🚀 Bitcoin (BTC) Smashes $122K ATH—Is $200K Just a Pit Stop on the Moon Mission?

Bitcoin just rewrote the rules—again. The king of crypto bulldozed past $122K, leaving skeptics scrambling and hodlers popping champagne. Here’s why this rally has legs.

The breakout no one saw coming (except your anarchist uncle)

Traditionalists called it a bubble. Institutions dismissed it as a sideshow. Yet BTC’s relentless surge just turned Wall Street’s spreadsheet models into confetti. With the $122K barrier vaporized, the psychological runway to $200K looks shorter than a meme-stock CEO’s attention span.

Liquidity tsunami meets institutional FOMO

BlackRock’s ETF inflows could buy a small country. MicroStrategy’s treasury now holds more BTC than some central banks. Meanwhile, Jamie Dimon’s anti-crypto rants age like milk in a heatwave. The smart money’s betting big—while retail traders YOLO into leveraged longs like it’s 2021 again.

The cynical footnote

Sure, the SEC might still try to regulate Bitcoin into a bond ETF. And yes, your bank will finally "adopt blockchain"—just in time to miss the next 10x. But for now? The charts scream one thing: Buckle up. (And maybe hedge with some physical gold—you know, for that vintage 1970s inflation flair.)

This rally comes amid record-breaking ETF inflows, increased on-chain activity, and renewed Optimism over crypto-friendly U.S. policies. As BTC enters price discovery once again, many analysts now project that Bitcoin could reach $200K by the end of 2025—a forecast that once seemed overly ambitious but is gaining momentum with each passing week.

Market Overview: Bitcoin Breaks Out as Technicals Stay Strong

After weeks of hovering near $118,000, Bitcoin price today surged to a high of $122,533, according to CoinMarketCap. The breakout followed a clean bullish setup across several indicators.

Bitcoin (BTC) was trading at around $122,505, up 3.89% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

The 4-hour EMA cluster (20/50/100/200) remains stacked below the price, indicating a strong uptrend, while the RSI has cooled to 68.3 after briefly entering overbought territory. MACD continues to show positive momentum, and Bollinger Bands have expanded, signaling that volatility is increasing in favor of the bulls.

Short-term resistance now sits at $125,500, followed by a major psychological barrier near $130,000. On the downside, support remains firm around $118,200, with deeper fallback levels at $114,000. These levels suggest bitcoin is preparing for further upside as the current structure shows no immediate threat of reversal.

ETF Inflows and Geopolitics: The Hidden Drivers Behind the Rally

The recent breakout is not just technical. According to Bitcoin ETF news, the last 24 hours saw $309 million in net inflows into BTC-linked funds. This comes after Thursday’s historic $1.18 billion ETF inflow—setting a 2025 record. Bitwise’s IBIT fund has now surpassed $53 billion in gross inflows, with Fidelity’s FBTC following at over $12 billion.

Coinbase anticipates a surge in Bitcoin ETF inflows once financial advisors are permitted to recommend them, signaling strong potential for increased BTC investment. Source: @CryptoNewsHntrs via X

“The sheer scale of institutional demand is unlike anything we’ve seen before,” said Matt Hougan, CIO of Bitwise. “There’s relentless appetite from corporate treasuries and asset managers, and it’s colliding with Bitcoin’s fixed supply.”

Simultaneously, President Trump’s recent 30% tariffs on the EU and Mexico have sparked global market jitters, prompting some investors to rotate into Bitcoin as a macro hedge. Combined with crypto-friendly legislation under debate in Congress, these developments are lifting sentiment and encouraging large capital flows into BTC.

Expert Insights: $200K Forecasts Gaining Legitimacy

With institutional demand rising and technicals aligning, analysts are becoming more confident in bitcoin price predictions, calling for a move to $160,000 to $200,000 within the next 6–12 months.

“This shift signals a maturing perspective on Bitcoin—not merely as a speculative asset, but as a structurally scarce store of value,” said George Mandres, senior trader at XBTO Trading.

Bitwise CIO Matt Hougan remains bullish, outlining why Bitcoin could reach $200K by the end of 2025. Source: @CryptosR_Us via X

Technical projections based on Fibonacci extensions show $136,000 and $160,000 as upcoming targets, while market sentiment indicators like the Fear & Greed Index hover around 68, suggesting more room for growth.

Rachael Lucas, a crypto analyst at BTC Markets, commented: “Bitcoin’s cleared $120,000, but the real test is $125,000. ETF demand is strong, and dips to $112,000 will likely be bought aggressively. We’re not in reversal territory yet.”

Even more bullish is James Lavish, a hedge fund manager who noted, “Bitcoin may have no ultimate limit—this is a once-in-a-cycle opportunity.”

Bitcoin Halving 2025 and the Bigger Picture

Another influential variable in shaping long-term predictions is the upcoming Bitcoin halving in 2025, forecasted in April. Previously, Bitcoin rallies during the time leading up to and after a halving occurrence due to reduced miner supply. Now, the shortage of supply is even higher, with daily ETF demand exceeding daily mining output by 20x on some days.

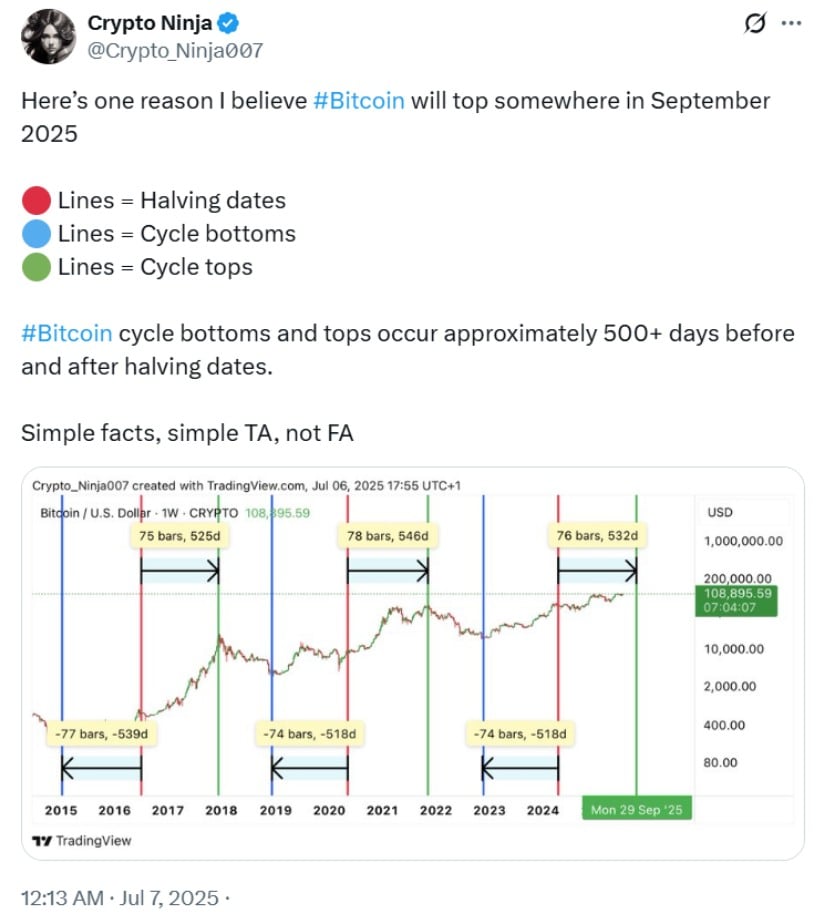

Bitcoin is projected to peak around September 2025, based on historical cycle patterns occurring roughly 500+ days before and after each halving. Source: Crypto Ninja via X

Meanwhile, revenues for Bitcoin miners continue to grow as network usage increases, resulting in earned transaction fees. Improvements to the Bitcoin Lightning Network and the Taproot update are also boosting confidence in Bitcoin’s scalability and long-term adoption.

Looking Ahead: What’s Next for Bitcoin’s Price?

Today’s bitcoin story is a textbook case of bullish technicals, macroeconomic volatility, ETF-driven demand, and political tailwinds. Bitcoin is no longer a specialized asset but increasingly an anchor component of institutional portfolios, and its scarcity is pushing price discovery to all-time highs.

Bitcoin’s potential price targets range from around $134,000 to $200,000–$230,000, with some forecasts reaching up to $250,000 by the end of 2025. Source: TradingShot on TradingView

Though a near-term retreat to $110,000 is still conceivable, the long-term picture continues to be exceptionally bullish. With support in place, ETF inflows pouring in, and the halving in 2025 on the horizon, Bitcoin could be moving towards $200,000 sooner than most were expecting.

As always, volatility should be expected, but for now, the Bitcoin price forecast remains one of historic upside potential.