SEC Greenlights Grayscale’s XRP-Exposed ETF – Is a Spot Listing Surge Next?

The SEC just handed Grayscale a golden ticket—an ETF with XRP exposure. Cue the market frenzy.

Why this matters: Regulatory approval for crypto-linked ETFs has been like pulling teeth. This move signals a rare thaw in the SEC's deep freeze on digital asset products.

The ripple effect: Traders are now betting big on XRP spot ETFs getting the nod next. Never mind that the SEC spent years claiming XRP was a security—apparently money talks louder than lawsuits.

Wall Street's hypocrisy meter just redlined: The same institutions that called crypto a 'fraud' in 2022 are now falling over themselves to cash in. Some things never change—except price charts.

Notably, the ETF includes XRP among its portfolio assets, marking a pivotal moment for Ripple and the broader XRP crypto market after years of regulatory hurdles.

XRP Gets a Boost from SEC Approval

This development marks the first time U.S. investors can gain regulated exposure to XRP through a publicly listed ETF. While the XRP lawsuit with the SEC had once clouded the token’s legal status, its inclusion in the Grayscale ETF indicates a shift in regulatory tone.

XRP is now accessible to everyday investors through the SEC-approved Grayscale Digital Large Cap ETF, marking a full-circle moment after nearly five years of SEC vs Ripple litigation. Source: Nate Geraci via X

The ETF, which tracks the five largest digital assets by market capitalization, comprises approximately 80% Bitcoin, 11% Ethereum, and 4.8% XRP, alongside solana and Cardano. Though XRP’s weight in the fund is comparatively small, its presence is symbolically and strategically important.

“This is a huge step forward for XRP and altcoin legitimacy in regulated markets,” said ETF analyst James Seyffart. “It also raises the likelihood of standalone XRP spot ETF approvals moving forward.”

What the Grayscale ETF Means for Ripple and XRP

The fund’s manager, Grayscale Investments Sponsors LLC, is a subsidiary of Digital Currency Group, while Coinbase Custody Trust Company serves as the custodian. The product is structured as a Cayman Islands LLC and operates under the CoinDesk 20 Index framework.

The SEC has approved Grayscale’s Digital Large Cap Fund as a spot ETF, giving U.S. investors regulated access to top cryptocurrencies like BTC, ETH, and XRP. Source: crypto Coin Show via X

The ETF’s approval represents a turning point in the Ripple vs SEC narrative, where Ripple Labs has long argued for fair treatment of XRP as a decentralized asset. With the legal fog lifting, financial institutions and traditional investors may now be more inclined to allocate capital into XRP.

Until now, U.S. investors faced challenges purchasing XRP coin directly due to ongoing legal uncertainty. The ETF offers a regulated on-ramp, enabling exposure to xrp price performance without engaging with crypto exchanges or self-custody.

More XRP ETFs Could Be on the Horizon

With this approval, attention has shifted to the 17 pending XRP ETF filings, which could soon receive similar regulatory green lights. Analysts suggest that the Grayscale decision may fast-track approvals of single-asset XRP ETFs from issuers like Franklin Templeton and Hashdex.

ETF analyst Nate Geraci commented, “This could be the start of a floodgate moment for altcoin ETFs. The SEC’s acceptance of XRP in a multi-asset ETF suggests a broader willingness to embrace more diverse crypto exposure.”

Notably, countries like Brazil and Canada have already listed spot XRP ETFs, positioning the U.S. to follow suit. In Brazil, the Hashdex XRP ETF trades on the B3 exchange, while Purpose Investments introduced a similar product on the Toronto Stock Exchange in June.

XRP Price Outlook: Will XRP Go Up From Here?

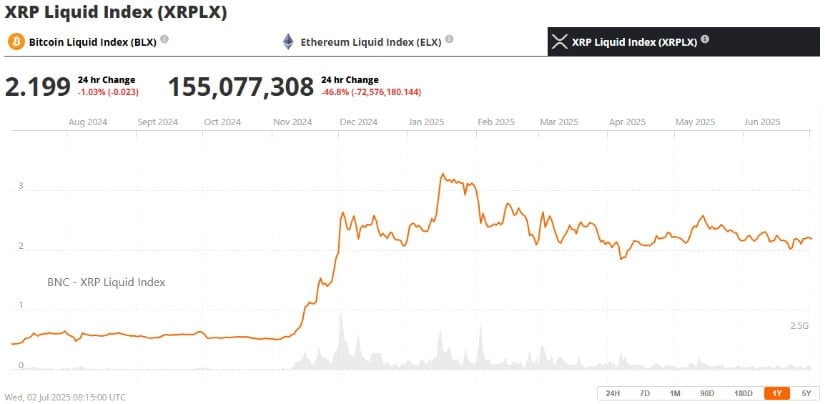

Market participants are now eyeing the impact of the ETF approval on XRP price action. At the time of writing, XRP today is hovering around $2.19, slightly down from recent highs. However, traders believe that the inclusion in Grayscale’s ETF could lead to increased institutional inflows, supporting price momentum.

XRP was trading at around $2.199, down 1.03% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

With the XRP ledger expanding its ecosystem and new developments like the XRPL EVM Sidechain rollout, technical fundamentals are also improving. Combined with renewed investor confidence, these factors may set the stage for a potential breakout.

Some analysts suggest the ripple price could revisit key resistance zones near $2.34 and $2.65 if Bitcoin continues its upward trajectory and macroeconomic conditions remain supportive. Others remain cautiously optimistic, awaiting confirmation from additional ETF approvals before revising their XRP price prediction 2025 outlooks.

Looking Ahead: A New Chapter for XRP Crypto

The SEC’s green light on Grayscale’s ETF marks a symbolic victory for Ripple XRP after years of regulatory scrutiny. By allowing XRP into a publicly traded ETF, the SEC is signaling growing acceptance of the asset as a legitimate component of institutional portfolios.

As more ETF products emerge and market access widens, XRP predictions are likely to remain at the forefront of crypto investor discussions. While XRP prices remain tightly range-bound for now, the door is open for a fresh leg upward—fueled by regulatory clarity, institutional adoption, and growing market optimism.

For those watching the XRP Ripple price prediction story unfold, this could be just the beginning of a new era for one of crypto’s most resilient digital assets.