BNB Price Alert: Bearish Storm Brews After $710 Rejection—What’s Next for Binance Coin?

Binance Coin just got smacked down from $710—hard. The rejection was brutal, and now traders are scrambling to figure out if this is a temporary setback or the start of something uglier.

### The Bearish Case Strengthens

BNB’s failure to hold $710 signals trouble. The bulls had their shot, and they blew it. Now, the question isn’t whether there’s pressure—it’s how low we go from here.

### A Familiar Story for Crypto ‘Investors’

Another day, another crypto asset getting rejected at a key level. Will traders ever learn? Probably not—but hey, at least the volatility keeps things entertaining.

### What’s Next for BNB?

If the bears keep pushing, we could see a retest of lower supports. Or, maybe the bulls regroup and make another run. Either way, buckle up—this isn’t over.

The asset’s recent rally was met with strong rejection, triggering a retracement that has pulled prices down to the $670 range.

Despite maintaining relatively high trading volume, the price action suggests a weakening of bullish momentum. At the time of writing, BNB is consolidating around $679.71, with market participants watching closely for direction.

Intraday Chart Confirms Sharp Reversal Pattern

The 1-hour chart for BNB/USDT shows a swift decline after testing resistance NEAR $710. Price action turned bearish immediately following this peak, with consecutive red candles dragging the price down to $675, before a minor recovery toward $679.66.

This movement indicates short-term exhaustion in bullish momentum, potentially caused by profit-taking and unwinding of overleveraged long positions. The quick pullback highlights the significance of the $710 level as a resistance zone.

Source: Open Interest

Open interest data reflects a clear decline, dropping from over 7 million to 4.734 million contracts. This steep fall in open positions signals reduced speculative activity and suggests that both manual exits and liquidations contributed to the drop.

Despite a brief recovery in price, open interest remains low, indicating trader hesitation to re-engage until more confirmation appears. For the price to resume upward movement, renewed interest accompanied by growing volume will be required to overcome short-term resistance near $690.

Broader Timeframe Reveals Market Uncertainty

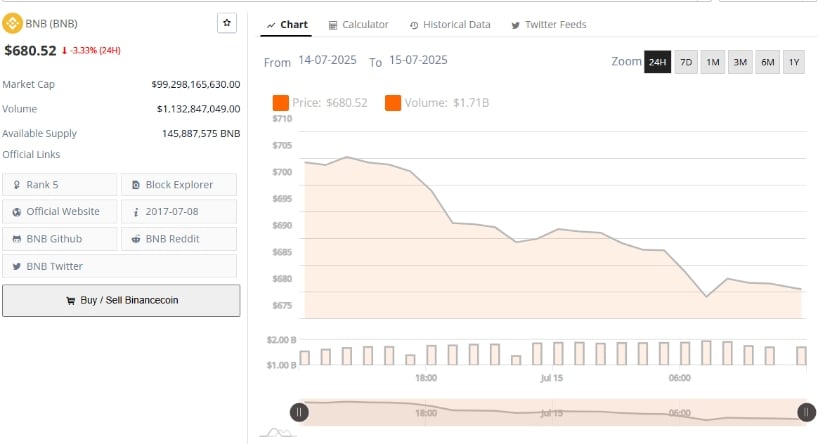

On the 24-hour chart, BNB has recorded a 3.33% decline, falling from above $705 to $680.52 within the session. The sell-off gained momentum after midnight UTC on July 15, coinciding with resistance around the psychological $700 level.

The trend highlights a phase of selling pressure likely influenced by macro sentiment or positioning around a key price zone. The correction, while sharp, appears to have unfolded steadily, pointing to controlled exits rather than panic selling.

Source: BraveNewCoin

Volume remained stable throughout the move, with daily trading activity totaling $1.71 billion, showing no significant spikes. This consistent FLOW indicates traders may be observing the market rather than actively repositioning, with eyes on the $675–$685 range for cues.

BNB’s market cap currently stands at $99.29 billion, placing it firmly in the top five crypto assets by capitalization. However, should the asset fail to recover above $685, the next key support may emerge near $650, as the price searches for a stronger base.

Momentum Indicators Suggest Caution Ahead

The daily chart shows that BNB recent rejection from $732 has disrupted its prior uptrend, with price now testing key support near $675. While the medium-term structure remains bullish, momentum indicators suggest caution.

The MACD line (9.91) remains above the signal line (7.26), and the histogram prints a positive value of 2.64, supporting continued upward bias. However, the flattening histogram indicates that momentum may be weakening, with reduced buyer participation.

Source: TradingView

The Relative Strength Index (RSI) currently reads 58.23, below the overbought threshold but still within a bullish range. The indicator has started to trend downward, reflecting a slowdown in buying strength.

At the time of writing, BNB price is trading at $679.71, and any sustained movement below this level could increase bearish sentiment. To reestablish bullish control, the asset must stabilize above $685 and retest $700, while a deeper pullback below $665 could expose it to further downside pressure in the coming sessions.