Sei Price Set to Soar: Technical Analysis Points to 70% Rally Toward $0.44

Charts are flashing green for Sei—and traders are taking notice. A bullish pattern suggests this under-the-radar altcoin could be primed for a breakout.

Target locked: $0.44

The setup? A textbook technical formation that's delivered similar gains across crypto markets before. When these patterns trigger, they tend to move fast—just ask the bagholders who ignored the last breakout.

Of course, in crypto, TA is just astrology for MBAs. But when liquidity starts chasing a narrative, even the skeptics pay attention. The real question isn't whether the chart's right—it's whether your FOMO can wait for the retest.

Following a sharp pullback from recent highs, the token is now consolidating within a crucial support zone. Market watchers, including analyst Kriptoteless, are monitoring these levels for potential capital rotation into SEI ahead of a projected MOVE toward the $0.44 region.

Bitcoin-to-SEI Rotation Strategy Highlights Smart Entry Zone

In a recent X post, analyst Kriptoteless outlined a strategy for rotating capital from Bitcoin into SEI at technically significant levels. He identified a broad accumulation range between $0.24 and $0.27 as a smart entry point, supported by a potential rounded bottom formation and a bullish throwback structure. The chart shared by the analyst visualizes a trade setup with a favorable risk-to-reward profile, using clear invalidation and target zones.

Source: X

The risk zone is defined between $0.2026 and $0.1589, where a breakdown WOULD negate the bullish setup. In contrast, the target zone reaches up to $0.4479, reflecting over 70% potential upside from current levels. Kriptoteless points to the $0.44–$0.49 area as the primary resistance, historically associated with high selling pressure. A successful breakout above $0.30 would likely attract momentum and open the door to retesting this higher range.

Market Activity and On-Chain Dynamics Indicate Accumulation

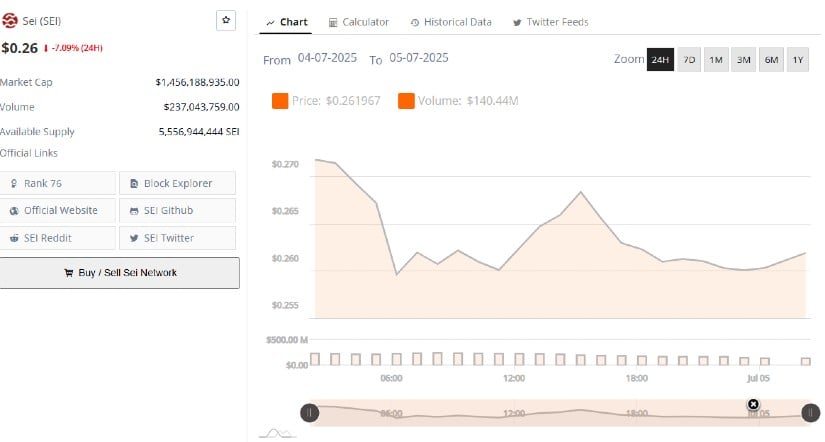

Volume behavior over recent sessions reinforces the idea of a cooling phase and possible accumulation. SEI’s 24-hour chart from Brave New Coin shows that the price dropped from $0.270 to an intraday low of $0.256 before stabilizing.

Although daily volume totaled $237 million, participation dropped as the session progressed, signaling a cautious stance among market participants. The muted response on the rebound suggests that traders may be waiting for confirmation before committing to new positions.

Source: BraveNewCoin

Despite this pullback, SEI’s market cap remains steady at $1.45 billion, placing it at Rank 76 in the global market. With a circulating supply of over 5.55 billion tokens, SEI remains highly reactive to changes in sentiment and liquidity cycles.

The consistent positioning NEAR support levels and visible volume spikes near recent lows point to potential whale involvement, supporting the theory that accumulation is underway within the $0.24–$0.26 band.

As of July 4, 2025, the daily chart for SEI/USD (TradingView data) closed at $0.2571, down 5.51%. The candlestick formed a long-bodied red bar with minimal lower wick, reflecting sustained intraday selling pressure.

This marks the second consecutive red close since the rejection at $0.29, confirming the ongoing short-term correction. The structure remains bearish, but the consolidation within a historical accumulation zone supports the potential for a reversal.

Source: TradingView

From an indicator perspective, the Chaikin Money FLOW (CMF 20) is currently at -0.05, showing a slight dominance of outflows over inflows. The CMF had briefly turned positive earlier in the week, but failed to hold, suggesting that larger market players have paused accumulation.

The Bull and Bear Power (BBP 13) reads +0.0014, reflecting a neutral tone as bullish momentum fades from late June highs. This declining strength in BBP may indicate that Sei is in a cooling-off phase, requiring stronger confirmation before a sustainable rally can begin. A bounce supported by rising volume would validate the bullish scenario projected by Kriptoteless.