🚀 CFTC Charges Full Steam Into Crypto: US Spot Trading Greenlit – These Altcoins Are Primed to Explode

The CFTC just dropped the regulatory hammer—US crypto exchanges are cleared for spot trading. Buckle up.

### The Domino Effect Begins

With the CFTC’s blessing, institutional money floods into altcoins. No more OTC whispers—this is mainstage adoption. Ethereum killers? More like legacy finance killers.

### The Altcoin Arms Race

Solana, Avalanche, and a handful of DeFi dark horses are already pricing in the liquidity tsunami. TradFi dinosaurs scrambling to ‘blockchainify’ their PowerPoints? Priceless.

### The Fine Print (Because Wall Street)

Expect ‘accidental’ flash crashes, ‘totally not insider’ trading, and at least one SEC tantrum. Same circus, new digital tent.

Bottom line: The casino’s open—and this time, the house doesn’t own all the chips.

Acting Chair Caroline Pham confirmed the push, aligning it with the Trump administration’s 18-point crypto policy roadmap, which seeks to bring digital assets deeper into the US financial system without stifling growth.

If implemented, this framework could mark a turning point for crypto market structure — shifting price discovery from offshore venues to domestic, regulated platforms. For altcoins, that’s a game-changer.With clear rules and easier US market access, cryptos positioned for compliance-friendly growth may see significant upside. From large-cap players to newer narrative-driven tokens, the stage is set for an explosive re-pricing as Washington finally signals it’s ready to play ball.

What the CFTC’s Move Means for Spot Crypto Trading

Spot crypto asset contracts represent direct, regulated trading of digital assets, where buyers and sellers exchange tokens for immediate delivery. This is very different from futures or derivatives, which are cash-settled bets on price movements rather than actual ownership of the underlying asset.

By enabling spot contracts on federally regulated exchanges, the CFTC is aiming to bring the Core crypto market – real token trading – under the same legal framework that governs commodities like oil or gold.

This initiative dovetails with the SEC’s Project Crypto, which seeks to clarify jurisdictional boundaries and coordinate oversight across agencies.The CFTC’s plan hinges on Section 2(c)(2)(D) of the Commodity Exchange Act and Part 40 regulations, which empower it to approve and monitor new contract markets. Together, these rules WOULD provide a clear compliance pathway for exchanges that want to list spot crypto pairs in the US.

For retail and institutional traders, this could be transformative. Regulated spot markets reduce counterparty risk, invite deeper institutional liquidity, and dampen some of the extreme volatility caused by fragmented offshore trading. Increased US participation could also accelerate mainstream adoption, making crypto markets behave more like mature asset classes.

While the CFTC faces staffing shortages, Acting Chair Caroline Pham has made it clear the political will is there. The CFTC is full speed ahead, she said, signaling that Washington is preparing to finally give crypto a regulated home on American soil.

With federal oversight finally taking shape, the playing field for crypto could look very different in the months ahead.

And while Bitcoin will likely soak up the headlines, it’s the altcoins with strong narratives and real liquidity tailwinds that stand to gain the most from this CFTC-driven shift. Here are three that could be first in line for liftoff:

1. Bitcoin Hyper ($HYPER) – Bitcoin’s True Layer 2 Accelerator

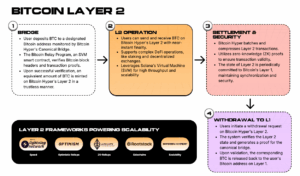

Bitcoin Hyper ($HYPER) isn’t just another token riding Bitcoin’s coattails. It’s building the first real bitcoin Layer 2 ecosystem on Ethereum, powered by Solana Virtual Machine (SVM) tech.

This hybrid setup gives Bitcoin what it’s been missing for years: lightning-fast transactions and ultra-low fees, all while staying DeFi-native.

With planned support for cross-chain swaps and a launchpad for Bitcoin-native dApps, it’s setting the stage for serious utility beyond simple speculation.

The numbers are already turning heads: its presale has raised over $7M, the token sits at $0.012525, and staking rewards are a jaw-dropping 152%. For degens who want Bitcoin exposure without sacrificing yield or speed, $HYPER has quickly become a serious contender.

$HYPER’s potential US market unlock is huge. Regulated access could pull in traders looking for a Bitcoin-backed play that delivers more than just price speculation: $HYPER is weaponizing Bitcoin for the next phase of crypto adoption.

To join the presale, visit our how to buy Bitcoin Hyper ($HYPER) walkthrough.

2. Best Wallet Token ($BEST) – Crypto Wallet Market Disruptor

Best Wallet Token ($BEST) is the fuel behind Best Wallet’s push to dominate 40% of the crypto wallet market by 2026.

Built as an ERC-20 token, $BEST offers reduced transaction fees, exclusive early access to presales, and even gamified rewards that keep users actively engaged. Its integration with iGaming perks adds another LAYER of stickiness for those who live and breathe Web3.

The presale speaks for itself: over $14M raised, a current price of $0.0254, and a 93% staking APY that’s already pulling in heavy interest.

With the CFTC’s push for regulated spot crypto trading, $BEST could see a major adoption wave in the US, where safer, compliant access would remove barriers for retail and institutional players alike.

And with Best Wallet’s upcoming crypto card, seamless fiat-to-crypto spending, and plans to expand multi-chain support, $BEST is shaping up to be an entire financial ecosystem.

Discover how to buy Best Wallet Token ($BEST) in our detailed guide.

3. Hyperliquid ($HYPE) – DeFi Layer 1 Offering Perpetual Futures & Spot

Hyperliquid ($HYPE) is rewriting the playbook for decentralized trading. As a Layer 1 blockchain purpose-built for DeFi perpetual futures, it combines a fully on-chain order book with zero gas fees – giving traders the speed and cost-efficiency they expect from centralized platforms, without the custodial risk.

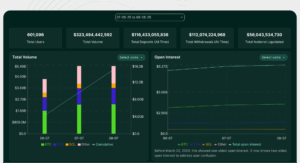

The metrics speak volumes: Hyperliquid now boasts 601K+ total users, over $323B in total trading volume the past month alone, and more than $8.2B in open interest as we write.

$HYPE itself is ranked #11 out of all cryptocurrencies, and with a market cap of $12.93B, it trades at $38.72. With $269M in 24-hour volume, it remains a dominant force, sitting just over 3 weeks removed from its $49.86 all-time high.

Though Hyperliquid is best known for its perpetual futures engine, it also supports spot trading, giving traders a unified platform for both Leveraged and non-leveraged crypto markets.

If US oversight opens the floodgates, Hyperliquid’s growth story is just getting started.

Final Verdict: Regulation Could Fuel the Next Altcoin Boom

The CFTC’s push for regulated spot crypto trading could be the spark that reshapes the US crypto market, opening the door for greater access, liquidity, and institutional participation.

Projects like Bitcoin Hyper ($HYPER), Best Wallet Token ($BEST), and Hyperliquid ($HYPE) stand to gain the most as clear rules bring cautious traders off the sidelines.

That said, the road ahead isn’t without risk. Market swings, shifting policies, and competitive pressure remain key factors you’ll need to watch closely.