World Coin Price Surge: From $0.78 Rebound to $1.00 Target – Bullish Momentum Unleashed

World Coin isn't just bouncing—it's staging a full-blown comeback. After a sharp rebound from $0.78, traders are eyeing the psychological $1.00 barrier as the next battleground.

Why the rally? Market sentiment flipped bullish after the $0.78 support held firm—now the question is whether institutional FOMO kicks in or if this is just another pump before the usual crypto rug-pull. Either way, leverage traders are already piling in.

Key levels to watch: A clean break above $0.95 could trigger algorithmic buying, while failure to hold $0.85 might invite the shorts back in. Classic crypto volatility—where 'technical analysis' is just astrology for finance bros.

The current price of approximately $0.915 reflects a stabilization effort, with buyers cautiously re-entering the market. While momentum remains fragile, market structure improvements and technical data suggest that $1.00 could come into focus if support levels continue to hold.

Hourly Chart Reversal and Open Interest Stabilization

The 1-hour chart for WLD/USD Price Prediction reveals a pronounced V-shaped recovery following a prolonged downtrend. After bottoming NEAR $0.78 on June 22, price action reversed sharply, climbing above $0.90 with minimal resistance. This strong upward momentum was not accompanied by erratic movement but formed in a clean, directional structure.

The current price action sits within a narrow consolidation band just under $0.95, where the latest candle shows a +0.33% gain. However, the failure to break above $0.95 highlights a key resistance level that may cap immediate upside unless supported by increased volume.

Source: Open Interest

Open interest data tracked alongside price activity provides additional insight. Open interest declined through the bearish phase, showing reduced speculative exposure as traders exited positions. Following the June 22 rebound, open interest began rising again, currently resting near 3.278 million contracts.

While this rebound is modest, it indicates re-engagement from market participants and may signal the formation of a stronger bullish base. A decisive break above $0.95 coupled with rising open interest above 3.4 million WOULD reinforce a bullish outlook in the short term.

World Coin Price Prediction: 24-Hour Chart and Market Sentiment

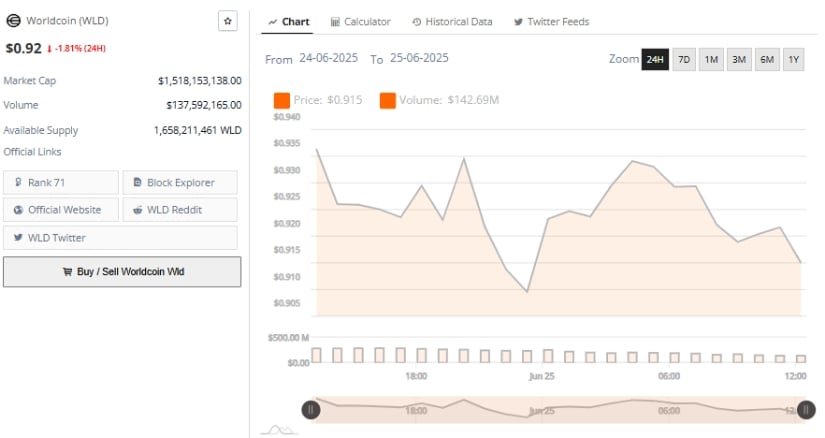

The 24-hour chart for WLD price prediction between June 24 and June 25 captures a restrained decline from $0.935 to $0.92, reflecting a -1.81% move. The price action during this period features multiple minor peaks and valleys, all occurring within a tight range, suggesting a lack of strong directional momentum.

The nature of this movement indicates market indecision, with both buyers and sellers waiting for a clearer signal before initiating new positions. Price volatility remains moderate, reinforcing the likelihood of a short-term consolidation zone.

Source: Brave New Coin

Trading volume during this period amounted to approximately $142.69 million. While this figure confirms steady participation, it lacks the intensity required for a sustained breakout. Volume patterns show consistent FLOW during both upswings and downswings, further supporting the notion of a market balanced between accumulation and distribution. In this context, traders may look to a confirmed breakout above $0.94 on rising volume as a potential signal of trend continuation.

WLD maintains a market capitalization of $1.51 billion, ranking it 71st among cryptocurrencies by size. Its circulating supply stands at 1.65 billion tokens, a figure that contributes to price stability by limiting extreme volatility. Although current price action lacks aggression, the macro structure suggests that short-term range trading may continue until stronger volume or external catalysts emerge.

Daily Indicators Show Cautious Optimism

The daily chart for WLD/USD Price Prediction shows a broader downtrend, with the asset falling approximately 57.58% from prior highs. Current price sits near $0.9187, with recent sessions dominated by red candlesticks. This contrasts with BNB/USDT, which only lost 7.44% over a similar period, highlighting relative underperformance. Price action remains constrained beneath resistance, reflecting ongoing selling pressure and a cautious market stance.

Source: TradingView

Momentum indicators offer early signs of possible stabilization. The MACD line is currently at -0.0677, with the signal line at -0.0647, while the histogram shows a minor negative value of -0.0029. Although the MACD lines have yet to cross, the narrowing gap between them hints at decreasing bearish momentum. Confirmation of a crossover could indicate the start of a new bullish phase.

The Chaikin Money Flow (CMF) adds a nuanced perspective. Its current reading of 0.02, though modest, is above the neutral line, indicating light capital inflow into WLD. This may represent preliminary buying interest but lacks the magnitude needed to confirm a broader accumulation trend. Sustained positive CMF readings, paired with a bullish MACD crossover and rising volume, would help validate upward continuation toward the $1.00 resistance target.