Ethereum (ETH) Breaks $3,700 Barrier—Is $4,000 the Next Stop in This Bull Run?

Ethereum isn’t just holding ground—it’s charging. With ETH now firmly above $3,700, traders are eyeing the next psychological milestone: $4,000. Here’s why this rally might have legs.

The Setup: Ethereum’s price action has shifted from cautious optimism to full-throttle momentum. No flukes, no hype—just steady climbs and higher lows.

The Catalyst: Institutional inflows? DeFi revival? Or just traders tired of watching Bitcoin steal the spotlight? Whatever the reason, ETH’s chart looks like a spring coiling.

The Target: $4,000 isn’t just a round number—it’s a liquidity magnet. Break it, and the FOMO crowd jumps in. Fail, and… well, there’s always another ‘altseason’ around the corner (or so they say).

The Jab: Wall Street still thinks Ethereum is ‘tech stock lite.’ Meanwhile, ETH’s up 150% this year—suckers.

Analysts suggest ethereum could break above the $4,000 mark if its current bullish momentum continues. Sustained demand, supported by rising transactions and institutional inflows, may be the key driver behind this potential breakout.

Ethereum Price Today: Buyers Defend $3,700 Level

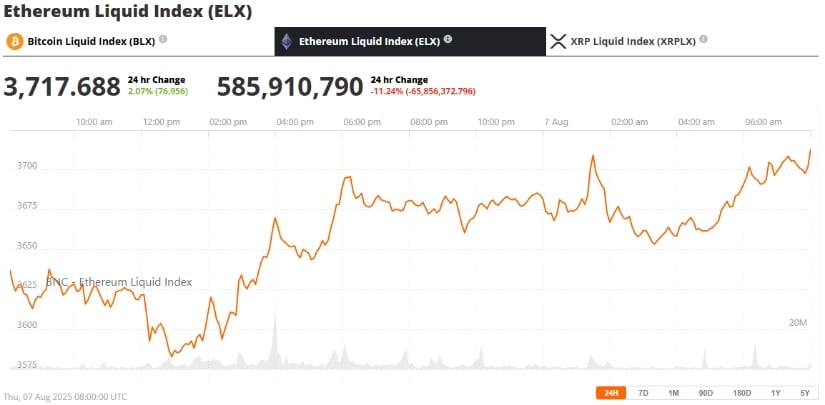

Ethereum (ETH) is currently trading around $3,800, reflecting a 5.3% increase over the past 24 hours. Despite a 4.7% decline over the past week, ETH remains 30% higher than it was a month ago, suggesting broader bullish sentiment remains intact.

Ethereum rebounds to $3,692 as daily transactions surge NEAR all-time highs, signaling renewed bullish momentum. Source: Galaxy via X

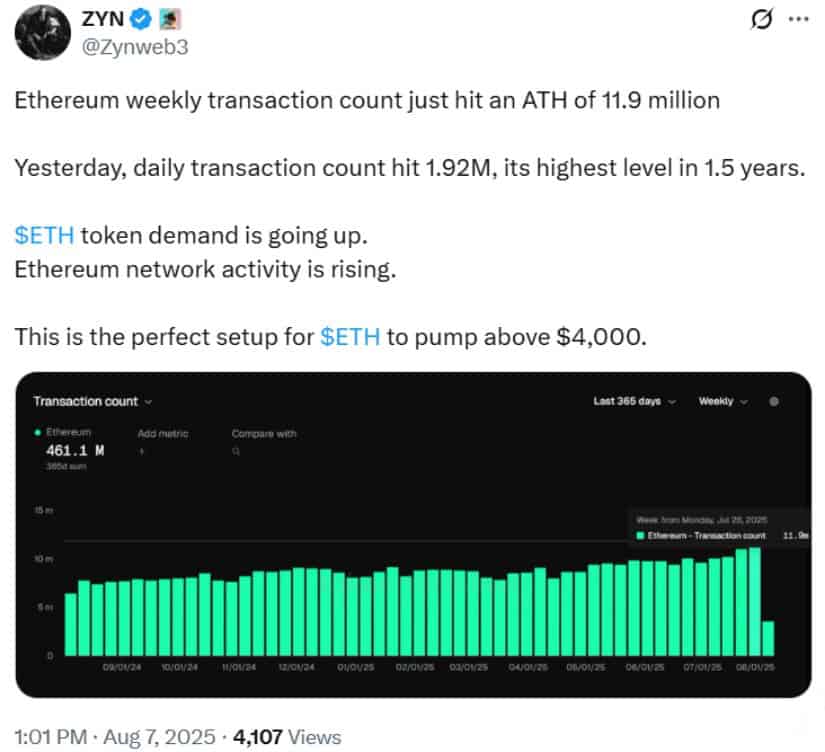

The recent recovery is underpinned by a strong rise in daily transaction volumes, with Ethereum processing nearly 1.87 million transactions on August 6, according to Etherscan. This figure nears the all-time high of 1.96 million recorded in January 2024, signaling a notable resurgence in network activity.

Market Overview: Ethereum Consolidates, But Bulls Remain in Control

After briefly peaking above $3,800 in July, Ethereum has entered a consolidation phase between $3,450 and $3,920. Technical indicators currently show neutral momentum, with ETH hovering just under the 20-day Simple Moving Average (SMA) at $3,685.

Ethereum forms a bullish cup and handle pattern—analysts eye $4,000 with targets at $3800, $3900, and beyond; DYOR, not financial advice. Source: DAY11 on TradingView

The Relative Strength Index (RSI) sits around 58—neither overbought nor oversold—while most oscillators, including the MACD and Stochastic, suggest indecision. Still, Ethereum is maintaining its uptrend structure, supported by a rising trendline that stretches back to April.

A breakout above the $3,733 resistance zone, marked by the upper Bollinger Band and prior March highs, could open the door to further gains toward $3,880 and eventually $4,092, which remains a major supply barrier.

Fundamental Catalysts: Institutional Interest and Stablecoin Demand Fueling Activity

Ethereum’s growing utility is drawing attention from institutional investors. According to data cited by Standard Chartered and NovaDius Wealth, ETH treasury-holding companies and U.S. spot Ethereum ETFs have each accumulated around 1.6% of the total ETH supply since June—combined, that’s over 3.2%.

Standard Chartered calls Ethereum treasury firms “very investable,” claiming they now offer better value than U.S. spot ETH ETFs. Source:

“Given NAV multiples are currently just above 1, I see the ETH treasury companies as a better asset to buy than the US spot ETH ETFs,” said Geoffrey Kendrick, Head of Digital Asset Research at Standard Chartered.

Unlike U.S.-based spot ETFs, many of these treasury firms are actively staking Ethereum and earning DeFi yields—adding a revenue-generating LAYER on top of price exposure.

Meanwhile, the recently passed GENIUS Act in the U.S. has boosted regulatory clarity for stablecoins like USDC and USDT. This has led to a spike in stablecoin transfer volume, contributing to Ethereum’s transaction growth and positioning it as the settlement layer for digital dollars.

Ethereum Layer 2 Ecosystem: L2s Remain Active, But Ethereum Mainnet Shines

Despite rising competition from faster Layer 2 networks such as Arbitrum, Optimism, and zkSync, Ethereum’s mainnet continues to dominate transaction flow. Analysts attribute this trend to the surge in DeFi, NFT activity, and a recent spike in DEX volumes on Uniswap, which has seen users migrate back to the main chain amid growing concerns over centralized exchanges.

While L2 total value locked (TVL) remains high, Ethereum’s base layer continues to attract high-value users and institutional transactions.

Technical Indicators: Breakout or Breakdown?

Ethereum is currently compressing between $3,650 and $3,733. A decisive MOVE above $3,733 with accompanying volume could initiate the next rally toward $3,880 and beyond.

Ethereum eyes breakout above $3,733 as Supertrend flips bullish and $49M net inflow fuels momentum—pullback risks remain if resistance holds. Source: Ali via X

A failure to breach this ceiling, however, may trigger a pullback toward $3,630, with deeper support lying at $3,529 (EMA100) and the rising trendline base near $3,400.

ETH’s Supertrend indicator on the 4-hour chart has flipped bullish above $3,489, suggesting a favorable setup if follow-through buying emerges. Net inflow data supports this view: Ethereum saw a net inflow of $49.05 million on August 7, reversing a weeks-long outflow trend.

Ethereum Price Forecast: Can ETH Break $4,000 in August?

Ethereum’s next move hinges on its ability to break above the key resistance band near $3,733–$3,880. If buyers can maintain pressure and absorb sell-side liquidity, a retest of $4,092 is on the cards—marking a potential gateway to higher levels later in Q3.

Ethereum network activity surges to record highs, setting the stage for a potential breakout above $4,000. Source: @Zynweb3 via X

Market structure remains bullish, and analysts like Benjamin Cowen believe that if ETH clears the $3,900–$4,100 zone in August, a move toward $6,000 to $7,500 by year-end could follow.

“Ethereum’s current rebound could echo past parabolic moves,” Cowen noted, comparing the present structure to Tesla’s 2023 performance—a pattern marked by consolidation, breakout, and vertical price acceleration.

Final Thoughts: Ethereum’s Future Outlook Remains Strong

Ethereum is consolidating at a critical technical zone with robust on-chain support. Growing institutional accumulation, renewed stablecoin activity, and near-record transaction volumes paint a fundamentally strong picture.

Ethereum (ETH) has been trading at around $3,717, up 2.07 % in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

While short-term price movement depends on breaking key resistance levels, the macro setup suggests Ethereum is well-positioned for further upside—especially if the $4,000 threshold is breached convincingly.