing volatility, which could suggest a short-term correction or breakout depending on how it interacts with these bands.

Source: TradingView

The Relative Strength Index (RSI) at 54.22 is currently neutral, but with a rising trend approaching the 56.03 mark, there may be enough strength to push the price toward the upper Bollinger Band.

If the coin can break through the $10.213 resistance, it could set its sights on $11.287. Conversely, if the price slips below $9.00, it may test the lower support at $8.822, marking a crucial juncture for the coin’s price movement.