Dogwifhat Roars Back: $0.82 Support Holds Strong as Traders Target $1 Breakout

Memecoin madness isn't dead—Dogwifhat just bounced off critical support at $0.82, and degens are piling back in.

Can WIF flip resistance into rocket fuel?

The charts scream bullish: After a 30% plunge last week (thanks, 'macroeconomic headwinds'), WIF found footing at $0.82—a level that's now acting as a springboard. Liquidity's building above $1, and options traders are betting big on a breakout before month-end.

Just don't tell the SEC we called it 'rocket fuel.'

Meanwhile, Bitcoin maximalists are muttering about 'narrative cycles' while secretly checking WIF's order book. Some things never change.

Currently trading NEAR $0.88, WIF has bounced off the $0.856–$0.860 zone, a critical support area that has held multiple times in recent sessions.

Crypto analysts see this recovery as a strong bullish signal, with Imran targeting a MOVE back to $0.894 and anticipating a reclaim of the $1.00 level if momentum holds. The recent bounce, combined with strong trading volume and oversold indicators, suggests WIF may be preparing for an upward breakout. This positions the token as one to watch in the meme coin sector.

Dogwifhat Price Rebounds From $0.82 With Eyes on $1 Breakout

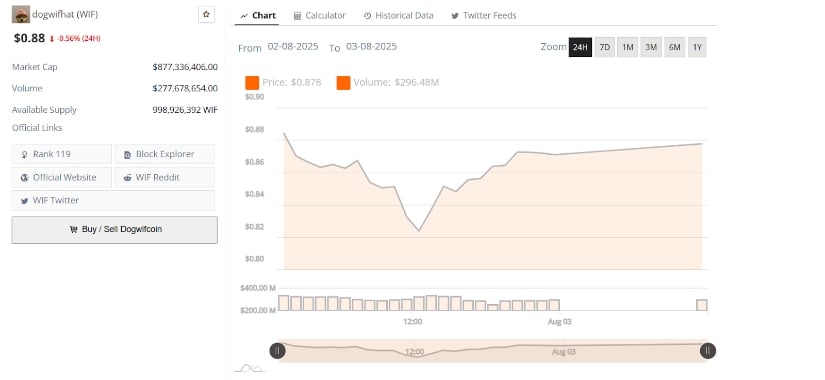

The dogwifhat (WIF) Price has shown a steady recovery from intraday lows around $0.82, supported by renewed buying activity and increased market participation. The asset recently traded near $0.88 after posting a minor 0.56% decline over the past 24 hours. Analysts are monitoring the $0.90 and $1.00 levels as potential resistance points, especially as momentum indicators suggest room for a possible upside continuation.

Source: BraveNewCoin

Trading volume for WIF over the past 24 hours reached $296.48 million, indicating consistent participation by traders. Early in the session, WIF experienced a brief drop below $0.84 before reversing direction. The price action since that bounce shows a sequence of higher lows, reflecting renewed interest near the base formed around the $0.84 to $0.86 support range.

$0.856 Support Zone Sparks Intraday Recovery

According to crypto analyst Muhammad Imran, WIF experienced a sharp bounce after sweeping the $0.856 support level. The quick rebound suggested that buyers were active in this zone, reversing the downward movement and restoring short-term structure. A chart shared by the analyst illustrates a clear long setup with an entry near $0.867 and a target at $0.894, marking a potential short-term upside range.

Source:X

This recovery phase aligns with previous reactions at the same support level, which has historically attracted demand. The bounce came after multiple rejections from lower levels, strengthening the argument for an ongoing accumulation range. The structure of the rebound and its follow-through will determine whether bulls can maintain the current trajectory or face renewed resistance at higher price points.

Analyst Eyes Return to $1.00 Price Level

Another Crypto analyst commented on the daily chart structure of WIF, stating that the token is trading near a reclaim zone. The chart shows WIF hovering above a horizontal support level just under $0.86, which coincides with previous bounce zones. The analyst shared that they are accumulating at current prices, indicating confidence in a price move toward the $1.00 mark.

The area between $0.84 and $0.86 has seen repeated defenses by buyers, forming a base that now aligns with high-volume nodes on the visible range volume profile. The 200-day moving average also lingers near this level, adding another technical factor of interest. If WIF can push beyond $0.90 and reclaim $1.00, traders may begin targeting the next zone near the previous high of $1.40.

WIF Maintains Higher Lows After Midday Rebound

The intraday chart structure reveals that WIF dropped below $0.84 earlier in the session but recovered quickly. Price rebounded from the $0.82 range and moved back above the $0.870 mark by the close of the observed timeframe. The recovery was gradual but sustained, with bulls maintaining a series of higher lows throughout the afternoon.

Volume patterns show ongoing interest in WIF, with steady buy-side pressure appearing at each dip. The area between $0.82 and $0.86 appears to be functioning as an accumulation zone, where short-term holders and active traders continue to support the token. However, WIF remains below the $0.90 resistance, which has capped recent rallies. Whether this level will be reclaimed in the coming sessions remains a focus for both swing and intraday participants.