🚀 XRP News Today: Whale Frenzy & ETF Hype Propel XRP Toward $3.82 Target

Whales are betting big—$130M big—on XRP as ETF rumors electrify the market.

### The Whale Play: Deep Pockets Dive In

Fresh capital floods in as institutional players snap up XRP like it's a Black Friday sale. No retail FOMO here—just cold, hard nine-figure bets.

### ETF Tailwinds: Rocket Fuel for Price Action?

With crypto ETFs gaining mainstream traction, XRP's $3.82 target looks less like hopium and more like a waypoint. Traders eye the charts while Wall Street 'discovers' blockchain—again.

### The Cynic's Corner

Funny how these 'groundbreaking' ETF developments always coincide with whales needing exit liquidity. But hey, this time it's different—right?

Coupled with increasing speculation around a potential spot ETF and renewed legal clarity, analysts are beginning to eye a possible surge toward the $3.82 mark, and possibly even higher in the NEAR term.

Whale Accumulation Signals Growing Confidence in XRP

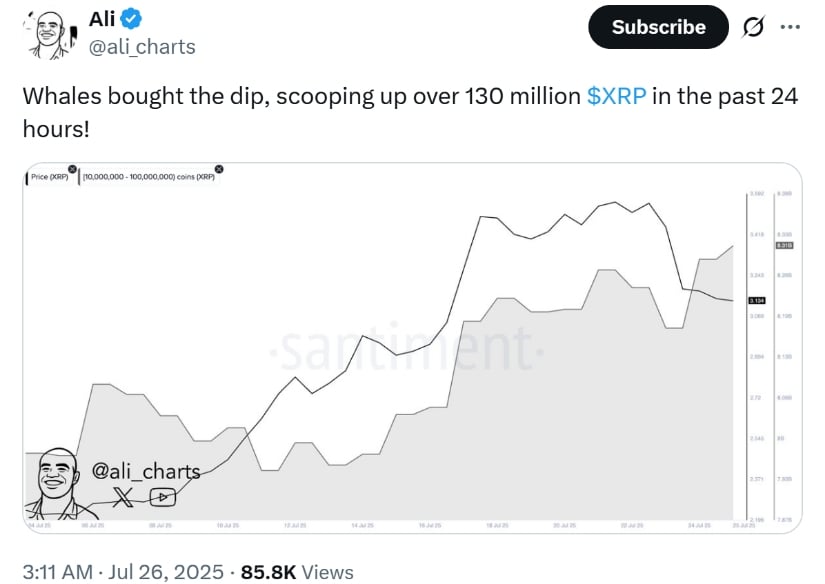

According to blockchain analytics shared by Ali_Charts, wallets holding between 10 million and 100 million XRP have scooped up more than 130 million tokens in just the past 24 hours. This significant whale accumulation occurred during a brief dip in xrp price toward the $3.00 support level.

Whales accumulated over 130 million XRP in the past 24 hours, signaling strong buy-the-dip activity. Source: Ali Martinez via X

This buying spree follows the launch of a $20 million XRP treasury initiative by Nature’s Miracle, a MOVE some analysts view as a vote of confidence in the token’s medium-term potential. Analyst CasiTrades noted that XRP had completed a wave 2 correction and touched the 0.854 Fibonacci level—historically a key bounce point if the support at $3.00 holds, a “wave 3” rally could be in play, with a potential target around $3.82.

“The 2.618 Fibonacci extension points directly to $3.82, aligning with XRP’s former all-time high and strengthening the bullish case,” said CasiTrades via X.

ETF Speculation Adds to Bullish XRP Price Forecasts

Adding further momentum is a resurgence in ETF speculation. Following Ripple’s partial legal victory over the U.S. Securities and Exchange Commission (SEC) earlier this year, attention has turned toward the potential approval of a spot XRP ETF. Currently, XRP exposure remains limited to futures products like ProShares’ UXRP, but any move toward a spot listing could dramatically boost demand.

Jamie Elkaleh, CMO at Bitget Wallet, commented on this shift in sentiment:

“XRP is regaining market momentum as renewed ETF speculation intersects with increasing legal clarity. This shift is boosting market depth and signaling a structural step forward for XRP’s legitimacy in U.S. markets.”

Ryan Lee, Chief Analyst at Bitget Research, also weighed in, stating that $3.50 to $4.00 remains plausible “in the coming weeks” if the ETF narrative continues gaining traction.

Derivatives Volume Drops, But Long Positions Dominate

Despite bullish sentiment, derivatives market data presents a more cautious picture. According to Coinglass, XRP trading volume dropped 37% to $15.43 billion, while open interest declined nearly 6%. Options volume and open interest plummeted even further—by over 75% and 95% respectively—indicating reduced speculative activity.

XRP Futures Open Interest (USD) chart. Source: CoinGlass

However, on major exchanges like Binance and OKX, long positions still heavily outweigh shorts. Binance reports a long/short ratio of 2.82, and OKX shows a similar bullish skew at 2.08. These metrics suggest that while trading activity has cooled, professional traders continue to position for an upward move in XRP price.

Price Action: XRP Holds $3.00 as Bulls Eye $3.82

At the time of writing, XRP today is trading near $3.20, following a 2.3% gain in the last 24 hours. The recent decline before the $3 rebound has been linked to a $175 million transfer of XRP to exchanges by Ripple co-founder Chris Larsen. Despite this, XRP has shown resilience, rebounding from the $3.00 support and attempting to reclaim short-term moving averages.

If trading volume increases and XRP reclaims the $3.21 resistance, a swift move toward the $3.82 Fibonacci target may follow. Source: CasiTrades via X

Technical charts show XRP back above the 21 EMA, with an RSI hovering near neutral territory at 47.89—leaving room for upside potential. If the price of XRP today can maintain its foothold above $3.00 and overcome the $3.50 resistance zone, a breakout toward the previous high of $3.61 and ultimately $3.82 becomes more feasible.

Outlook: XRP Price Prediction Eyes $3.82 With Cautious Optimism

While short-term volatility remains a concern—especially amid broader crypto market shifts—the convergence of whale accumulation, growing ETF speculation, and improved legal clarity has created a cautiously optimistic tone in the XRP news today.

XRP was trading at around $3.17, up 3.69% in the last 24hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Analysts remain divided on the longer-term trajectory. Some predict continued growth as institutional interest builds and the SEC lawsuit fades into the background. Others warn that a failure to hold $3.00 could invalidate the bullish setup.

Still, the general sentiment leans positive. The combination of technical structure, strategic whale behavior, and regulatory progress may pave the way for XRP to retest historical highs and, according to some XRP price predictions, even surpass them by 2025.