🚀 XRP Surges Past $3.03: Breaking Free From Falling Channel as 20 EMA Holds Strong

XRP bulls just flipped the script—price punches through a weeks-long descending channel with conviction, now testing waters above $3.03. The 20-day EMA isn’t just holding; it’s become a springboard.

Technical Tightrope Walk

No fluke here. The breakout coincides with trading volume spikes, suggesting institutional fingers in the pie. Watch for a retest of the channel’s upper boundary—now turned support.

Wall Street’s Worst Nightmare

While traditional markets obsess over Fed minutes, crypto assets like XRP rewrite playbooks mid-game. Another reminder that decentralized networks don’t wait for quarterly earnings calls to make moves. (Take notes, Jamie Dimon.)

The token has managed to reclaim the 20-day EMA, signaling short-term strength despite a dip in trading volume. With buyers defending $3.03 and broader market sentiment improving, analysts are watching closely for a potential push toward $3.20 or higher in the coming sessions.

XRP Breaks Out: Technical Picture Improves

As of August 6, 2025, XRP today is trading at $3.03, reflecting a modest 1.16% gain over the past 24 hours. This increase follows a breakout above the top of a descending channel that had been suppressing upward movement since the July highs NEAR $3.80.

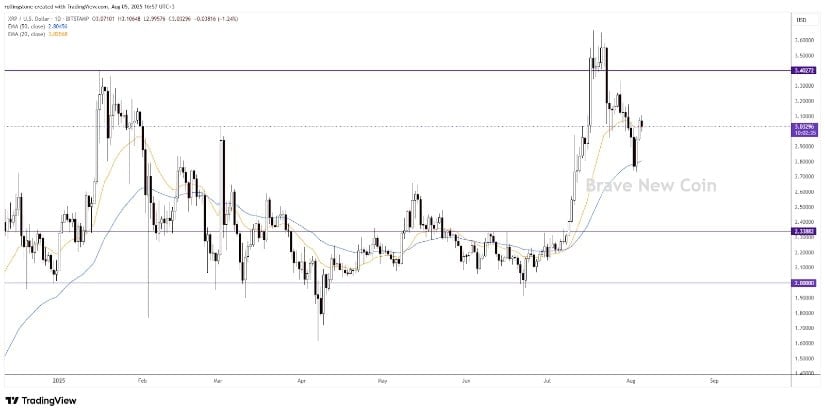

XRP price is currently holding the 20 EMA support on the daily timeframe chart. Source: TradingView

Technical indicators show XRP holding its 20 EMA (Exponential Moving Average), a key short-term support now acting as a potential launchpad. According to multiple chart readings, the breakout was initiated from a bounce off the $2.75 low, with price reclaiming levels above the 200 EMA at $2.91—a MOVE that some analysts view as a bullish reversal signal.

However, overhead resistance in the $3.14 to $3.34 range remains significant. A failure to close above this supply zone could see XRP retest support near $2.98 or even the accumulation base around $2.76.

On-Chain Data: Mixed Signals Amid Accumulation

Recent XRP news points to conflicting signals in market participation. On August 4, XRP posted a net spot inflow of $19.79 million, suggesting long-term investor accumulation. Previously, such inflows have been followed by trend reversals or consolidation.

XRP was trading at around $3.038, up 1.16% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

However, on August 5, the net FLOW reversed with a $15.21 million outflow, according to Coinglass data. Daily trading volume also declined 2.15% while price increased, suggesting the recent rally is running on reduced participation.

This volume and price action disparity is an indicator of broader market hesitation—a wait-and-see approach as XRP tests the structural integrity of its breakdown.

XRP Price Prediction: What’s Next?

Closing above $3.05 still remains an essential condition for the bulls to be fully in charge. As long as XRP sustains gains above this level, analysts forecast an advance up to $3.30 and potentially $3.55. Should momentum persist, price targets stretch to $3.69 on Fibonacci extension levels.

XRP is expected to maintain its bullish momentum as long as the price holds above the key $3.40 support level. Source: Reazosman on TradingView

Conversely, a breakdown below current levels could bring back $2.80 or $2.60, particularly if short-term resistance is too strong. Both the Relative Strength Index (RSI) and the Directional Movement Index (DMI) are currently displaying a neutral to bearish tilt on short-term frames, reinforcing confirmation before a complete trend reversal can be labeled.

Outlook: XRP Caught in a Delicate Balancing Act

Since xrp price models remain guardedly bullish, the ride from here is far from certain. There has been technical progress, but significantly more than a breakout will be required to hold for enduring upside—volume confirmation, broader market agreement, and maybe things that occur in the XRP lawsuit between Ripple Labs and the SEC.

Today, the XRP coin price is showing strength but no conviction. The traders are looking for a clear break above resistance to confirm that the recent move is not merely a corrective bounce.