Master Multi-Trade Mode on LeveX: Turbocharge Your Crypto Trading in 2025

Crypto traders, listen up—LeveX's Multi-Trade Mode just became your new secret weapon. Here's how to exploit it before the herd catches on.

Why Settle for Single Trades When You Can Go Multi?

LeveX's feature lets you execute complex strategies with one click—no more juggling windows like a circus act. Hedge, arbitrage, or just panic-sell faster than ever.

The Step-by-Step Power Move

1. Activate Multi-Trade in your dashboard (it's hiding behind the 'Advanced' tab—because of course it is).

2. Set your parameters: pairs, leverage, and that hilariously optimistic take-profit target.

3. Watch the system bypass traditional exchange bottlenecks like a VIP sneaking past velvet ropes.

Pro Tip:

Combine with limit orders to avoid getting rekt by 2025's inevitable 3am volatility spike.

Remember: This won't magically turn bad decisions into gains—but at least you'll lose money *efficiently*. Happy trading, and may your margins stay liquid (unlike some hedge funds we know).

Learn to manage multiple independent positions with different leverage and margin settings.

Requirements Before Starting

- A registered LeveX account (How to register an account on LeveX)

- Funds in your futures wallet (How to transfer funds between wallets)

- Basic understanding of futures trading (Understanding futures trading on LeveX)

- Understanding of Multi-Trade Mode concepts (Understanding Multi-Trade Mode)

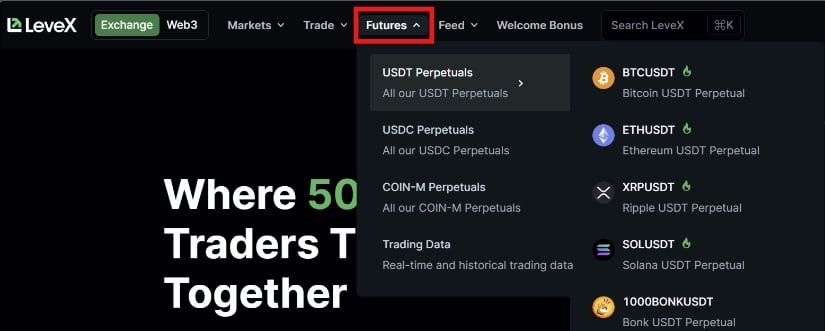

Step 1: Navigate to Futures Trading

Go to the LeveX homepage and hover over “Futures” in the top navigation menu, then select USDT Perpetuals, USDC Perpetuals, or COIN-M Perpetuals depending on your preferred contract type.

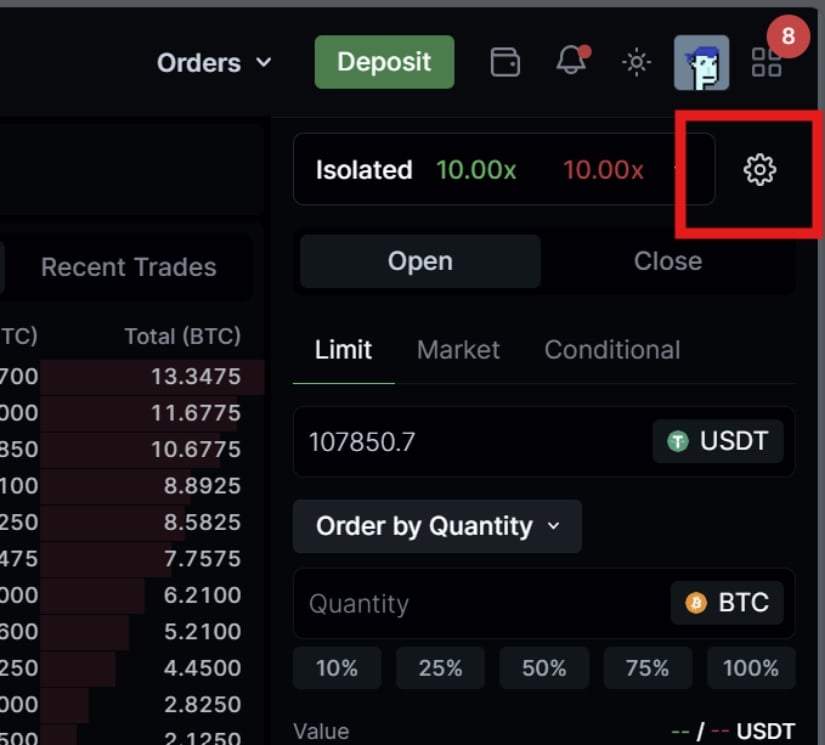

Step 2: Locate Position Mode Settings

On your futures trading interface, find the position mode selector. This is located NEAR the top right of the trading panel, above the order placement area. Click the “Setting/Gear” icon.

Step 3: Activate Multi-Trade Mode

The current position mode defaults to “Hedged)

Select “Multi-Trade Mode” instead

Click “Confirm” to activate Multi-Trade Mode

Step 4: Understand Interface Changes

After activating Multi-Trade Mode, your trading interface will show:

- Individual position tracking for each order you place

- Separate margin allocation for each position

- Independent leverage settings per position

- Individual profit/loss calculations for each trade

Step 5: Open Your First Multi-Trade Position

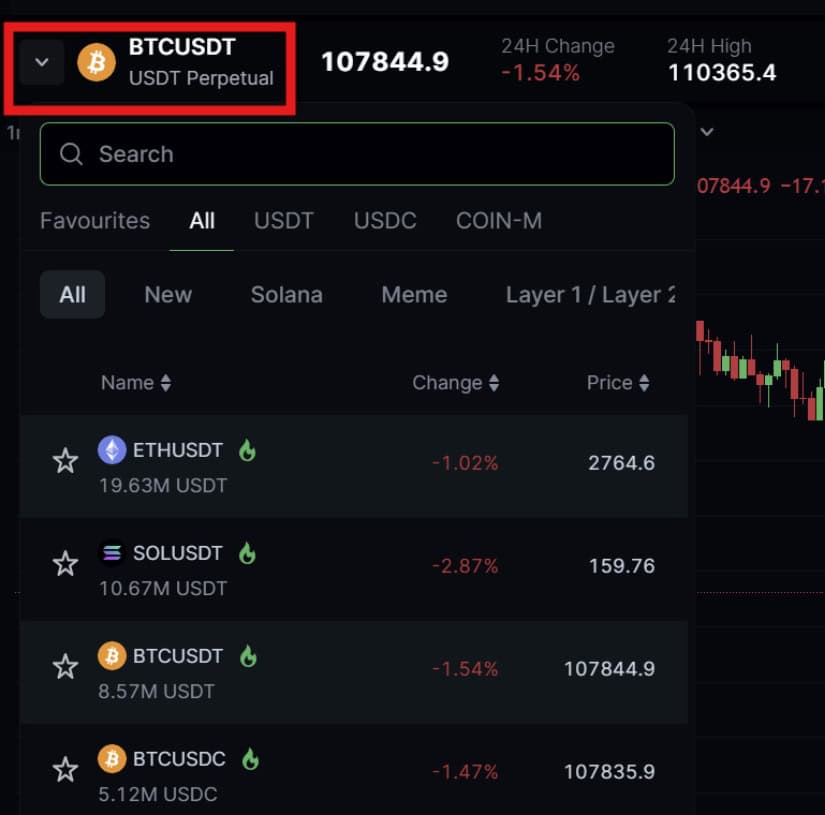

Select Your Trading Pair

Choose your desired futures contract from the trading pair selector (e.g., BTCUSDT).

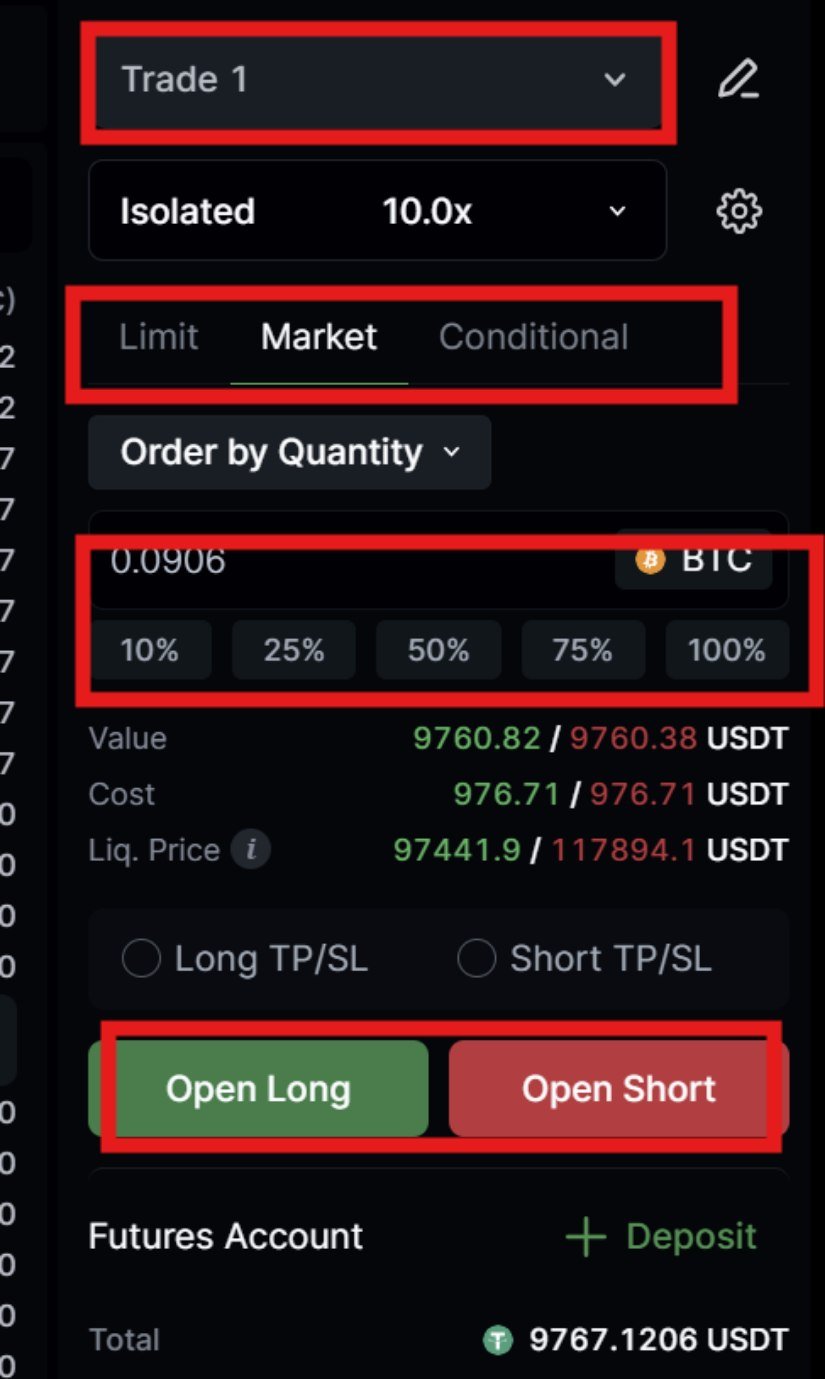

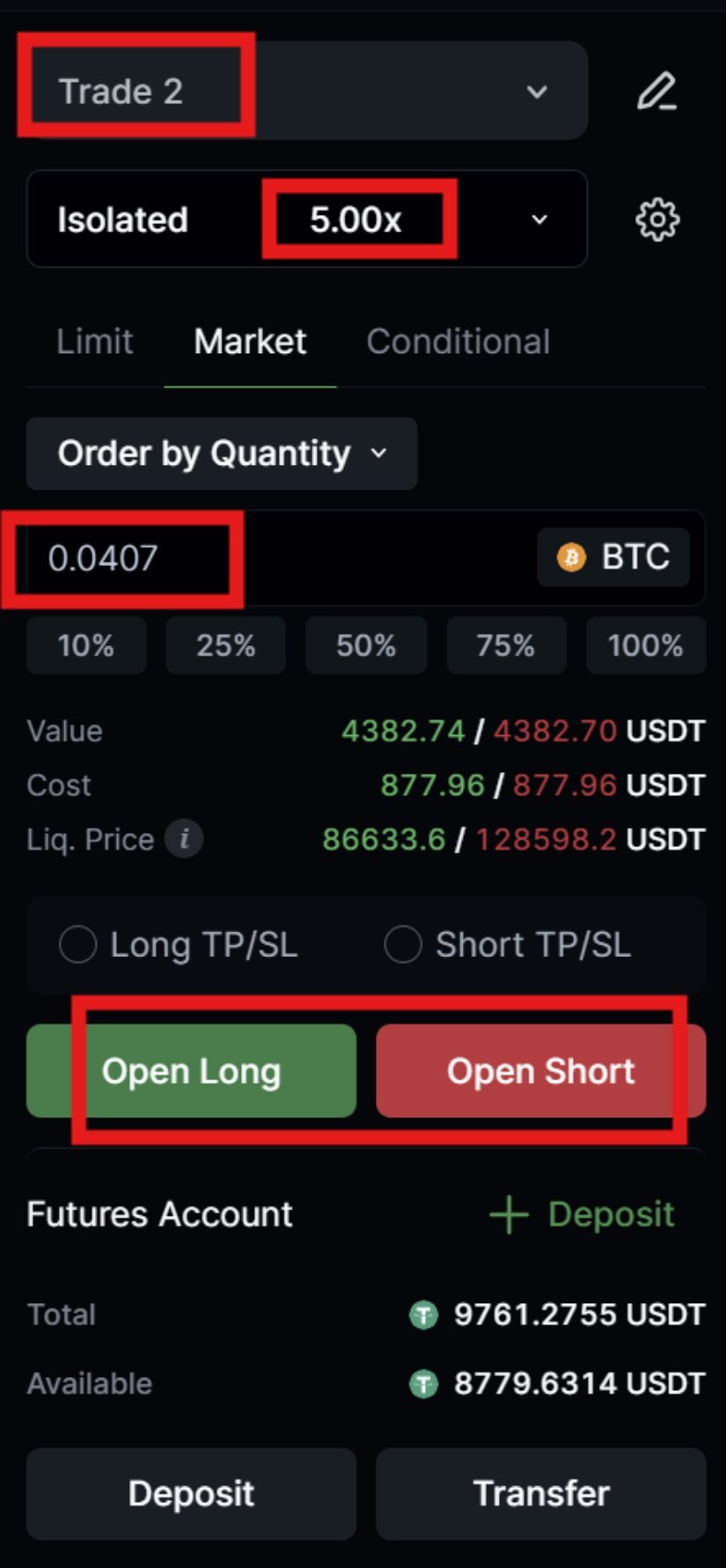

Configure Your First Position

Notice that the trading area now has an additional dropdown specifying which position you’re opening/adjusting.

Choose your order type (Market, Limit, or Conditional)

Select your position direction (Long or Short)

Enter your position size in the Quantity field

Set your desired leverage for this specific position

Review your margin allocation for this trade

Place Your Order

Click “Open Long” or “Open Short” to create your first position in Multi-Trade Mode.

Step 6: Add Additional Independent Positions

Opening a Second Position in the Same Direction

To demonstrate Multi-Trade Mode’s capabilities, open another position in the same direction:

Wait for price movement or choose a different entry strategy

Configure different parameters:

- Different leverage (e.g., 5x instead of 10x)

- Different position size

- Different order type if desired

Place the order – this creates a completely separate position

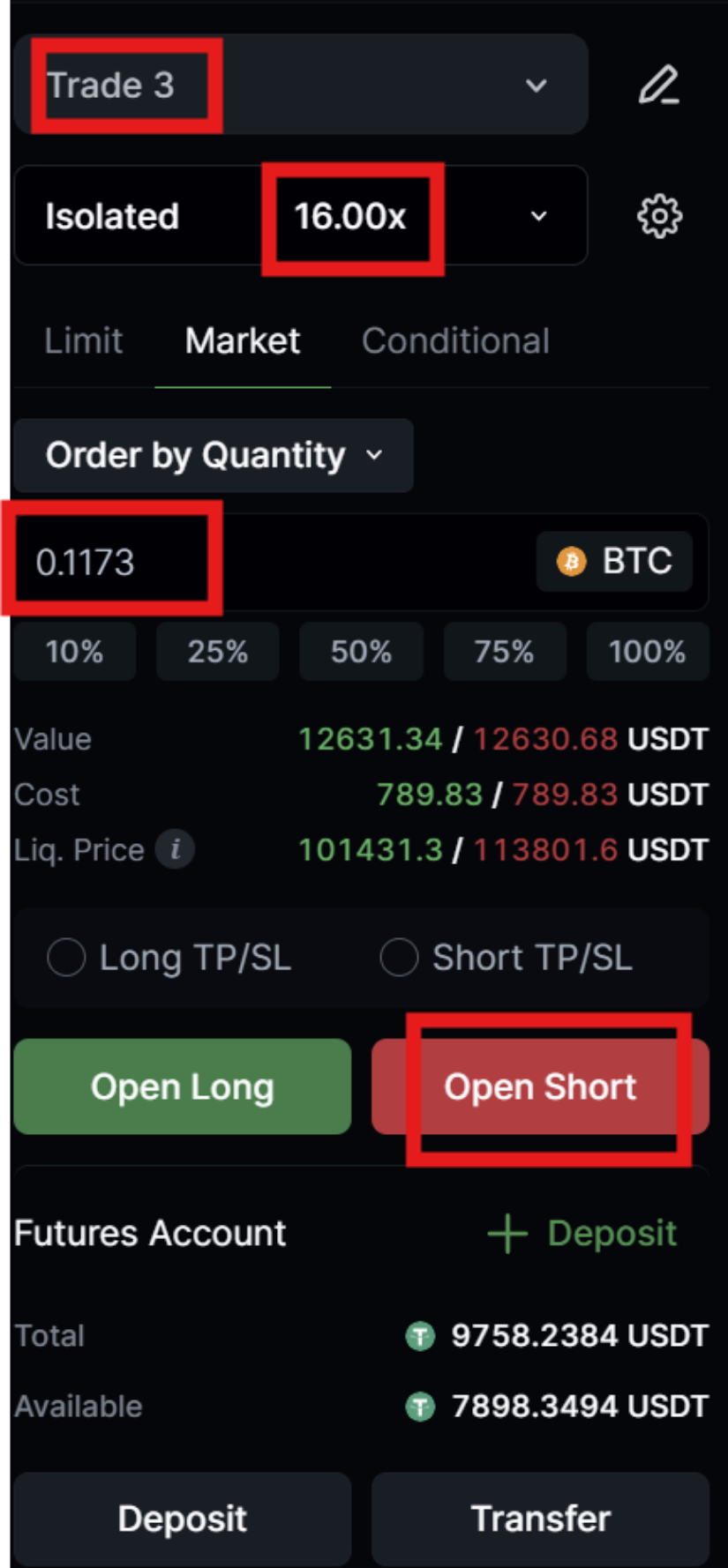

Opening Positions in Opposite Directions

Multi-Trade Mode allows simultaneous long and short positions:

Select the opposite direction from your existing position(s)

Configure the short position:

- Choose appropriate leverage

- Set position size based on your strategy

- Consider this as a hedge or separate trade

Place the order to create an independent short position

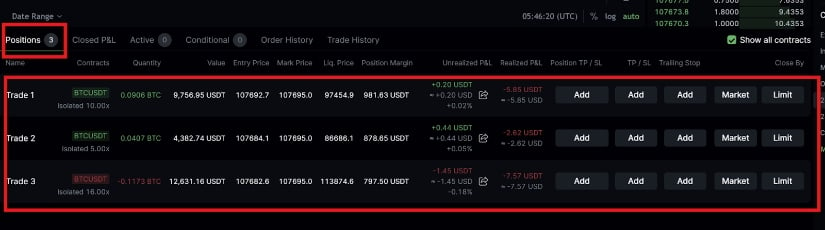

Step 7: Monitor Your Multiple Positions

Individual Position Tracking

Your positions will appear in the “Positions” tab below the trading interface:

- Each position shows its own entry price, size, and leverage

- Individual profit/loss calculations for each trade

- Separate margin allocation per position

- Independent liquidation prices

Managing Position-Specific Settings

For each position, you can:

Set individual take-profit levels based on each entry price

Configure separate stop-losses for different risk tolerances

Adjust leverage for individual positions if needed

Close positions independently without affecting others

Step 10: Advanced Multi-Trade Strategies

Scaling Into Positions

Build positions across multiple price levels:

Open initial position at current market price

Set limit orders at lower prices (for longs) or higher prices (for shorts)

Each filled order creates a new independent position

Manage each position with its own risk parameters

Hedging Specific Entries

Protect individual positions with targeted hedges:

Identify the position you want to hedge

Open an opposite position of appropriate size

Configure the hedge with suitable leverage and stops

Manage both positions independently

Multi-Trade Mode Best Practices

Start Small

Begin with 2-3 positions to understand the interface and management requirements before scaling up to more complex strategies.

Clear Documentation

Keep track of your strategy for each position to maintain clarity about your trading plan and risk management approach.

Regular Monitoring

Multi-Trade Mode requires more active management than traditional position modes, so plan for regular account monitoring.

Risk Management

Set position limits for yourself to prevent over-leveraging and maintain disciplined trading practices.

Next Steps

After mastering Multi-Trade Mode basics:

- Explore advanced order types that work with multiple positions

- Learn about margin and leverage optimization for complex strategies

- Practice with trading tournaments to test Multi-Trade strategies in competitive environments

- Review funding fees impact on multiple position strategies

For additional support with Multi-Trade Mode, visit the LeveX Support Center or contact our support team directly.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.