🚀 Bitcoin to $150K? Analyst Bullish as GENIUS Act Fuels Crypto Optimism

Bitcoin's price could skyrocket to $150,000, according to a bullish analyst—and the GENIUS Act might be the catalyst. Here's why traders are flipping bullish.

The GENIUS Effect: Policy Meets Price Action

Regulatory tailwinds are pushing Bitcoin into uncharted territory. The GENIUS Act—suddenly gaining traction in Congress—has crypto markets buzzing. No hard numbers yet, but optimism’s priced in.

Technicals Scream Breakout

Charts suggest Bitcoin’s coiled for a massive move. That $150K target? Not just hopium—it aligns with historic cycle projections. (Though let’s be real: Wall Street will take credit if it happens and blame ‘speculators’ if it doesn’t.)

The Bottom Line

Whether you’re a diamond-handed HODLer or a swing trader, this market’s heating up. Just remember—in crypto, the only thing faster than gains is the SEC changing its mind.

A well-known crypto analyst has predicted that Bitcoin (BTC) could rally to $150,000 if the U.S. House of Representatives passes the GENIUS Act — a move that may unlock a fresh wave of institutional and retail buying.

BTC Consolidates Ahead of Policy Vote

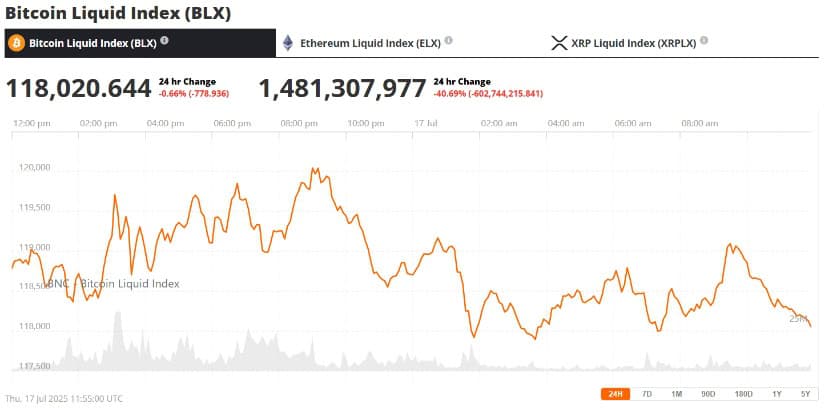

Bitcoin price today is consolidating around $118,000, still within reach of its all-time high of $123,000. The market has paused briefly after a strong multi-week rally, with investors closely watching the outcome of the GENIUS Act vote expected in the House.

U.S. House Passes GENIUS, Clarity, and Anti-CBDC Acts — crypto Set to Soar! Source: Christopher Greene via X

The legislation, part of a broader crypto policy push during this “crypto week,” aims to regulate stablecoins. It requires issuers to fully back tokens with fiat reserves and government bonds while enforcing mandatory disclosures and audits. If passed, it could provide long-awaited regulatory clarity for the industry.

Crypto analyst Crypto Rover posted on X that “$BTC could jump to $150,000 if the GENIUS Act passes,” referencing how bitcoin has historically responded to major policy shifts and pro-crypto political narratives.

Market Overview: Bitcoin Technical Analysis Signals More Upside

From a Bitcoin technical analysis standpoint, BTC continues to look bullish on the daily chart. The price remains above the critical support at $110,000 and has completed both a cup-and-handle and bull flag pattern — two classic continuation formations.

Bitcoin Holds Strong Above Key Support at $115K — Bullish Momentum Builds Toward a Potential Breakout Past $118K! Source: JasonWaveFx on TradingView

According to pattern projections, the measured move from the bottom of the cup ($74,723) to the breakout point ($109,220) gives a height of $34,500. Adding that to the breakout level yields a near-term price target of $144,500. A breakout above that level WOULD raise the probability of reaching $150,000.

The Bitcoin RSI indicator remains healthy, and the price is well-supported above its 50-day and 100-day moving averages — further confirming the trend’s strength.

Momentum Factors: Institutional Buying, Whales & ETF Flows

Beyond technicals, the rally is being powered by a wave of institutional activity. Over the past two months, Bitcoin ETF news has been overwhelmingly positive. According to 10x Research analyst Markus Thielen, more than $15 billion in institutional inflows have flooded into U.S. spot Bitcoin ETFs, pushing Bitcoin’s value up and shifting the market dynamic.

Thielen noted, “This is no longer just a retail-driven rally. We’re seeing a structural transition to institutional dominance in Bitcoin.”

At the same time, Bitcoin whale alert platforms have flagged large purchases by funds and corporations. Crypto funds have also recorded $3.7 billion in net inflows, the second-highest on record, signaling sustained confidence.

Despite some short-term selling from legacy Bitcoin holders — including a reported 40,000 BTC from a Satoshi-era whale — the market has largely absorbed the pressure.

Expert Insights: Bitcoin as an Inflation Hedge and Macro Asset

Long-term projections are even more optimistic. Analysts from BlackRock believe that Bitcoin could eventually surpass $700,000, while ARK Invest has a forecast of $2.4 million in the coming decade. These expectations are rooted in Bitcoin’s growing role as a hedge against inflation and an alternative store of value.

Bitcoin Eyes $125K–$150K Peak by Aug/Sep 2025 If Parabolic Trend Resumes — Major Correction Could Follow! Source: Peter Brandt via X

Veteran trader Peter Brandt and analysts at Standard Chartered have more conservative short- to medium-term targets of $135,000, supported by breakout signals and ongoing fiat inflows into the crypto ecosystem.

Wall Street veteran Fred Krueger added that Bitcoin could reach as high as $444,000 if another $400 billion in capital enters the asset class.

Bitcoin Halving 2025 Could Be the Next Big Catalyst

In the coming years, the next halving of Bitcoin in 2025 will also be a major event. Halving events — where block rewards have halved — in the past have been preceded by enormous price runs because supply has been reduced and demand enhanced. If history repeats itself, the post-halving environment could make whatever bullishness created by positive regulation or market flows even stronger.

In addition, the technological developments like the Bitcoin Lightning Network and Taproot upgrade are further entrenching Bitcoin’s usability, scalability, and business appeal.

Final Thoughts: BTC’s Next Move Hinges on Policy and Momentum

In short, Bitcoin price breakout over $110,000 has left BTC in a favorable position, with technical indicators and institutional factors favoring a move to $150,000 in the foreseeable future. However, experts caution that the ride won’t be easy.

BTC was trading at around $118,020. down 0.66% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

A “sell the news” decline is possible, especially if the GENIUS Act gets enacted and speculators want to lock in gains. Subsequently, the next BTC MOVE would be a retest of $110K, with a new push higher if buying interest picks up again.

However, with legislative clarity, picking-up institutional demand, and the halving cycle in the future, the long-term outlook for Bitcoin still appears brighter.