Ethereum Primed to Crush Bitcoin in 3–6 Months – Novogratz’s Top Altcoin Picks

Ethereum's gearing up for a breakout – and Wall Street's crypto king Mike Novogratz says ETH could leave Bitcoin in the dust by early 2026.

Here's why the smart money's flipping bullish on altcoins:

The Merge 2.0 Effect

Post-upgrade transaction speeds are turning Ethereum into Wall Street's blockchain darling – while Bitcoin remains digital gold for the diamond-hands crowd.

DeFi's Sleeping Giant

TVL metrics show Ethereum still commands 60% of decentralized finance – and institutional players are finally building positions.

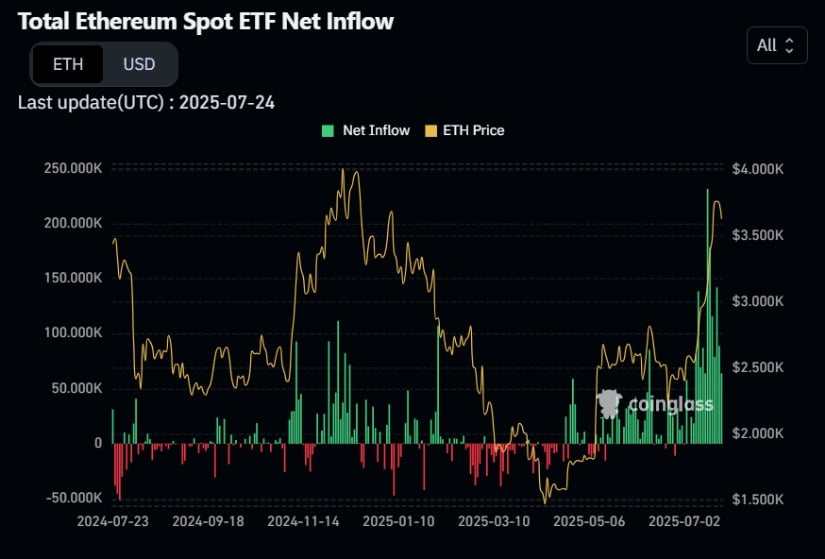

The ETF Dominoes

With spot Ethereum ETFs likely approved by Q1 2026, traders are front-running the liquidity tsunami (because nothing moves markets like Wall Street's herd mentality).

Novogratz's watchlist includes layer-2 solutions and AI-integrated tokens – though we all know half these 'fundamentals' will evaporate when the next crypto winter hits. For now? The altcoin pumps are back.

Galaxy Digital CEO Michael Novogratz presents a strong case for Ethereum.

In his view, $ETH might outperform $BTC over the next 3–6 months due to strong institutional demand, structural supply constraints, and shifting market narratives.

Will ethereum completely overshadow Bitcoin? Certainly not. However, for now, following Bitcoin’s lead has strengthened Ethereum’s position, as Ethereum-based corporate treasuries gain traction with companies seeking yield-earning options beyond Bitcoin.

Rising Institutional Appetite for ETH

Novogratz emphasized the treasury aspect. Leading companies like BitMine Immersion (566K $ETH, $2B), SharpLink Gaming (361K $ETH, $1.3B), and Ether Machine (launching publicly with $1.5B in ETH reserves) are following the strategy set by MicroStrategy’s Bitcoin approach.

And by doing so, they’re channeling large amounts of capital into the Ethereum ecosystem and steadily increasing demand for $ETH.

At the same time, approved Ethereum ETFs in the U.S. have experienced rapid inflows. A single day brought in $726M, with weekly totals surpassing $2.1B, indicating increasing institutional adoption.

$ETH’s total circulating supply is increasingly locked through corporate accumulation, staking, or long-term holding, leading to a supply squeeze, even as the Ethereum ecosystem makes significant gains.

Novogratz argues that the constraint will amplify demand pressure; in his words, ‘there’s not a lot of $ETH.’

That constraint in supply will make price moves more pronounced than for Bitcoin.

Crucially, Novogratz highlighted that if ETH breaks above the $4K resistance, it could enter price discovery and possibly rally much higher. Unlike Bitcoin, which just reached a new all-time high at $123K, Ethereum remains far from its own $4.8K ATH.

Bitcoin’s Role: Growth, but at a Slower Pace

While optimistic about ETH’s short-to-mid term prospects, Novogratz still predicts bitcoin will reach $150K by the end of the year, driven by strong fundamentals and macroeconomic support.

$ETH may outperform BTC in the immediate term due to its utility-driven ecosystem, faster-paced adoption cycle, and some pent-up energy pouring into Ethereum treasuries.

Recent policy shifts, such as legislation supporting fiat-backed stablecoins, further strengthen ETH’s strategic role, particularly as the blockchain that underpins most stablecoins – $132B of a total $235B.

With Ethereum in a strong position and Bitcoin rising, which altcoins are poised to make moves?

SUBBD Token ($SUBBD) – Red-Hot AI + Blockchain Project for $85B Market

SUBBD Token ($SUBBD), the AI-powered, Web3-native creator ecosystem, seeks to disrupt established platforms. Its $SUBBD token facilitates genuine crypto-native monetization – seamless payments, staking rewards (20% APY during the presale, shifting to platform advantages), exclusive content, and AI tools to help creators grow.

Built to revolutionize the $85B creator economy, SUBBD empowers both creators and fans through decentralized incentives. Fans can subscribe, request AI-generated content, and take part in creator governance, all directly from the creators without intermediaries.

With over 250 million ecosystem members, the ongoing presale is set for rapid growth. Tokens are currently priced at $0.056 each, and the project has raised $887,000 so far.

Looking for a Web3 platform that combines real-world utility with AI and creator empowerment? SUBBD provides an engaging mix of subscription tools, token rewards, and a fan-focused economy design.

Check out the SUBBD Token presale page for the latest information.

Token 6900 ($T6900) – Raw Meme Coin Energy, Endless Potential

Token 6900 ($T6900) consumes your soul, emerging as the viral meme coin presale of 2025. Clearly prioritizing chaos over utility, $T6900 targets meme culture directly. There’s no roadmap, fundamentals, or utility—just HYPE and community-driven energy.

Despite its zero real-world utility (or maybe because of it), Token 6900 has raised over $1M within days, driven by speculative demand and meme coin momentum.

Whale-level investors are pouring in, with large token purchases of $16.3K and $7.3K, driven by comparisons to SPX6900, which achieved 7,500% returns.

Of course, Token 6900 is better than SPX 6900. It has an extra token in its tokenomics—which will make all the difference.

Financial satire? Performance art? Risk-fueled speculation? It doesn’t matter. Token 6900 is designed to be the ultimate modern meme coin, built to thrive on irrelevance and viral engagement.

Visit the Token 6900 presale page today.

Solana ($SOL) – Another Contender for Crypto Treasuries

Solana – next‑generation Layer‑1 blockchain, designed to power the Web3 economy at scale. And offer memes, of course. Lots of memes.

Solana is widely adopted across DeFi, NFTs, memes, and blockchain gaming, with ecosystems built on fast and predictable settlement. Its developer-friendly stack (LLVM‑compatible smart contracts) attracts builders from diverse sectors.

Like Ethereum, solana is well off its ATH; but also like Ethereum, it’s had a good run in the past month, gaining 24%.Major financial institutions, including HSBC, Bank of America, Euroclear, and Singapore’s MAS, are integrating Solana through a partnership with R3.

Since Trump added $SOL to the US digital assets reserve, Solana has become an increasingly appealing option for corporate treasuries.

Solana also tackles some of the scalability issues that Ethereum faces, providing faster transaction speeds, lower fees, and security suited for institutions.

Ethereum Poised for Bullish Second Half of 2025, Altcoins to Follow?

Over the past 30 days, the $ETH/$BTC strength ratio has increased by 36%, showing ETH’s stronger momentum.

Michael Novogratz’s nuanced outlook suggests Ethereum will likely be the short-term outperformer, fueled by institutional treasury adoption, ETF inflows, and limited supply.

But Bitcoin remains a long-term anchor with an immediate upside to $150K. Will $SOL, $T6900, and $SUBBD capitalise?

Be sure to do your own research; this isn’t financial advice.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.