Avalanche (AVAX) Primed for Breakout: Falling Wedge Pattern Signals $20 Surge in July

Avalanche (AVAX) is painting a textbook bullish reversal pattern—and traders are circling. The falling wedge formation on AVAX charts suggests an imminent breakout, with $20 as the near-term target. Here’s why July could be explosive for the Layer 1 contender.

The Technical Setup: Compression Before Liftoff

AVAX’s price action has been coiling like a spring since Q2, forming lower highs and even lower lows within a narrowing channel. Classic falling wedge behavior. These patterns typically resolve upward—especially when volume picks up during the breakout (hint: it’s starting to).

Why $20 Matters More Than Your Analyst’s Golf Handicap

A clean breakout past wedge resistance would confirm the pattern’s measured move target near $20—a 25%+ rally from current levels. That price zone also aligns with AVAX’s 200-day moving average, turning it into a magnet for momentum traders. Meanwhile, Bitcoin’s sideways action gives altcoins room to run.

Caveat Emptor: The Fine Print

Not all wedges lead to paradise. A failure to hold above the trendline could trigger false breakout alarms—and send AVAX retesting June lows. But with staking yields still juicy and institutional interest creeping back into crypto, the bulls have physics on their side. For now.

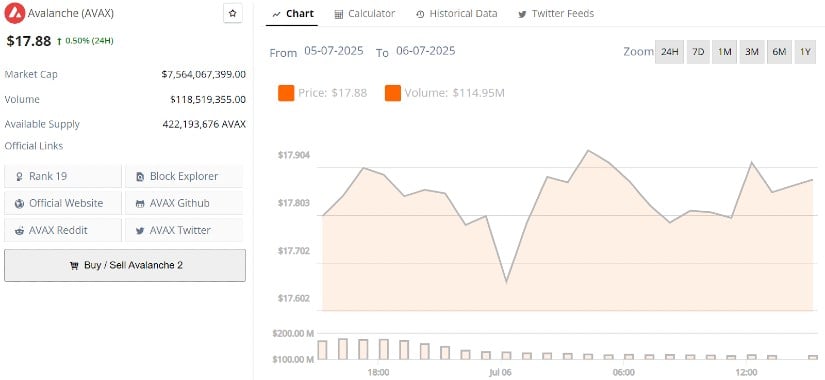

AVAX is trading at $17.88, up 0.50% today. With the price holding steady and signs of growing momentum, it’s positioning itself for a possible breakout, setting the stage for further upside.

AVAX’s current price is $17.88, up 0.50% in the last 24 hours. Source: Brave New Coin

AVAX Falling Wedge: Primed for Breakout

AVAX might be nearing the end of its corrective phase. The weekly chart from TrendFi shows a well-defined falling wedge pattern. Price has been compressing within this wedge for several months, steadily forming lower highs and higher lows. This kind of structure typically builds pressure that eventually resolves upward, especially when volume starts to pick up NEAR the end.

AVAX is forming a falling wedge pattern, signaling potential upward momentum. Source: TrendFi via X

Currently, AVAX price is trading just above $18, sitting right at the wedge’s lower boundary. The setup becomes more interesting after the flattening of momentum indicators and bullish divergence on the weekly stochastic. If AVAX can push through the descending trendline resistance near $18 to $18.50 and hold above it on the weekly close, the next upside targets open around $28 and potentially $48.

AVAX Price Pridiction Targets $20 for July

Ty’s opinion that AVAX could break $20 this month might not look obvious right now, but technically, it’s starting to get possible. Price has been hovering just below key resistance, with tighter consolidation suggesting a potential move brewing. AVAX is currently sitting around $18, and with the falling wedge setup tightening, a push past $20 could come quickly if momentum shifts.

The AVAX community is calling for $20 this month. Source: Ty via X

Momentum indicators are curling, and the lower boundary has held multiple times. The $20 level isn’t just round-number psychologically; it’s also structurally important. Reclaiming it on volume could flip short-term sentiment and trigger follow-through toward $24 to $28.

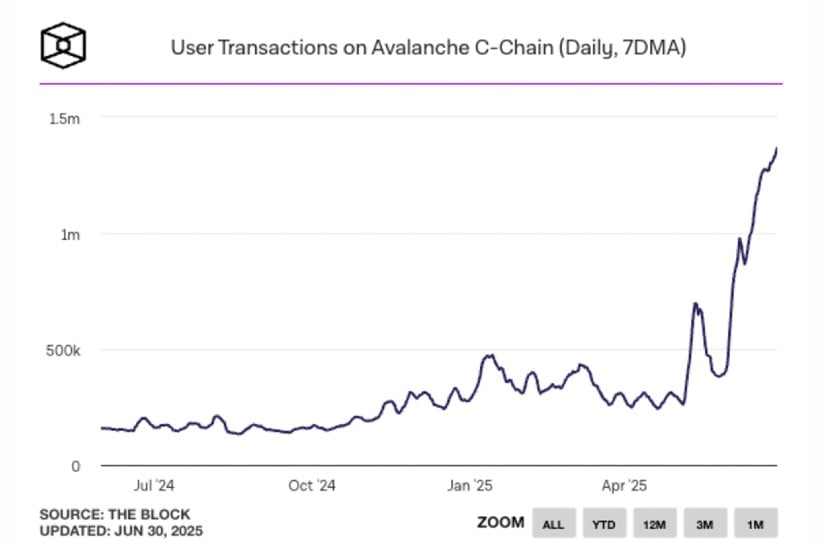

Avalanche On-Chain Keeps Recording Highs

While price action on AVAX is setting up for a breakout, the on-chain activity is already breaking records. As shown by ThaDream L1, Avalanche’s C-Chain daily transactions just hit an all-time high, surging past 1.5 million. This isn’t a yearly or monthly peak; it’s the highest ever, signaling that real network demand is heating up fast behind the scenes.

Avalanche’s C-Chain daily transactions hit an all-time high. Source: ThaDream L1 via X

Importantly, this metric only reflects the C-Chain and doesn’t even include subnets or other Avalanche L1s. It’s a strong confirmation of underlying user growth, even as the token consolidates just below key resistance. Historically, when transactional volume leads price, technical breakouts tend to follow with more conviction.

AVAX Eyes $50 Resistance Test as Momentum Builds

AVAX Avalanche price is holding firm at a well-established base that has historically acted as a launch zone. After breaking out of a falling wedge structure, the price is consolidating above $18 with signs of accumulation. This area has served as support multiple times and sets the foundation for a potential recovery leg. If momentum continues building here, the path toward retesting the $24–$28 region opens up next.

While $50 is still a distance away, crypto analyst BullSignal believes it remains a major technical milestone. That level marked the breakdown zone from previous cycles and serves as a natural magnet if bulls can sustain pressure. But before that happens, AVAX price needs to clear local resistance and prove the current base is more than just a pause.

AVAX/BTC at Trendline Support

The AVAX/BTC pair is now approaching a pivotal descending trendline support that has held price in check for over a year. A reaction from this level is expected, and if it follows through, it could align with the developing strength on AVAX/USDT. This convergence between the BTC and USD pairs WOULD mark a meaningful shift in momentum across the board.

If the bounce holds, AVAX/BTC has room to climb toward the 0.000270 level and potentially higher. That kind of relative strength would give AVAX/USDT the boost it needs to push beyond local resistance and start working its way back toward the $50 zone.

Both AVAX/USDT and AVAX/BTC are showing signs of a potential reversal ahead. Source: BullSignal via X

Final Thoughts

AVAX is on the verge of a potential breakout, with strong technical patterns and record-high on-chain activity signaling growing momentum. If it can clear key resistance levels, AVAX Price Pridiction could see a MOVE towards $28, with room for $50 in reach as well.