Chainlink Breaks Key Resistance – $20 Target Now in Sight as Bulls Charge

Chainlink just smashed through a critical resistance level—and the bulls aren’t stopping there. With momentum building, the next target is clear: $20. Here’s why traders are betting big.

The Breakout Play

No fluff, no hype—just price action. LINK’s surge past resistance signals a classic bullish breakout. Traders are piling in, expecting the rally to accelerate.

Why $20 Matters

Psychologically, round numbers act like magnets in crypto. Hitting $20 would solidify LINK’s uptrend—and probably trigger a fresh wave of FOMO from latecomers. (Because nothing says 'sound investing' like chasing pumps, right?)

The Bottom Line

This isn’t just another dead-cat bounce. The charts scream momentum, and the crowd’s leaning greedy. Whether it’s smart money or dumb luck, LINK’s next stop could be 20 bucks—or a brutal reminder that crypto moves both ways.

LINK is trading NEAR $19.20 and holding above $18.76 support, with analysts eyeing a push toward $20.01 and $23.30 resistance levels.

Supported by strong volume, rising RSI, and bullish crossover above short-term EMAs, Chainlink’s recent price activity reflects growing interest from traders. According to analysts, a continued breakout could drive LINK price toward $32 in the coming weeks, aligning with the broader bullish market recovery.

Chainlink Price Surges Past Resistance as Bulls Aim for Higher Highs

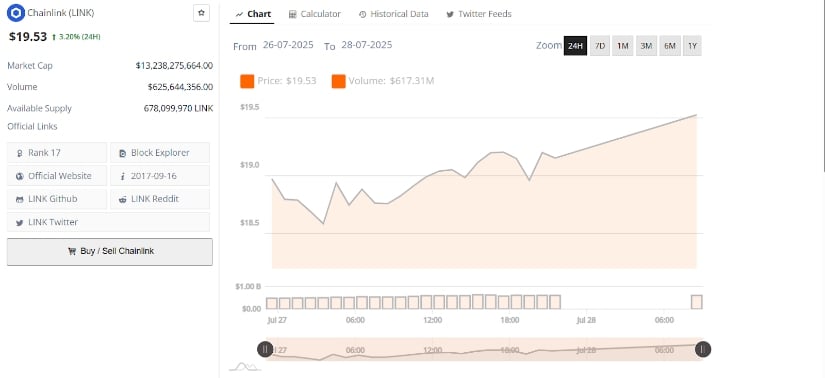

Chainlink (LINK) recorded strong upward price action over the last 48 hours, climbing past the $19.00 level after a clean breakout from key resistance. The chainlink price gained 3.20% to close at $19.53, showing a continuation of the bullish momentum that started earlier in July.

Source: BraveNewCoin

Analyst Trading Benjamins noted that LINK is advancing ahead of schedule, trading above the descending trendline in place since late 2023.

Source:X

The breakout above the long-standing trendline marks a structural shift in LINK’s chart behavior. Market activity now suggests that selling pressure has weakened, allowing bulls to reclaim control.

Moreover, the green projection suggests a possible retest of $18 support before targeting the $32 region in the coming weeks. Market participants continue to monitor volume and daily closes to assess the strength of this trend continuation.

Uptrend Builds Above $18 as Support Holds

LINK’s ability to hold above $18.00 has been a critical development for technical traders. After a temporary pullback near $18.50 on July 27, the Link price rebounded quickly, supported by steady volume and strong market interest. This retest aligns with prior resistance levels now acting as support, which reinforces the ongoing trend and reduces the probability of a deeper reversal in the short term.

However, the bullish structure remains intact, with price action forming higher highs and higher lows. The volume increase near the $19.00 level, observed late in the session, suggests that buyers are active and defending the zone. This behavior supports the thesis that $18.00 has been flipped into a key foundation for the next upward wave, provided market conditions remain favorable.

New Projections Indicate Room Toward $32 Target

The projected path shared by Trading Benjamins outlines a stepped progression of price targets, with intermittent retracements along the way. The chart envisions a gradual climb toward $26.00, followed by a pullback to the $22.00 region, and then a final push to $32.00. The scenario assumes the breakout structure continues to hold and that volume supports price expansion in the coming weeks.

The trend began in early July when LINK broke above $14.60 resistance. Since then, the token has gained traction, pushing through multiple levels with increasing buyer confidence. The projected moves reflect a shift in sentiment where the token now trades in an environment where buyers are willing to enter on dips and maintain control above key exponential moving averages.

Momentum Builds Near $20 as Traders Watch RSI

Chainlink’s intraday momentum has continued into the early hours of July 28, with the price testing the $19.20 level. The RSI currently sits near 69, indicating strong buying interest without yet entering deeply overbought conditions. The clean bounce off the short-term EMA cluster (20/50/100) has added to the strength of the current trend.

Analyst @ShardiB2 observed that the double-tap formation near the $20 mark could evolve into a full breakout if supported by volume. Should LINK Price surpass the $20.01 level convincingly, further resistance is expected near $23.30 and $23.95.

With a $13.23 market cap and $625M volume, LINK Price stays active as traders watch key resistance levels to gauge rally strength.

Source:X