Bitcoin’s Meteoric Rise: Is $200K by 2025 Inevitable?

Bitcoin's price trajectory has Wall Street scrambling—again. The king of crypto flirts with uncharted territory as analysts whisper about a $200K target by year's end. Here's why the smart money (and the reckless money) is paying attention.

Halving Hype Meets Institutional Hunger

Supply shocks meet demand surges. With the last Bitcoin halving in the rearview, scarcity narratives collide with BlackRock's ETF inflows—creating a perfect storm for price discovery. Even gold bugs are side-eyeing their portfolios.

The Retail FOMO Factor

Main Street hasn't forgotten 2021's euphoria. As exchanges report record sign-ups, that familiar tingle of 'maybe I should YOLO' spreads through suburban WhatsApp groups. Because nothing says financial literacy like leverage trading between daycare pickups.

Regulatory Roulette

The SEC's dance of enforcement actions and whispered approvals keeps volatility juicy. Politicians suddenly 'understand blockchain'—just in time for election-year donor outreach. How convenient.

200K or Bust?

Whether Bitcoin hits the magic number or not, one thing's certain: the crypto carnival isn't packing up anytime soon. Banks will keep pretending to hate it while building backdoor exposure. And your Uber driver will still explain tokenomics better than your financial advisor.

Hougan first rolled out the target in Bitwise’s “10 crypto Predictions for 2025” back in December 2024 and has doubled down on it at every microphone since, most recently at Consensus 2025. His logic is brutal in its simplicity: basic supply-and-demand math says there just won’t be enough coins to satisfy the institutional money stampeding in.

“Miners will crank out only 165,000 BTC this year. Public companies and ETFs have already swallowed more than that,” Hougan told Cointelegraph. “Once sellers at $100 k are exhausted, the next stop is $200 k.”

Matt on CNBC today talking up his Bitcoin price target of $200,000

Where We Stand Mid-2025

- ETF fire-hose still on: Spot-bitcoin ETFs have sucked in a record $15 billion-plus YTD after shattering the 2024 launch-year record of $35 billion. Some weeks they’re pulling $2 billion while everything else bleeds.

- BlackRock effect: IBIT alone vacuumed up $6.3 billion in May, lifting its AUM north of $70 billion.

- Macro tailwinds: Trump’s public tantrum that Fed rates are “300 bps too high” has traders salivating over cheap money and risk-asset rocket fuel.

- Policy thaw: Next week’s “Crypto Week” on Capitol Hill could finally hand the industry the regulatory clarity Wall Street claims it needs.

Bitcoin is looking strong and ready for price discovery, Source: Bitcoin Liquid Index

Bitcoin is looking strong and ready for price discovery, Source: Bitcoin Liquid Index

The 5-Point Checklist to $200 k

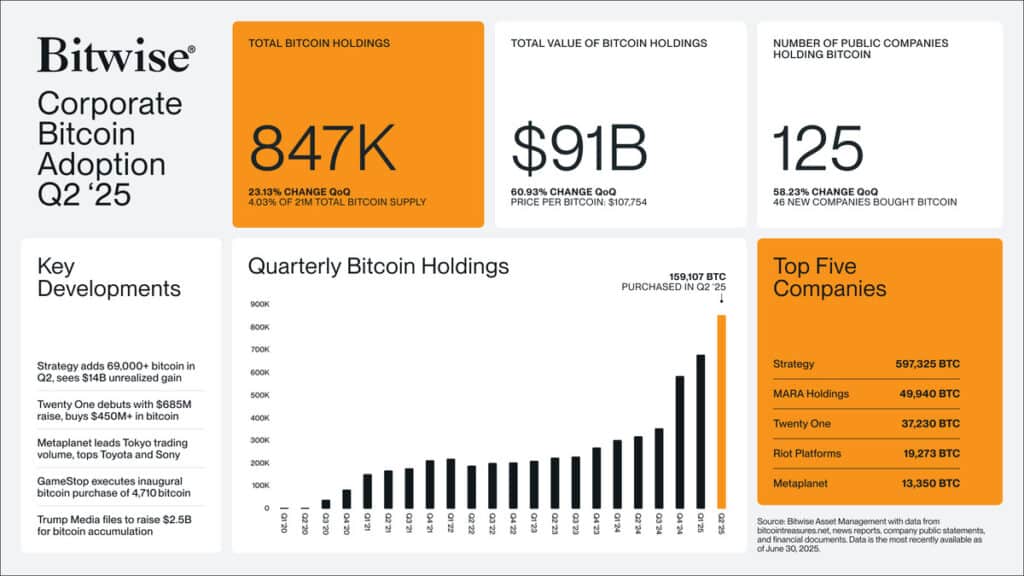

Corporate adoption of bitcoin is soaring to new levels in 2025, Source: Bitwise

What Could Go Wrong

- Regulatory rug-pull. A hostile amendment during “Crypto Week” or a Treasury clamp-down on dollar-denominated stablecoin rails would spook the wirehouses just when they’re warming up.

- ETF exhaustion. If flows stall below 1 k BTC per week—say, because hedge-fund basis trades evaporate—Hougan’s supply crunch thesis breaks.

- Macro shock. A surprise recession could send institutions back to cash and Treasuries, freezing the bid at precisely the wrong moment.

The original target from Bitwise Crypto Predictions 2025

Hougan’s $200,000 Bitcoin price prediction target is audacious, but it isn’t hopium. The plumbing is already half-built: ETFs, corporate treasuries, talk of a national reserve, and a macro backdrop that keeps rewarding anything scarce and unprintable. Tick these five boxes and $200 k stops being a moon shot and starts looking like base camp. Miss a couple and we might spend Christmas telling ghost stories around $120k. If you’ve been asking if now is the time to buy Bitcoin, this bull run is just getting started. Buy Bitcoin and crypto assets to ride the bull market, it won’t last forever so manage your risk.