SEI Bulls Dig In at $0.34 – Why This Support Level Could Launch the Next Rally

SEI's price floor holds firm as traders bet big on long-term upside.

Defensive Line Holds

The $0.34 support level has become crypto's newest battleground. SEI bulls are mounting a staunch defense—and their conviction suggests this isn't just another dead-cat bounce. With macroeconomic winds shifting, altcoins like SEI are flashing rare strength amid the usual market theatrics.

Targets Locked In

Technical charts show clean demand zones beneath current prices. While traditional investors chase 5% bond yields, crypto traders are playing for 50x moves. The math isn't complicated—just ask anyone who ignored Bitcoin at $3,000.

Wall Street's still trying to tokenize paperclips while real assets moon. Some things never change.

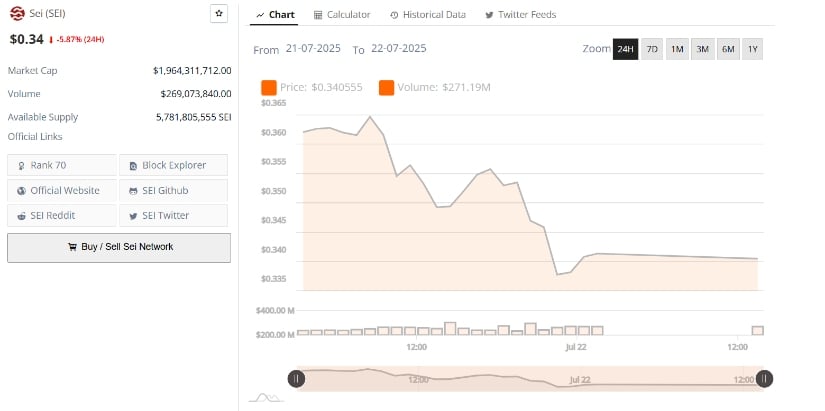

Analysts emphasize the importance of the $0.34 zone, which acts as a pivotal level for sustaining momentum. After a sharp rally from below $0.22 in June to a high of $0.3902, the recent 5.87% pullback suggests SEI may be entering a consolidation phase.

Despite the correction, Sei Price remains above its 20-day moving average, signaling underlying bullish structure. Technical projections suggest that a successful defense of the $0.34 zone could open the path toward Fibonacci-based resistance levels at $0.55, $0.73, and beyond.

SEI Bulls Defend $0.34 Support as Long-Term Targets Remain Intact

SEI/USDT is currently stabilizing around the $0.34 level following a pullback from its recent high of $0.3902. The daily chart shows that the price dropped by 4.16% in the latest trading session, opening at $0.3555 and closing at $0.3407.

Source: BraveNewCoin

This downward MOVE extended from a local high of $0.362, with the pair dipping as low as $0.3402 before recovering slightly. Despite the decline, the $0.34 mark continues to serve as a support zone, limiting further downside.

Market volume during this period remained steady at approximately 5.83 million SEI, with USDT trading volume recorded at 2.03 million. While bearish pressure dominated the session, the consistent volume suggests ongoing market interest at this price range. Short-term traders are closely watching for signs of consolidation or reversal above $0.34 to determine whether bullish activity may resume.

Long-Term Moving Averages Show Uptrend Continuity

The SEI/USDT chart reflects an uptrend that started in late June 2025, following a strong breakout from below the $0.22 level. Since then, SEI has maintained upward momentum, climbing steadily before encountering resistance near $0.39. Despite the recent dip, the SEI price continues to trade above key moving averages, all of which remain upward-sloping.

This technical alignment suggests that the medium-term trend is still intact. The 20-day moving average, often used as a swing-trade indicator, remains below the current price, which could continue to act as dynamic support if bearish momentum accelerates. Traders using trend-following strategies are likely to maintain a bullish bias as long as Sei Price holds above its 20-day average on a closing basis.

Analysts Mark SEI Price $0.34 as a Key Pivot Zone

According to chart insights from @moneyhunter443 and @i_bot404, $0.34 is viewed as a pivotal support level in the ongoing market structure. The chart presented by @ibot404 uses hollow candles for clarity and shows SEI approaching this level after a strong accumulation pattern earlier in July.

Holding above this zone on the daily timeframe is considered important for maintaining the current trend formation.

Source:X

Above the current SEI crypto level, Fibonacci-derived resistance points are projected at $0.5505, $0.7398, $0.9086, and $1.1429. The highest resistance zone at $1.1429 has been labeled as the next target.

These levels remain valid as long as the price does not fall below the $0.32–$0.34 support range. Observers are monitoring price closes and volume activity to assess whether SEI will initiate a new leg upward or return to range-bound trading.

Volume Stability Suggests Sustained Interest

Trading volume for SEI has remained consistent even during the most recent decline. In the 24 hours leading to the most recent session, SEI registered $269 million in trading volume. Despite the negative price action, this level of participation indicates that investors remain engaged. Declines accompanied by consistent or rising volume are often viewed as controlled pullbacks rather than reversals.

Should SEI Price manage to reclaim the $0.35 mark with stronger bullish volume, it may provide the foundation for a move back toward the $0.39 high. For now, attention remains on how the market reacts around the $0.34 level, which has repeatedly served as both resistance and support in recent sessions.

Holding above this line could keep the longer-term structure intact as bulls look ahead to higher targets.