XRP News Today: Quiet Volume at $2.17 Suggests Whale Accumulation—Is a Mega Pump Imminent?

XRP just flashed its most intriguing technical signal in months—while traders snoozed.

The digital asset clawed its way above $2.17 this week on suspiciously thin volume. Classic accumulation behavior before institutional players make their move.

Market Mechanics 101

When an asset grinds higher without retail participation, someone's building a war chest. The last time XRP saw this volume-to-price divergence? Right before its 2021 parabolic rally.

Regulatory ghosts still haunt the corridors—but since when did fundamentals ever stop a proper crypto pump? The charts whisper what SEC lawsuits can't silence.

Watch the order books. When 'quiet' volume turns into explosive action, even the Wall Street suits will FOMO in—probably right at the top.

Despite a modest 0.28% increase over the last 24 hours, trading volume has dipped by nearly 13% to approximately $2.63 billion. Analysts interpret this drop in volume as a potential sign of accumulation, often a precursor to a larger market move.

Over the past week, XRP has gained 1.49%, pushing its market capitalization to over $129 billion. While this uptick might seem muted on the surface, on-chain indicators and macroeconomic factors suggest that something larger may be building beneath the surface.

On-Chain Indicators Signal Undervaluation

XRP appears undervalued according to on-chain metrics. The Market Value to Realized Value (MVRV) Z-score — a popular valuation tool — currently sits at 2.13. Historically, XRP has reached overvaluation zones when this score exceeds 3.45, peaking around 6.72.

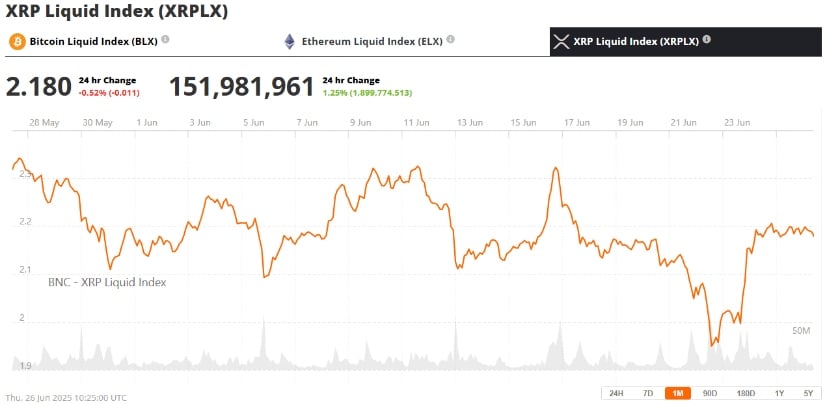

XRP was trading at around $2.18, down 0.52% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

For example, when the xrp price touched $3.25 in January, the Z-score surged to 6.65, marking a local top followed by a correction. Today’s lower Z-score implies that XRP remains relatively undervalued and may be positioning for a more significant upward move.

This aligns with recent Ripple XRP news, where the company has been making strides in expanding its ecosystem, potentially adding long-term value to the token.

Whale Activity Pauses as Buying Pressure Builds

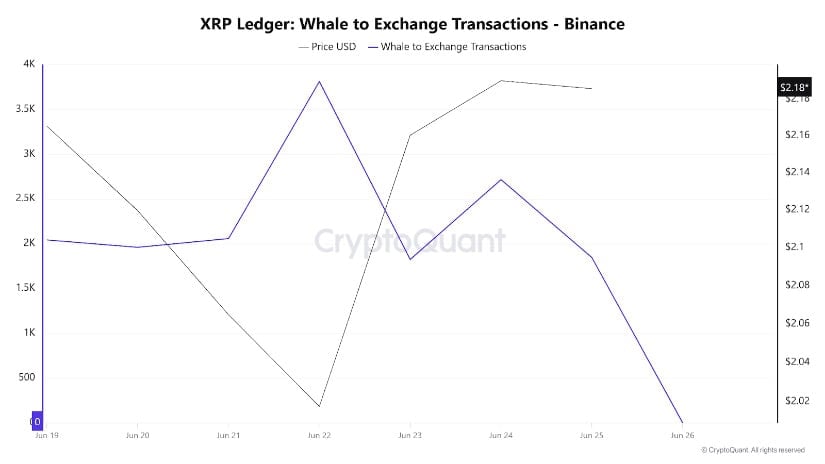

Data from CryptoQuant reveals a sharp drop in whale-to-exchange transactions — from 2,716 transfers two days ago to zero today. This sudden change suggests that major holders are no longer offloading their XRP, possibly waiting for better prices ahead.

XRP Ledger: Whale to Exchange Transactions – Binance. Source: CryptoQuant

The pause may be tied to broader economic expectations. Speculation around a potential interest rate cut from the Federal Reserve between July and September could lead to increased capital inflows into digital assets like XRP, enhancing its short-term appeal.

XRP Price Prediction: Bullish Technical Setup Ahead of Q3

Technically, XRP is showing signs of a potential breakout. The Chaikin Money FLOW (CMF) has crossed above the zero line, signaling increasing buyer interest. Meanwhile, the price action is approaching the upper boundary of a falling wedge — a pattern typically considered bullish.

The key XRP chart is approaching a critical level, where a breakout could trigger significantly higher prices. Source: @Steph_iscrypto via X

Additionally, the Moving Average Convergence Divergence (MACD) has formed a bullish crossover, further reinforcing the likelihood of upward momentum. If XRP can break through the immediate resistance at $2.25, it may quickly target $2.69, and possibly revisit its yearly high at $3.40.

Analyst Zach Rector has echoed this sentiment, suggesting XRP has completed its wave 2 correction. According to his Elliott Wave analysis, wave 3 — typically the most explosive phase — could be next for XRP.

U.S. Mortgage Policy Spurs Broader Crypto Adoption

In parallel with market movements, U.S. policy is becoming increasingly favorable toward digital assets, including XRP. The Federal Housing Finance Agency (FHFA), under President Trump’s directive, has instructed mortgage giants Fannie Mae and Freddie Mac to recognize crypto holdings like XRP, Bitcoin, and ethereum in mortgage applications.

“This marks a major step toward fulfilling the President’s vision of making the United States the global capital of crypto,” stated FHFA Director Bill Pulte.

This policy shift significantly boosts Ripple currency price legitimacy and XRP’s role in personal finance. It’s the first time government-backed mortgage underwriters have included crypto assets in home loan assessments, marking a pivotal moment in mainstream adoption.

Ripple News: Real-World Utility Expands for XRP

Ripple, the company behind XRP, has long championed practical use cases in finance — from cross-border payments to enterprise liquidity solutions. With mortgage eligibility now on the table, XRP could find new utility in consumer finance, a development that adds a tangible dimension to the ongoing Ripple lawsuit and SEC debates.

The stablecoin market cap has surpassed $250B, with RLUSD on XRPL driving real-world utility for both institutions and retail users, according to Bitstamp’s Leonard Hoh. Source: RippleX via X

This growing use case strengthens Ripple’s position in both regulatory discussions and market sentiment. As the XRP lawsuit news evolves, such real-world adoption stories may influence how U.S. agencies approach digital assets under the SEC Ripple case.

Outlook: Q3 Could Define the Next XRP Price Cycle

With a favorable confluence of technical signals, supportive macro policy changes, and renewed whale behavior, XRP appears primed for a significant move. If accumulation continues and resistance levels break, XRP could re-test previous highs or even push toward uncharted territory.

Whether driven by regulatory progress, investor optimism, or economic stimulus, the Ripple market is entering a phase where both XRP value and use cases are expanding. The coming quarter may well determine whether XRP’s current consolidation is merely the calm before a bullish storm.

As crypto becomes further integrated into financial systems — from mortgages to banking products — XRP is uniquely positioned to capitalize on the momentum. The next few months could be decisive for both price and perception.