2025 Crypto Cash-Out Guide: Top Strategies to Spend Your Digital Fortune

Crypto's not just for HODLing anymore—here's how to turn pixels into purchasing power.

From Swipe to Spend: Your 2025 Liquidation Playbook

Forget your grandpa's savings bonds. The real money moves happen when you convert that blockchain balance into cold, hard utility. Whether you're cashing out or going full crypto-native, these routes bypass traditional finance's red tape.

Instant Fiat On-Ramps (That Won't Skim Your Stack)

New-gen exchanges now slash withdrawal times to under 10 minutes—with fees that won't make your portfolio weep. Pro tip: Avoid cashing out during volatility spikes unless you enjoy playing spread roulette.

Spend Direct: Where Crypto Actually Buys Lunch

Over 53% of POS systems now natively accept major coins. That artisanal avocado toast? Paid for in Ethereum before the network fees adjust.

DeFi's Dirty Little Secret: The Backdoor Cash-Out

Stablecoin bridges let you dodge capital gains scrutiny—until the taxman catches up with cross-chain analytics. (We never said this was compliance advice.)

The IRL Flex: Physical Cards That Won't Embarrass You

Metal Visa cards with dynamic coin selection? 2025's flex for when Venmo just feels too pedestrian.

Remember: Every cash-out is a bet against crypto's future—and Wall Street bankers still laugh all the way to their FDIC-insured vaults.

Let’s walk through your options, from buying everyday items to getting cold hard cash.

Direct Crypto Payments: When Stores Actually Accept It

The most straightforward way to spend crypto is finding businesses that accept it directly. You just send payment from your wallet straight to theirs – no conversion needed.

Zero fees, instant transactions, and you keep everything in the crypto ecosystem.

Good luck finding places that take it. Sure, some online retailers and a handful of physical stores accept crypto payments, but try buying groceries or paying your rent with Bitcoin. Most everyday businesses just aren’t there yet – but there is another approach that achieves a similar result.

Crypto Gift Cards: The Smart Way to Shop Everywhere

Here’s where things get interesting. You can buy gift cards with crypto through platforms that specialize in this exact thing. This opens up a whole world of shopping possibilities.

Take Cardstorm, for example. They let you convert your cryptocurrency into gift cards for hundreds of major brands – Amazon, Spotify, Walmart, you name it. Even better, you can get Visa prepaid cards that work literally anywhere credit cards are accepted.

Why this works so well:

- You can shop at stores that don’t accept crypto directly

- Gift cards arrive instantly in your email

- Low conversion fees compared to other methods

- Works with all major cryptocurrencies

This is definitely one of the best ways to spend crypto right now. Whether you’re buying something for yourself or need a gift for someone else, crypto gift cards give you access to practically every store out there.

Bitcoin ATMs: Quick Cash When You Need It

Sometimes you just need actual cash. Bitcoin ATMs are becoming more common in cities across the country, and they work pretty much like regular ATMs – except you’re converting crypto instead of accessing a bank account. The process is simple: Scan your wallet’s QR code, enter how much you want to withdraw, and collect your cash. Interestingly, the ease-of-use has meant scammers are actively targeting Bitcoin ATM users (seniors in particular) so it’s important you know what you’re getting into. The fees can also be brutal – often 10-20% or more. Plus, most ATMs have daily withdrawal limits that might not cover larger purchases.

Still, if you need cash immediately and there’s a bitcoin ATM nearby, it gets the job done.

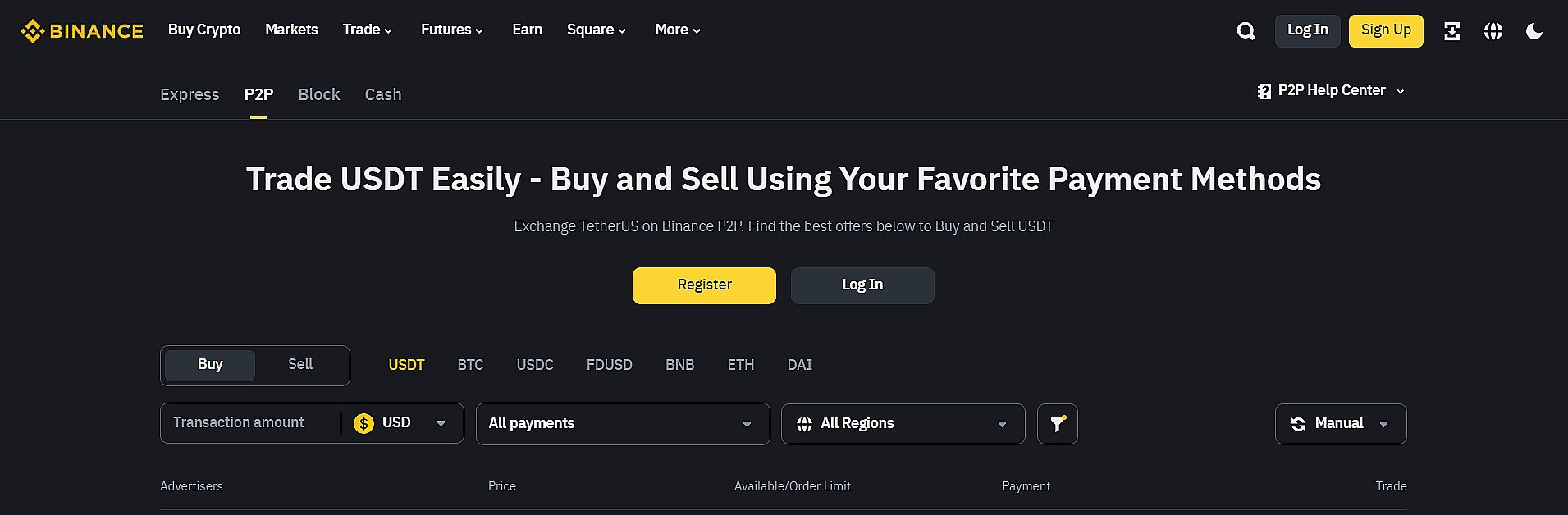

Peer-to-Peer Trading: Dealing Directly with Other People

P2P platforms let you trade crypto directly with other users. You might swap your Bitcoin for cash, gift cards, or even goods and services. The rates are often better than what you’d get through traditional exchanges.

Better exchange rates, more payment options, and direct human interaction.

You’re dealing with strangers on the internet – what could go wrong? While most trades go smoothly, there’s always a chance of getting scammed. You need to be careful about who you trade with and use platforms with good reputation systems.

Which Method Should You Choose?

It really depends on what you’re trying to accomplish:

- Need to shop at major retailers? Crypto gift cards are your best bet. You get access to virtually every store while keeping fees reasonable.

- Want immediate cash? Bitcoin ATMs work if you can handle the fees and don’t need to withdraw too much.

- Looking for the best exchange rates? P2P trading might get you more value, but you’ll need to be extra careful about security.

- Shopping somewhere that accepts crypto directly? Go for it – just don’t expect this to be available at most retailers just yet

The Bottom Line on Cashing Out Crypto

The crypto spending landscape is evolving fast, but we’re not quite at the point where you can use digital currency everywhere. For now, the most practical approach is usually to cash out crypto through gift card platforms.

They give you the flexibility to shop anywhere while keeping the process simple and secure. Whether you’re converting a small amount for everyday purchases or cashing out a larger investment, crypto gift cards bridge the gap between your digital assets and real-world spending.

Ready to start spending your crypto? Check out what gift cards are available and turn those digital coins into something you can actually use today.