TRON (TRX) Primed for 30% Surge: Deflation, Utility & Market Momentum Ignite Bull Case

TRX defies gravity as tokenomics and adoption collide.

Deflation bites—supply crunch looms

The burn mechanism's kicking in harder than a crypto influencer's coffee habit. With circulating supply tightening, TRON's scarcity play could outpace even the most optimistic buy orders.

Utility beyond speculation

Real-world dApps and staking yields are propping up demand—unlike those 'utility tokens' still waiting for their first actual user. The network's processing transactions like a high-frequency trader on Red Bull.

Technical tailwinds

Price action's carving higher lows while traditional markets wobble. Retail's late as usual, but the 30% upside target's looking increasingly conservative.

Just remember: in crypto, 'irresistible fundamentals' have a funny way of meeting 'unexpected' sell walls. Proceed with diamond hands—and an exit strategy.

TRX tron price has been flying under the radar. After holding strong through market swings and steadily climbing in both usage and revenue, TRX is shaping up to be one of the more stable plays in the market, one that could offer a 20–30% rally in the near term.

Macro Structure Points to Long-Term Strength

Despite waves of macro uncertainty over the past few years, TRON has remained one of the more structurally resilient names in the market. According to a recent chart by Bitcoin Trapper, TRX has closed 9 out of the last 10 three-month candles in the green, a level of consistency most altcoins have failed to match.

TRX has closed 9 of the last 10 quarterly candles green, signaling rare macro-level consistency. Source: bitcoin Trapper via X

This sort of performance through multiple black swan events signals a maturing trend for TRX TRON price. The quarterly candle shows a long upper wick from a prior push, and the current price is now to fill this candle. If TRX can close this quarter strong and start pushing through that level, the next area of interest stretches toward $0.50.

Elliott Wave Pattern Suggests More Upside for TRX

After weeks of sideways movement, TRX is finally showing signs of bullish activity. Analyst Autumn Riley highlighted a clean breakout above a descending trendline on the 2-hour chart, noting that the structure now leans in favor of the bulls. The MOVE comes after a period of tight consolidation and forms the right shoulder of a possible inverse head-and-shoulders pattern.

TRX breaks above key trendline with a potential 5-wave impulse pattern targeting $0.30. Source: Autumn Riley via X

TRX also appears to be working through a 5-wave impulse move from the recent local low, with wave (5) aiming for the $0.298 to $0.30 zone. For now, a push above the $0.275 level WOULD be key to confirming the breakout and setting the stage for continuation.

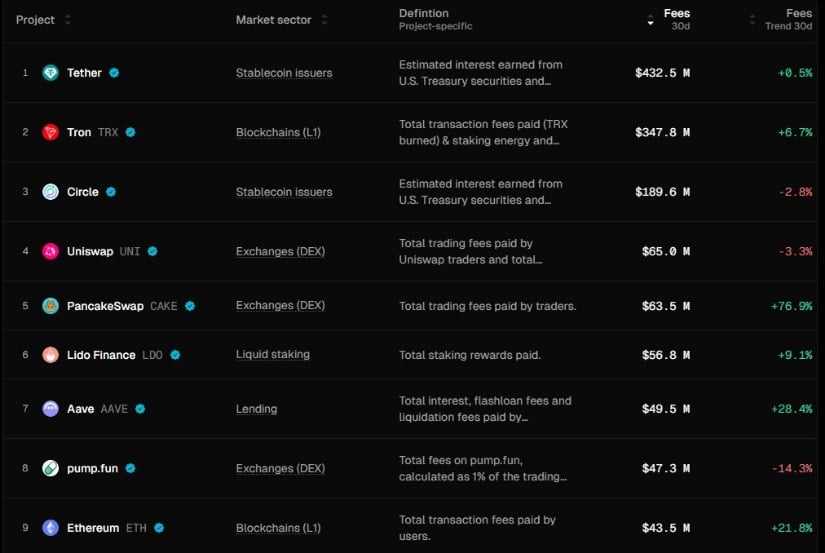

TRON Ranks As Highest Earning Layer 1

While TRX continues to firm up on the technical front, its fundamentals are delivering just as strongly. According to data shared by Satoshi Club, tron pulled in $347.8 million in protocol fees over the last 30 days, more than Circle and just behind Tether.

TRON leads all LAYER 1s in earnings with $347.8M in 30-day fees. Source: Satoshi Club via X

TRON is the highest-earning Layer 1 blockchain across the entire market, reflecting real network usage. TRON’s fee growth has been climbing steadily, logging a +6.7% increase during the same window. It’s a clear sign that the network is being used at scale, especially for transactions tied to stablecoins and staking.

Utility at Scale: TRON’s Winning Formula

In a market where HYPE often overshadows actual utility, TRON has taken the opposite route, focusing on real-world use cases and letting the data speak. The network just surpassed $80 billion in USDT supply, more than any other blockchain. Even more impressive, TRON now handles nearly a third of the entire stablecoin supply.

That quiet focus on utility has translated into a rare kind of price stability. Unlike many Layer 1s that swing wildly on sentiment, TRX has held a steady path, supported by actual usage metrics. Fees are up, user activity is high, and stablecoin FLOW continues to dominate. It’s this foundation that has helped TRON avoid the boom-and-bust cycles many competitors fall into.

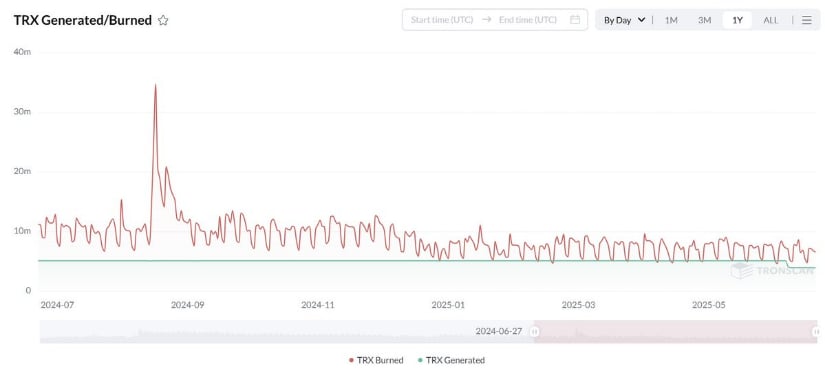

TRON Deflation Trends Reinforce Long-Term Value

Over the past year, TRON has been burning more tokens than it creates. This steady burn is reducing the total supply a little more every day. On average, about $10 million worth of TRX is removed from circulation regularly. This shrinking supply could help TRX become more valuable over time, as fewer tokens are available while demand stays strong.

TRON burning maintains a deflationary trend that supports long-term price strength. Source: Dendorion via X

Final Thoughts

TRON might not grab headlines with flashy hype, but it keeps showing up with strong data and steady results. From burning to ranking as the top Layer 1 by fee revenue, it’s proving its long-term value.

Technically, it has remained strong as well. The quarterly chart reveals 9 out of the last 10 candles closing green, an unusually consistent uptrend in a volatile space. If TRX TRON price breaks above the $0.275 to $0.30 resistance zone, it could trigger a move toward the $0.50 area. A confirmed breakout above that range would flip the macro structure bullish, aligning nicely with the deflation narrative and high protocol earnings.