Crypto Buying Signal? These Charts Scream Opportunity in July 2025

Bitcoin's bouncing off support levels while altcoins flash oversold RSI readings—just as institutional money starts flowing back in. The smart money's positioning, but retail's still licking wounds from the last leverage massacre.

Key indicators turning bullish:

- BTC dominance dipping as capital rotates to ETH and layer 2s

- Stablecoin reserves hitting 18-month highs

- Mining hash rate recovering post-halving

Wall Street's latest 'crypto is dead' narrative lasted exactly until their own algos detected the bottom. Now watch them FOMO in after 6 months of shorting—classic hedge fund timing.

This isn't financial advice (obviously), but the charts haven't lied like this since your last 'sure thing' DeFi farm.

Is Bitcoin about to go parabolic?

Four top signals in Bitcoin’s history. Each corresponded to a top. We are nowhere NEAR one. Four launch signals in Bitcoin’s history. Each one sent it parabolic. That’s the one that just triggered. Source: X

Can Bitcoin break the channel?

On the BTC monthly chart. Will the eleventh attempt to close above this giant linear parallel channel be successful? Source: X

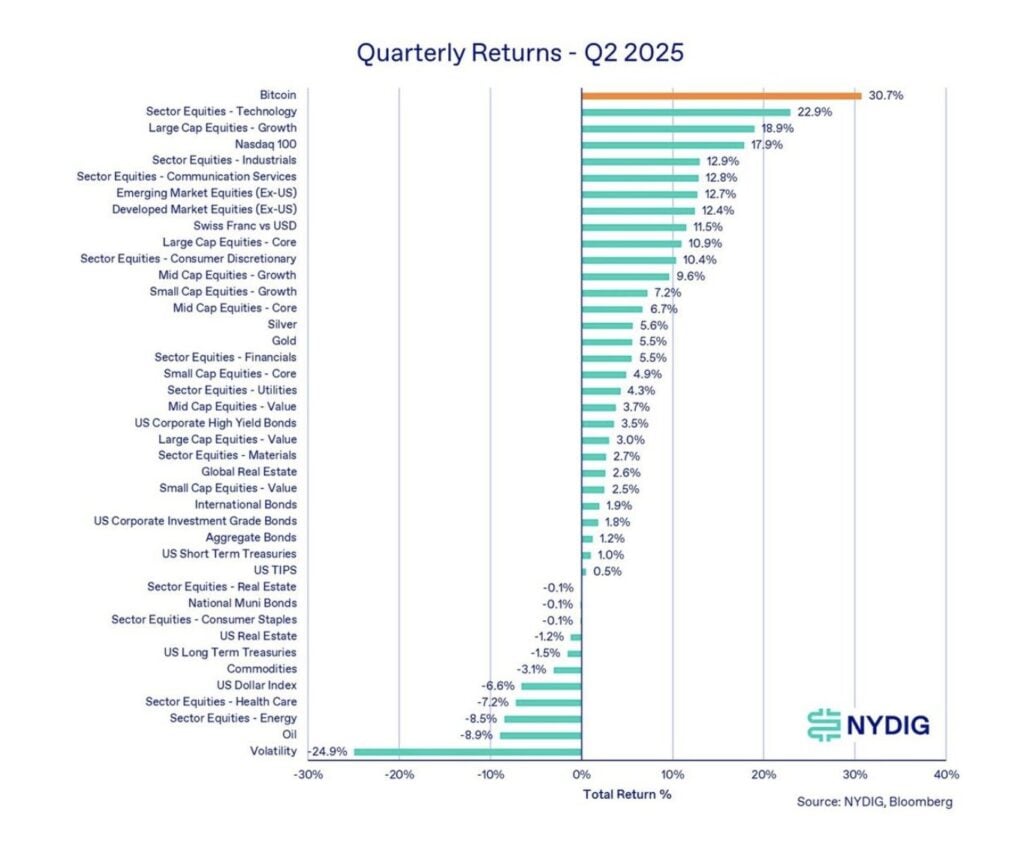

Bitcoin had a good second quarter in 2025

Bitcoin has already outperformed every other asset class. Source: X

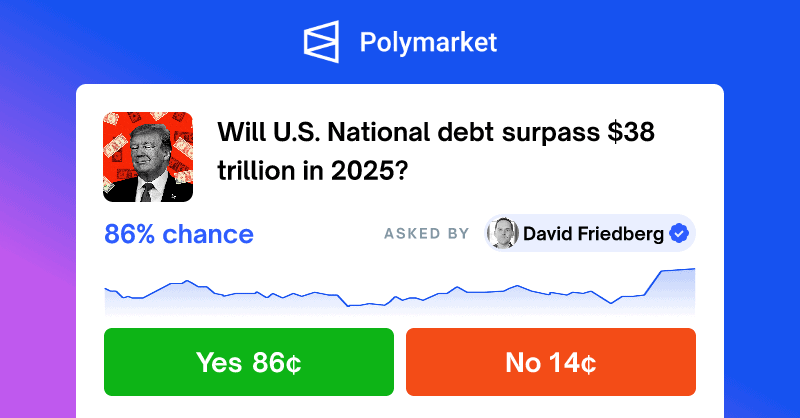

Money printing is coming because nothing stops this train

Will the US National debt surpass trillion in 2025? Source: X

Bitcoin’s Bull Market is 88% Complete

Progress will speed up on Parabolic advances. Source: X

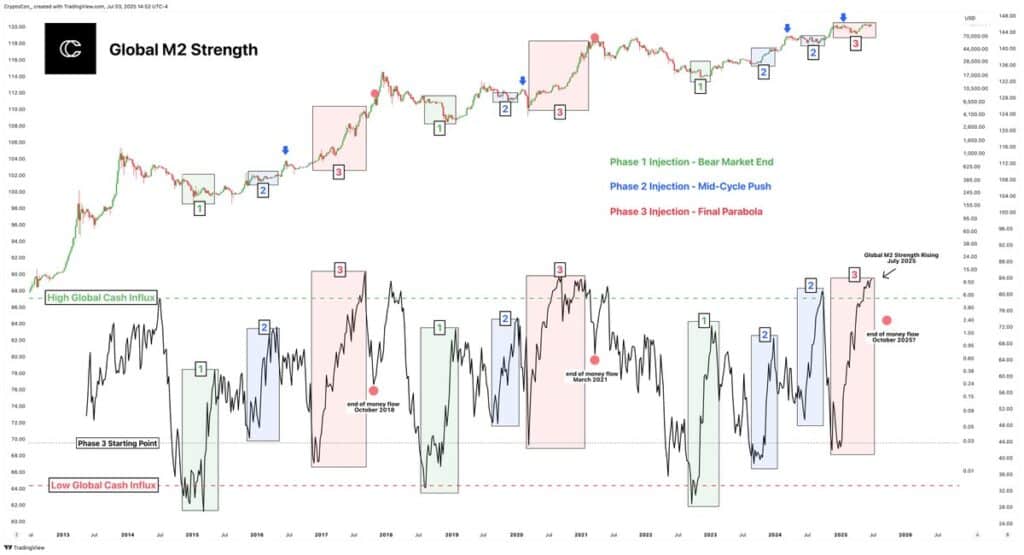

Bitcoin’s cycle is closely tied to the strength of global M2

We’re in the thick of the final phase. Every bear market ends with a surge of global cash (phase 1) Throughout the cycle, there are secondary cash influxes (phase 2). This is the first time we’ve seen two of these in a single cycle. The final phase begins at the phase 3 starting point, and rallies to the high global cash line. It’s clear that this is underway now. M2 strength has entered its final phase, but it’s not over yet. Huge amounts of money are waiting to arrive to crypto. Source: X

The Bitcoin ETFs are Eating the Supply

![]()

There is simply not enough Bitcoin to keep meeting demand. Act accordingly, Source: X