Dogecoin (DOGE) Surges 3.5% to Hold $0.20—Are Bulls Ready to Break Out?

Dogecoin isn’t just barking—it’s biting back. The meme coin clawed its way to a 3.5% gain, fiercely defending the $0.20 support level. But can the bulls turn this rebound into a full-blown rally?

The $0.20 Standoff

DOGE’s latest bounce at $0.20 signals stubborn resilience—or just another dead-cat bounce before Wall Street ‘experts’ dump their bags. Either way, traders are watching for a decisive breakout.

Meme Momentum or Mirage?

With volatility tighter than a crypto influencer’s profit targets, Dogecoin’s next move hinges on whether retail FOMO can overpower the usual cycle of hype and heartbreak. Buckle up.

This modest recovery has sparked renewed interest in the popular meme coin; however, a deeper examination of technical indicators and market sentiment reveals a complex and uncertain path ahead.

Dogecoin Price Hangs in the Balance Near Key Resistance

Following a volatile week that saw Dogecoin slip nearly 5% to a low of $0.20, the cryptocurrency has managed to regain ground and is now trading just shy of $0.21. This level marks a crucial resistance zone that has historically been difficult for bulls to break. A sustained move above this point could pave the way for a rally toward $0.23 and beyond.

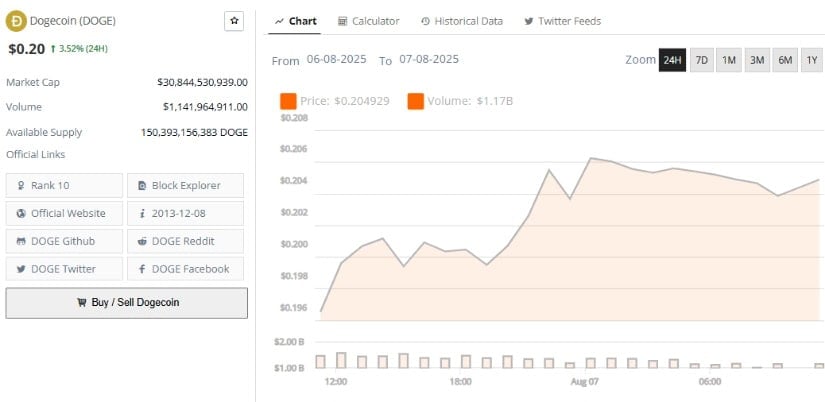

Dogecoin was trading at around $0.20, up 3.52% in the last 24 hours at press time. Source: Brave New Coin

Dogecoin is currently approaching a critical resistance level at $0.21, a point that analysts from The Tradable highlight as pivotal. If the price manages to break through this barrier, it could potentially trigger a rally toward $0.21 or beyond.

From a technical perspective, Dogecoin’s hour and day candles are showing growing bullish power. Breaking above $0.21 is still a tall order. Traders are hanging on to see whether Doge can not only break through this price level during the day but also close above it, which will confirm a genuine breakout and point to further upside potential.

Bearish Sentiment Persists Even as Price Rallies

Despite the recent comeback of Dogecoin, its derivatives market is less optimistic. According to Coinglass’s statistics, short positions continue to dominate on all time frames, which means that there is still hedging going on on a prolonged rally.

Bearish sentiment lingers as short positions continue to dominate the derivatives market despite Dogecoin’s recent price rebound. Source: Coinglass

Open interest in DOGE futures ROSE by 1.66% to $3.05 billion, while the trading volume fell more than 20% to $4.14 billion. This decoupling reflects weak participation from long speculators, supported also by high liquidations on both sides: $2.72 million by shorts and $2.01 million by longs in the last 24 hours.

This disparity might facilitate a short squeeze should bullish momentum gain pace. “If market sentiment shifts and DOGE breaks above key resistance levels, the concentration of Leveraged short positions could fuel a rapid price surge,” noted Ibrahim Ajibade from Coinspeaker.

Technical Indicators Show Mixed Signals

From a technical standpoint, DOGE is currently positioned within a long-term ascending channel that dates back to 2014, according to crypto analyst Trader Tardigrade. While the coin is currently in the lower-mid section of this range—typically seen as an accumulation zone—the upward trend remains intact.

Dogecoin ($DOGE) shows potential for upward movement as the TD Sequential indicator signals a buy on the daily chart. Source: Ali Martinez via X

Adding to the bullish case, Ali Martinez highlighted a falling wedge pattern on Dogecoin’s 1-hour chart, a formation often viewed as a precursor to upward movement. “A break above $0.22 to $0.23 could push DOGE to $0.26,” Martinez shared on social media.

Still, risks remain. Should DOGE fail to maintain support above $0.20 or get rejected at $0.22, it could tumble back to $0.18—a level that has provided strong support during recent consolidation phases.

Whales Accumulate Amid Uncertainty

While retail investors hold back, whale wallets appear to be accumulating. Surprisingly, over 310 million DOGE were scooped up during the correction, including a large 40 million coin purchase by digital asset company Bit Origin as part of a larger-scale $500 million portfolio diversification effort.

DOGE/USD rebounds from key demand zone with bullish momentum, eyeing $0.23 and $0.27 as next targets. Source: FrankFx14 on TradingView

This accumulation is a green flag that institutional and large investors are speculating on a future recovery, betting on Dogecoin’s longer-term growth and role in the broader crypto universe.

Can Dogecoin Break Out or Is a Pullback Due?

For Dogecoin to make a real reversal, analysts agreed it must close convincingly above the $0.23 level, also the median line of the Bollinger Band. That would shift technical momentum to bulls and possibly trigger a leap to $0.25 or even $0.26.

Dogecoin forms its third monthly bullish engulfing candle, indicating strong momentum. Source: Trader Tardigrade via X

However, Dogecoin price prediction models remain divided. Failure to sustain upward momentum could drag DOGE back to its lower Bollinger Band around $0.20. With the MACD currently flattening and trading volume declining, market participants are treading carefully.

Final Thought: Dogecoin at a Technical Crossroads

In the short term, Dogecoin’s price is caught between hope and hesitation. On one hand, historical patterns, whale accumulation, and wedge formations suggest a breakout could be on the horizon. On the other hand, derivatives data and declining trading volume point to ongoing bearish sentiment.

While many investors still wonder if dogecoin will reach $1 or if it can go up again, the near-term reality is that DOGE needs to conquer the $0.21–$0.23 resistance zone before any major bullish reversal can be confirmed.

Until then, the Dogecoin prediction remains cautiously optimistic—but highly dependent on broader market momentum and short-term technical breakouts.