Metaplanet Goes Big on Bitcoin: Japanese Firm Amasses 780 BTC, $2B Crypto Treasury

Tokyo-based Metaplanet just doubled down on its crypto bet—hard. The firm's latest 780 BTC purchase rockets its digital asset holdings past the $2 billion mark, making traditional treasury managers sweat.

Corporate Bitcoin Adoption Goes Next-Level

While Wall Street still debates ETFs, Metaplanet's aggressive accumulation strategy mirrors early MicroStrategy plays—just with more sushi and less boardroom drama. Their stack now rivals some nation-state reserves.

The New Corporate Balance Sheet Playbook

Who needs bonds yielding 2% when volatile assets can moon (or crater) your quarterly reports? One analyst quipped, 'At least they're not burning cash on metaverse real estate.'

As legacy finance scrambles to keep up, Metaplanet's vault grows heavier by the satoshi—proving crypto's institutional appeal isn't just hedge fund hot air.

Japanese technology company Metaplanet has made another major Bitcoin purchase, adding 780 coins to its treasury for $92.5 million. This latest buy brings the Tokyo-listed firm’s total Bitcoin holdings to 17,132 coins, worth approximately $2 billion at current market prices.

Stock Jumps on Bitcoin News

Metaplanet’s stock price responded positively to the announcement. Shares traded on the Tokyo Stock Exchange under ticker 3350 jumped 5.6% to 1,247 yen following the news. The stock has gained an impressive 258% year-to-date, far outperforming Japan’s broader market indices.

The company’s aggressive bitcoin strategy has transformed it from a struggling hotel business into one of the world’s largest corporate Bitcoin holders. Since adopting its Bitcoin treasury approach in April 2024, Metaplanet has achieved a remarkable 449.7% Bitcoin yield for 2025.

CEO Simon Gerovich stated that the company acquired all of its Bitcoin at an average price of $101,030 per coin, giving it significant unrealized gains as Bitcoin currently trades around $119,300.

Asia’s Bitcoin Leader

Metaplanet now holds the largest Bitcoin treasury of any public company outside the United States. Globally, it ranks seventh among all corporate Bitcoin holders, according to Bitcoin Treasuries data.

The company’s rapid accumulation has drawn comparisons to MicroStrategy (now called Strategy), the American software firm that pioneered the corporate Bitcoin treasury model. While Strategy holds over 600,000 Bitcoin worth more than $70 billion, Metaplanet has emerged as the clear leader in Asia’s corporate Bitcoin adoption.

Investment giant Fidelity has taken notice of Metaplanet’s strategy. The firm became the company’s largest shareholder through its subsidiary National Financial Services, owning 12.9% of shares worth approximately $820 million.

Ambitious Growth Plans

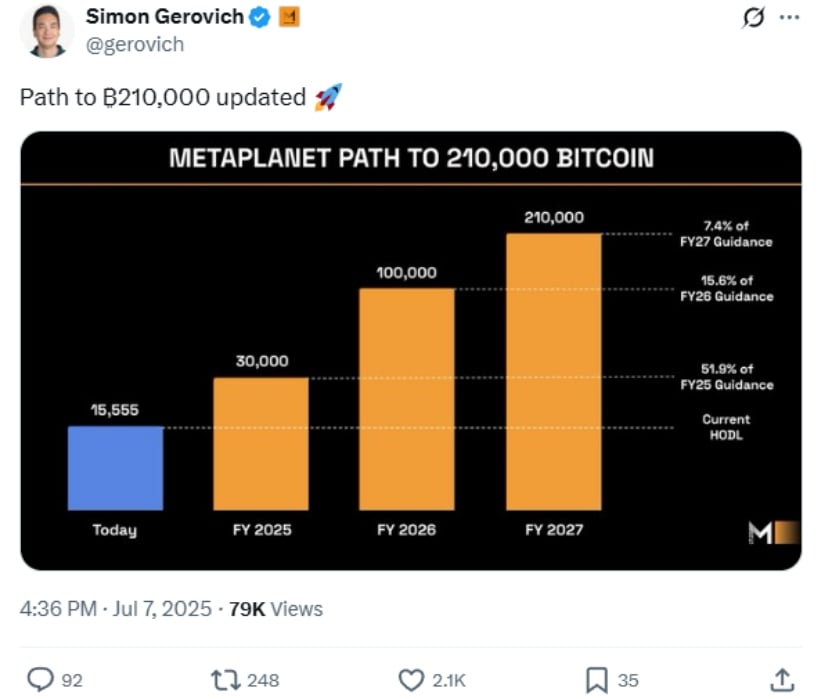

Metaplanet has set bold targets for future Bitcoin accumulation. The company aims to hold 210,000 Bitcoin by the end of 2027, which WOULD represent approximately 1% of Bitcoin’s total 21 million coin supply.

Source: @gerovich

To fund these purchases, Metaplanet has used various capital market activities. In July 2025, the company redeemed ¥12.75 billion (about $86.7 million) from bond offerings and issued new shares to raise capital for Bitcoin acquisitions.

The firm’s Bitcoin-focused business operations have also generated revenue. During the second quarter of 2025, this segment produced nearly 1.1 billion yen ($7.6 million) in revenue, marking a 42.4% increase from the previous year.

Beyond simply holding Bitcoin, Metaplanet plans to use its digital assets as collateral for other business ventures. The company has indicated it may launch a digital bank in Japan and acquire other cash-generating businesses using its Bitcoin holdings as backing.

Market Impact and Performance

Bitcoin’s recent performance has supported Metaplanet’s strategy. The cryptocurrency has gained about 10% over the past month and trades near $119,000. This price action has boosted the value of corporate Bitcoin treasuries across the board.

Between July 1 and July 28, 2025, Metaplanet achieved a 22.5% Bitcoin yield, demonstrating how its accumulation strategy continues to create value even as Bitcoin prices have risen significantly from earlier purchase levels.

The company’s approach mirrors that of other Bitcoin treasury companies but with a distinctly Japanese perspective. While American firms like Strategy have led corporate Bitcoin adoption in the West, Metaplanet is driving similar trends in Asia’s more conservative financial environment.

Looking Forward

Metaplanet’s latest Bitcoin purchase reinforces its position as a leader in corporate cryptocurrency adoption. The company’s willingness to buy Bitcoin at higher prices signals strong conviction in the asset’s long-term prospects.

With ambitious accumulation targets and plans to leverage Bitcoin for business expansion, Metaplanet continues reshaping how companies think about treasury management. As more firms consider adding Bitcoin to their balance sheets, Metaplanet’s strategy serves as a template for corporate digital asset adoption in Asia and beyond.