🚀 XRP News Today: Korean Traders Fuel Explosive Rally—Top Analyst Warns ’Decision Time’ Is Now

XRP's price action just got spicy—Korean traders are piling in, and analysts say the clock's ticking.

The Korean Pump Effect

Seoul's crypto whales are at it again, throwing weight behind XRP like it's 2021. Trading volumes on Upbit now rival Binance—because nothing says 'market mover' like a concentrated wave of FOMO.

Make-or-Break Momentum

One chart-watcher calls this 'decision time' for the embattled token. Break past resistance? Moon narrative activated. Reject here? Another 'institutional adoption' PowerPoint deck coming to a conference near you.

Funny how 'decentralized' assets still dance to regional liquidity patterns. But hey—when the music plays, even compliance officers tap their feet.

This sudden upward move, led by regional demand, shifted market momentum toward Asia and underscored the increasing influence of Korean investors in global crypto trends.

XRP Price Surges as Korean Traders Take the Lead

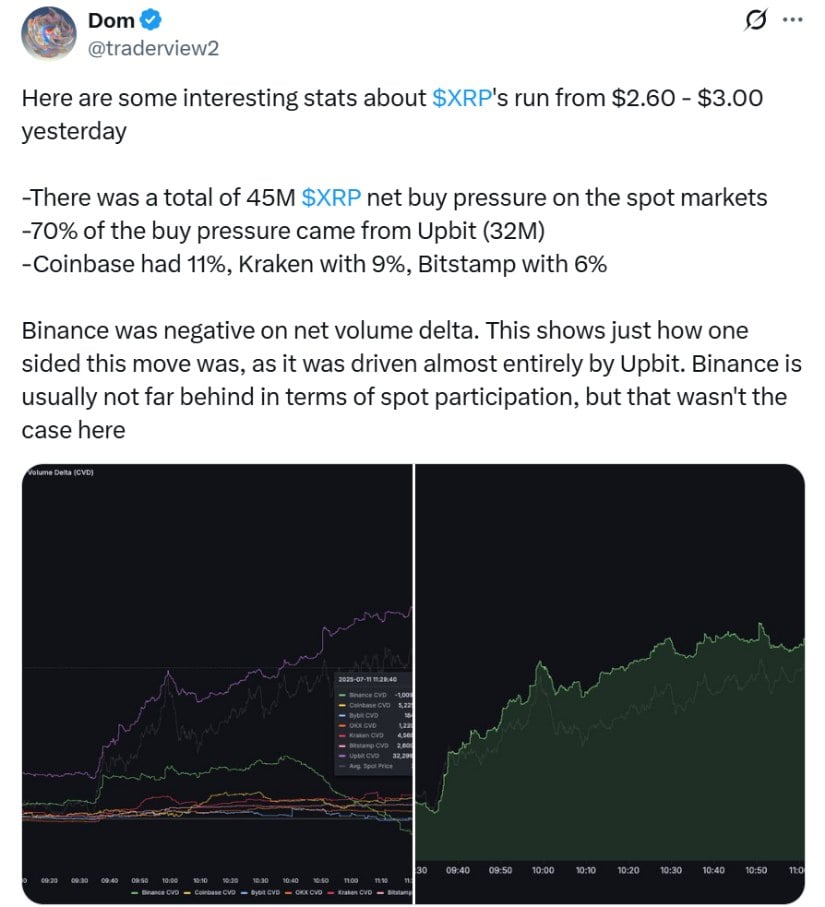

According to data shared by analyst Dom on social media platform X, Upbit accounted for a staggering 70% of net spot XRP purchases during the surge, with 32 million tokens traded within 24 hours. The exchange even outpaced Bitcoin and ethereum in volume, as XRP’s trading activity exceeded $500 million on the platform.

XRP’s $2.60–$3.00 rally was driven 70% by Upbit, with Binance notably absent from the buying trend. Source: Dom via X

In contrast, major global exchanges such as Binance and Coinbase contributed marginally to XRP’s rise—or in Binance’s case, even showed negative net volume. Analysts point to this anomaly as a reflection of regional trading dynamics rather than a global coordinated push.

South Korea’s Retail Frenzy and Regulatory Hope Drive Sentiment

South Korea’s appetite for XRP is not a recent development. Approximately 15% of the country’s population—more than 7 million people—are registered on domestic crypto exchanges. Many of them are younger investors who missed earlier Bitcoin booms and are turning to XRP for its affordability and potential.

XRP’s surge was led by Korean buyers on Upbit, with 30M XRP bought in an hour as Binance lagged and Coinbase remained mostly flat. Source: Dom via X

This recent surge is also backed by growing Optimism around XRP’s ecosystem. Developments such as the integration of USDC on the XRP Ledger and heightened technical activity have boosted confidence. Moreover, anticipation of a potential XRP spot ETF and progress in the Ripple vs SEC case continue to influence bullish sentiment.

Ripple’s decision to withdraw its appeal in the ongoing lawsuit has been interpreted by some as a sign that the legal battle may be winding down. This has further strengthened investor belief in XRP’s long-term outlook, especially in regions sensitive to regulatory clarity.

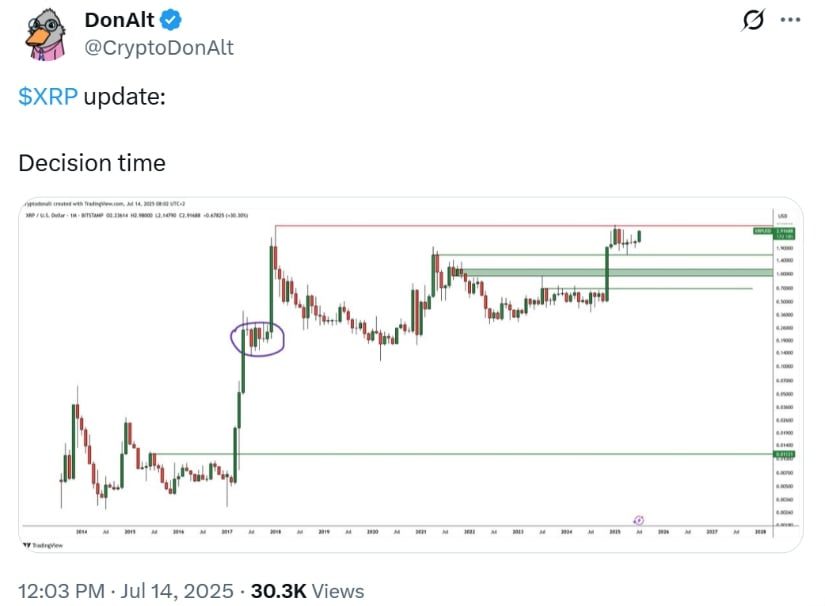

Top Analyst Issues Stark Warning: ‘Decision Time’ for XRP

Amid the price rally, veteran crypto analyst DonAlt added weight to the discussion by describing the current setup with two telling words: “Decision time.” Sharing a monthly chart, DonAlt pointed out XRP’s approach toward a significant resistance zone—historically tied to major price breakouts.

DonAlt’s chart highlights XRP nearing a breakout above $3, supported by rising prices and $7.39B in 24-hour trading volume, signaling a bullish trend. Source: DonAlt via X

DonAlt’s chart highlighted the 2017 order block—a zone that acted as a launchpad before XRP’s previous all-time high run. The pattern, he suggests, resembles a pre-breakout compression phase. If the rhythm from the past repeats, XRP could be on the cusp of another major upward leg.

In late 2024, DonAlt accurately anticipated XRP’s massive 500% surge. Now, with XRP gaining over 30% in July and trading NEAR $2.91, his assessment has prompted traders to closely watch whether the asset will break higher or face resistance once more.

XRP Price Prediction: Will XRP Break Through or Pull Back?

While the current trend appears bullish, analysts remain cautious. The key area of focus is the resistance zone that has historically capped XRP rallies. If XRP clears this structure with strong volume, previous targets such as $4.20—first projected during the breakout of an eight-year triangle—could return to play.

XRP’s 4-month high and rising 30-week MA signal bullish momentum, with key rebound potential near the 50–61.8% Fibonacci zone. Source: Jasperlawler on TradingView

At the time of reporting, XRP’s price remains just under $3.00. Short-term traders and long-term investors alike are watching closely, as this could be a pivotal moment. Whether XRP breaks out or retraces, the asset’s performance in the coming days will likely set the tone for its trajectory heading into the second half of 2025.

Final Thoughts

With whale accumulation rising, institutional interest building, and renewed focus on XRP’s legal and technical landscape, momentum is gathering. As Korean traders continue to assert their influence, XRP’s price action is set to remain in the spotlight.

XRP was trading at around $2.99, up 4.9% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

The XRP news today underscores a shift in market dynamics, where regional demand and top-tier analysis converge—making XRP one of the most closely watched cryptocurrencies at the moment.