🚀 Bitcoin (BTC) Rockets Past ATH: Bitwise CIO’s Bold $200K Forecast for 2025 Looks Increasingly Realistic

Bitcoin just rewrote the rulebook—again. The original crypto asset smashed through previous records today, leaving skeptics scrambling and hodlers popping champagne.

The $200K question: Bitwise's top strategist isn't backing down from their audacious prediction, even as Wall Street analysts clutch their pearls. 'This isn't 2021's meme-stock mania,' the CIO noted—while hedge funds quietly rebalance portfolios toward crypto.

Market mechanics at work: Scarcity protocols meet institutional FOMO. With the next halving cycle approaching, the math gets interesting: 90% of BTC already mined, daily issuance about to drop—again.

The cynical take: Meanwhile, traditional finance still can't decide if crypto is 'rat poison' or their next fee-generating product. Spoiler: They'll adopt it right after claiming they invented it.

One thing's clear—when the world's hardest money starts moving, you either stack sats or get left behind.

As the crypto market braces for its next leg up, Bitwise CIO Matt Hougan forecasts that Bitcoin could reach $200K by the end of 2025, citing fundamental and on-chain strength.

Bitcoin News Today: BTC Breaks $118K Barrier Amid Institutional Frenzy

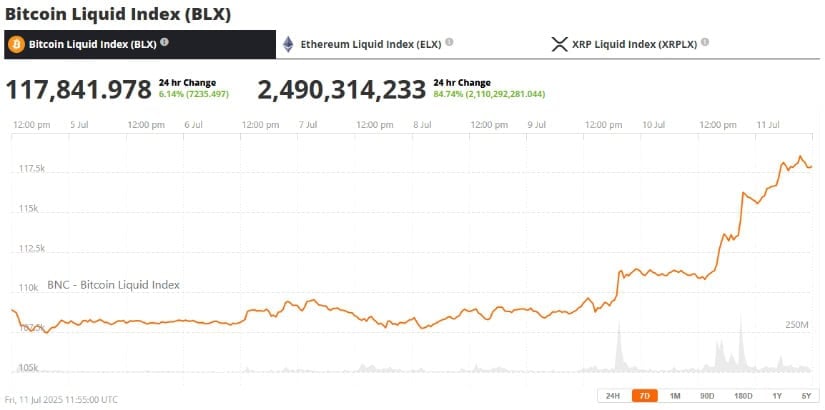

Bitcoin’s rally shows no signs of slowing down. On July 11, 2025, Bitcoin hit a new all-time high of $118,403, marking a 4.85% surge in 24 hours and continuing a strong monthly uptrend of over 6.5%. At press time, the Bitcoin price today remains near $118K, with a market capitalization exceeding $2.31 trillion and 24-hour trading volume skyrocketing to $101.86 billion.

The breakout was not isolated. ethereum and other major cryptocurrencies followed suit, confirming a broader market-wide growth spree. Analysts now point to $120K as the next major resistance level, with some technical targets extending to $130K–$140K if current momentum continues.

Market Overview: Bitcoin Technical Analysis Signals More Upside

From a Bitcoin technical analysis perspective, the asset has broken free from a year-long descending channel, moving firmly into a phase of expansion. Key support levels include the 50-day moving average at $107K and the psychological floor at $100K.

Bitcoin tested resistance at $116,577 and topped NEAR $121,100 before a pullback, but holding above $112,097 keeps the bullish structure intact with potential for further upside after consolidation. Source: DENOLLAFINANCERU on TradingView

Meanwhile, momentum indicators are flashing bullish. The RSI indicator remains below overbought territory, suggesting more room to run. Increased trading volumes—up to more than 66%—confirm that retail and institutional participants alike are fueling this rally.

Also, Bitcoin’s recent consolidation above $115K signals a good price structure with good bids coming in on each pullback. Initial resistance is at $120K, and an uninterrupted breakout over this could be a rapid trip to $122.8K and beyond.

What’s Fueling the Rally? Halving, Whales, and ETF Momentum

Several key reasons lie behind the latest bitcoin price breakout. For starters, heightened speculation around the imminent Bitcoin halving in 2025 has driven investors’ expectations. Halvings in the past have reduced BTC miner rewards and trimmed supplies, typically creating a price appreciation.

While Coinbase whales previously led the market, today’s BTC surge to $118,000 was driven by a major whale move on Binance. Source: Umair crypto via X

Second, bitcoin whale alert notices have revealed a consistent rise in whale accumulation. More BTC are exiting exchanges and going into cold storage, reducing the circulating supply and increasing scarcity, according to on-chain metrics.

Third, macroeconomic trends—headed by the Federal Reserve’s planned rate cuts—have improved investor appetite for risk assets. Bitcoin, oftentimes referred to as “digital gold,” is once more being considered as an inflation hedge and fiat devaluation bet.

And lastly, institutional trust in Bitcoin ETFs is increasing at a great pace. ETFs have acquired $5.2 billion in Bitcoin over the past 30 days alone, giving us a clear indication of adoption into the mainstream and financial industry interest.

Expert Insights: Bitwise CIO Predicts $200K Bitcoin by End of 2025

Matt Hougan, Chief Investment Officer at Bitwise, made headlines with his bold Bitcoin price prediction: a MOVE above $200,000 by the end of 2025.

Bitwise CIO Matt Hougan expects Bitcoin to surpass $200,000 by the end of the year. Source: Altcoin Daily via X

According to Hougan, the current rally is structurally different from previous cycles due to “unrelenting demand from regulated ETFs and corporate treasuries.” He noted that breaking past the $100K range has opened a new chapter for Bitcoin’s price discovery.

“Bitcoin is no longer a speculative asset,” Hougan emphasized. “It’s now a cornerstone in institutional portfolios. This trend is just beginning.”

The convergence of low supply, ETF-driven demand, and macroeconomic catalysts supports his thesis that Bitcoin’s long-term outlook remains extremely bullish—even beyond the $200K mark.

Looking Ahead: BTC Next Move—$120K or Beyond?

With the price of Bitcoin today hovering just below its latest all-time high, market participants and investors are eyeing the $120K breakout level as the next short-term target. Technicals and on-chain data are still positive for further prices, while whale accumulation and ETF inflows drive powerful tailwinds.

Bitcoin (BTC) was trading at around $117,841, up 6.14% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

In the future, the long-term perspective for Bitcoin looks good with institutional faith, macro backing, and the impending halving pushing prices forward. If the momentum is sustained, Bitcoin’s path to $130K or even $200K—predicted by Bitwise CIO—does not look far away.

As usual, market volatility is a consideration, but one thing is certain: Bitcoin is in price discovery mode, and the next few months may redefine what is possible for the world’s top digital asset.