Solana Price Prediction: SOL Targets $300 as $179 Support Flip Triggers Bullish Explosion

Solana bulls are back in the driver's seat—and this time, they're gunning for $300.

The $179 support reclaim isn't just a technical footnote—it's the launchpad for SOL's next leg up. Traders who slept on this breakout are already chasing entries.

Here's the kicker: This isn't hopium. The charts are printing the same bullish reversal patterns that preceded SOL's last 3x rally. Market makers love nothing more than squeezing shorts before a liquidity grab.

Of course, the usual crypto caveats apply. 'Support levels' in this market are just areas where bagholders cluster—until they aren't. But for now, the smart money's betting on SOL to outperform.

Funny how these 'decentralized' assets always seem to move in lockstep with Bitcoin's halving cycles. Almost like... nah, couldn't be.

Institutional attention towards solana is sending an exciting signal across the crypto market. With Upexi locking in a $500M line of credit for SOL purchases and key price levels flipping into support, momentum is building. Participants are now watching closely, as Solana edges towards a breakout that could reshape its short- to mid-term trajectory.

Solana Institutional Momentum Strengthens on $500M Treasury Backing

Solana just received another vote of confidence from the institutional world. Upexi, a treasury-focused firm, has secured a $500 million line of credit specifically aimed at funding additional SOL token purchases. This MOVE underscores the increasing interest from corporate entities in gaining deeper exposure to Solana, not just as a speculative asset, but as part of their long-term treasury management strategies.

Adding weight to the development, a chart from DeFi Dev Corp. shows a consistent pattern of strategic SOL accumulation dating back to early 2025. Each orange marker on the timeline pinpoints purchase events.

Solana sees steady institutional accumulation through 2025, with each marker signaling strategic purchases. Source: DeFi Dev Corp via X

This growing capital interest helps explain why SOL continues to find strong support during corrections. While retail participants may be quick to react to price swings, institutional behavior appears biased towards a macro trend.

Solana Price Prediction Eyes ATH Retest as $179 Flips Into Support

Following the recent $500M institutional backing, Solana’s technical structure is also sending a bullish message. Analyst Lennaert Snyder highlights that SOL has successfully reclaimed the $179 resistance level on the weekly timeframe, now flipping it into firm support.

Solana reclaims key weekly support at $179, setting the stage for a potential push toward $260 and $300. Source: Lennaert Snyder via X

This flip is critical, it’s the same zone that previously capped upside and triggered sell-offs, but now it’s acting as a base. Snyder’s chart lays out a clean projection path toward all-time highs, with price structure forming a higher high and clearing prior consolidation ranges. The next key zones to monitor sit around $260 and $300. If SOL holds above $179 over the coming weeks, the probability of momentum extending into a fresh leg higher grows considerably.

Solana Intraday Recovery Targets $195 Resistance

The latest intraday chart shared by Personel Trader gives us a closer look at Solana’s short-term rhythm following its macro reclaim of the $179 level. Price is currently reacting around the 1.272 Fibonacci extension NEAR $178.80, with a proposed recovery path aiming toward the mid-range resistance at $188.60 and potentially stretching to $195.13. This suggests that even short-term participants are aligning with the broader bullish thesis discussed in earlier charts.

Solana eyes short-term recovery as price reacts near $178.80, with targets set at $188.60 and $195.13. Source: Personel Trader via X

The sketched projection reflects a typical Monday range formation, where the initial drop sets up a sweep of liquidity before reversing into a directional push. If this pattern holds, the move toward the 0.618 retracement level could serve as a key pivot area.

Solana Liquidation Clusters Could Trigger Short Squeeze Move

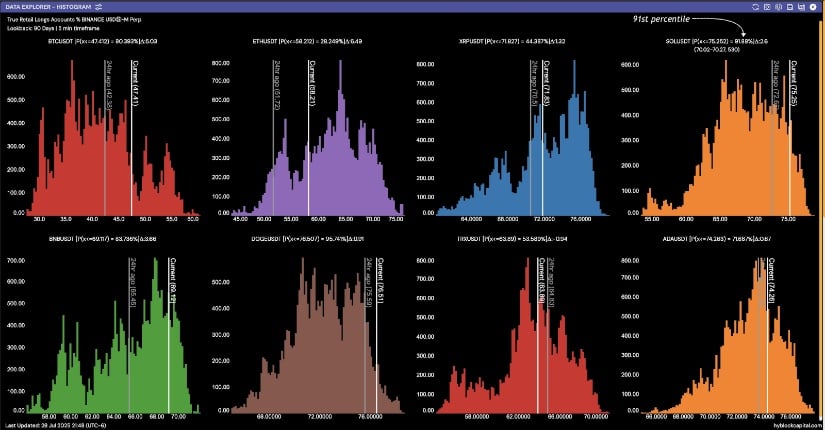

The latest Hyblock Capital data highlights an intriguing shift brewing beneath Solana’s surface. Retail long positions are in the 91st percentile, which often precedes a reversal or liquidity event. If that percentage begins to drop, as shorts enter and longs exit, Solana’s price may rise to trap aggressive short sellers, creating a potential squeeze scenario.

Solana’s retail long positions near extremes may set the stage for a short squeeze above clustered liquidity zones. Source: Hyblock Capital via X

What makes this more compelling is the context of rising institutional confidence and a macro reclaim of $179 support. If those retail longs begin unwinding into clustered liquidity zones, Solana could accelerate to higher levels.

Final Thoughts: Can Solana Extend Toward $260 and Beyond?

Solana’s bullish foundation is no longer just a story of technical setups; it’s now backed by serious institutional weight. The $500M treasury injection from Upexi, combined with strong chart formations and intraday recovery signals, paints a clear picture: the market is leaning bullish. If SOL can keep its footing above the reclaimed $179 zone, the solana price prediction towards $260 and $300 becomes a real possibility.