Bitcoin ’Diamond Hands’ Lock In $1T Unrealized Profits – Hyper-Bullish Phase Imminent

Bitcoin hodlers just flashed the ultimate diamond hands signal—collectively sitting on over $1 trillion in unrealized profits without flinching. This isn't paper-handed speculation; it's a full-scale conviction play.

The trillion-dollar HODL: Why this changes everything

Market veterans know unrealized gains at this scale historically precede parabolic runs. Every swing trader who 'waited for a pullback' just became fuel for the next leg up.

Wall Street's FOMO machine is warming up

Traditional finance still can't decide if Bitcoin is digital gold or a 'barbarous relic' with a blockchain—but that cognitive dissonance vanishes when institutional inflows start moving needles.

The cynical take: Of course retail won't sell—they're waiting for their crypto 'investment advisors' to tell them it's safe to cash out (right at the top, as always).

Like a winner at the poker table who keeps doubling-down, investors in Bitcoin are demonstrating remarkable resilience. Even while lesser investors cave and cash out, ‘diamond hands’ Bitcoin holders now have unrealized profits exceeding $1.2T.

As a recent report from Glassnode stated:

HODLing appears to be the dominant market mechanic across a plethora of spending metrics, with realized profit taking declining, liveliness continuing to trend downwards, and Long-Term Holder supply surging to a new ATH.

Glassnode, The Week On-chain, Week 26, 2025

Bitcoin holders are gambling that the ultimate top is coming for the world’s leading crypto – and they want more. In the meantime, projects like bitcoin Hyper are building their own future on the back of Bitcoin’s success.

Diamond Hands Weather Latest Bitcoin Dip

A recent price dip from around $106K to $99K – coinciding with geopolitical tension in the Middle East – tested the resilience of short-term holders.

But more buyers stepped in around the cost basis at $98.3K, propelling prices back up.They eventually crested above $107K in a MOVE analysts see as a bullish rebound.

On-chain data reveals multi-month metrics at record highs: coins untouched for 155+ days now total 14.7M $BTC, and the ‘liveliness’ indicator – which captures coin movement – continues to fall, further cementing a strong buy-and-hold posture.

Even those who acquired BTC during January’s breakthrough above $100k are continuing to hold, confident that there’s plenty of room left for Bitcoin to grow.And despite sky-high unrealized gains, realized profits have dwindled to about $872M daily, far below prior peaks of $3.2B.

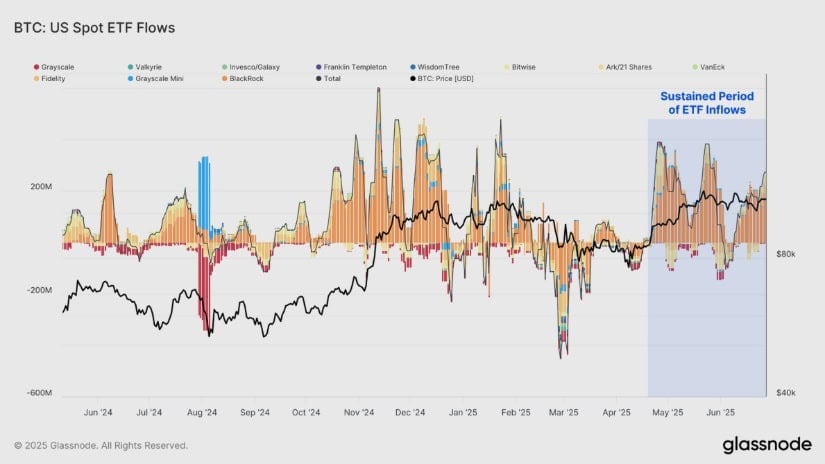

The upshot? There’s limited selling pressure and robust institutional demand, with US spot Bitcoin ETFs drawing average daily inflows of around $298M.

Without significant upward momentum, holders are unlikely to liquidate en masse – hinting that another price surge may be the catalyst required to unlock more supply.

According to Glassnode:

Investor behavior signals a strong preference for HODLing, as the current price range appears insufficient to trigger significant profit-taking.

Glassnode, The Week On-chain, Week 26, 2025

More demand is needed to push the price into the next ATH. Will it come from an upstart Bitcoin Layer-2?

Bitcoin Hyper ($HYPER) – The Fastest Layer in Bitcoin History Has Arrived

Unlock fast and cheap $BTC payments with Bitcoin Hyper ($HYPER) – a first-of-its-kind Bitcoin LAYER 2.

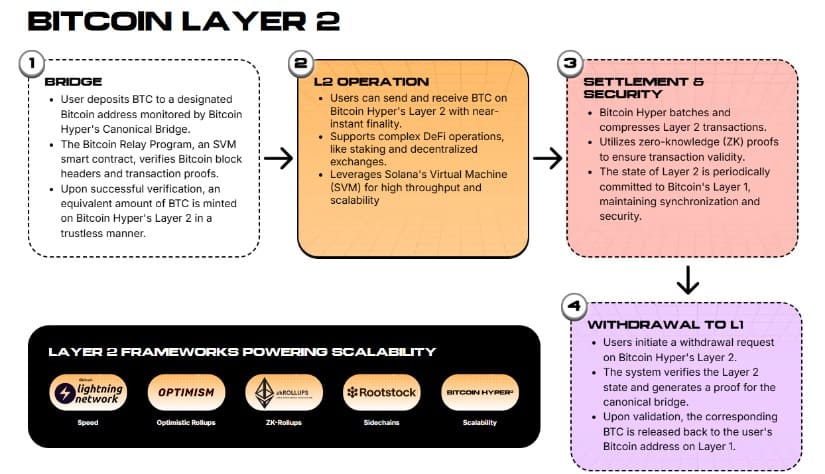

Powered by the Bitcoin Relay Program (an SVM smart contract), Bitcoin Hyper allows users to deposit $BTC to a designated address and receive freshly-minted $HYPER on a Layer 2. The process works in reverse too, allowing users to withdraw $BTC back on the Layer 1.

With Bitcoin Hyper, all the power of a proper Layer 2 comes to Bitcoin. That means ZK-rollups, the Lightning network, DeFi, all of it – now available to Bitcoin holders.

Staking also comes to Bitcoin via Bitcoin Hyper. During the presale, $HYPER tokens can be staked for a whopping 429% dynamic APY.

The project showcases fairly even allocation in its tokenomics. As expected, Development receives the most attention, with 30% of available tokens. Treasury (25%) and Marketing (20%) come next, with Rewards (15%) and Listings (10%) last.

Bitcoin Hyper is off to a roaring start, raising $1.8M in its first few weeks. Tokens are currently priced at $0.0121.

To learn how to buy Bitcoin Hyper ($HYPER), visit the presale page.

Bitcoin Enjoys Its Diamond Hands Phase

Bitcoin is entering a phase defined by entrenched long-term holding and tempered short-term selling.

With institutional capital flowing in and profits largely unrealized, the stage appears set for the next leg up – a step that could be accelerated by Bitcoin Hyper’s success.

Do your own research before investing. This isn’t financial advice.