🚀 Bitcoin Surges Toward $109K as Buyers Go Berserk – New ATH Incoming?

Bitcoin''s price rocket just hit afterburners—barreling toward $109,000 as institutional FOMO meets retail frenzy. Here''s why the charts scream ''bull market.''

### The Squeeze Is On

Liquidity''s evaporating faster than a meme coin''s promises. With spot ETFs hoovering up supply and miners hodling like diamond-handed relics, sellers are getting trampled by the stampede.

### Wall Street Catches Crypto Fever

Goldman traders are reportedly long BTC while shorting bankers'' dignity—again. Meanwhile, BlackRock''s ETF inflows could fund a small nation''s GDP (or one JPEG of a bored ape).

### The Cynic''s Corner

Sure, $109K sounds outrageous... until you remember Tesla''s stock trades at 200x earnings. At least Bitcoin''s backed by math and angry crypto Twitter threads.

Bitcoin has been grinding just below its January high of $110K, with the weekend price action holding firm at around $105,000, despite escalating tensions between Iran and Israel. That’s bullish — or at least, unusually chill under fire. On Monday, with ETF flows resuming, and Michael Saylor announcing a whopping 10,100 Bitcoin buy, Bitcoin pushed higher, touching $108,856, just shy of the $109,000 level and within touching distance of new all-time highs.

Bitcoin reached $108,865 on Monday night, Source: bitcoin Liquid Index

Trump Media Continues Crypto Push

Just as the ETF space settles into a BlackRock vs. Everyone Else dynamic, Trump Media & Technology Group (DJT) has crash-landed into the arena with all the subtlety of a MAGA rally. The company just filed with the SEC to launch a spot Bitcoin and ethereum ETF, allocating 75% to Bitcoin and 25% to Ether, giving it that patriotic-yet-DeFi twist only the Trump orbit could deliver.

Even more intriguing: Crypto.com will serve as custodian and market maker. That’s a Singapore-based exchange, by the way — irony alert, given Trump’s “America First” rhetoric.

This isn’t just random asset allocation either. It tracks with the TRUMP family’s deeper blockchain dabbling. Their associated project, World Liberty Financial, is basically Ethereum-maxi territory, with 96% of its assets parked on Ethereum, per Arkham Intelligence.

If approved, the ETF will enter a crowded but lucrative field, sitting alongside BlackRock, Fidelity, Franklin Templeton, and (yes, still clinging on) Grayscale. Bitcoin ETFs now manage over $131 billion in AUM, a sign that institutional adoption is real, and the money is moving fast.

ETH Gets Pricey in the Options Market

Ether might be getting sidelined in ETF flows, but options traders are paying attention. The spread between ETH and BTC implied volatilities is widening, which means ETH options are becoming more expensive relative to BTC on Deribit. Traders like Anderson see this as a prime time for ETH holders to sell options and harvest some juicy premium.

Meanwhile, in the altcoin jungle, Meme Strategy (yes, that’s a real company) saw a 20% share price spike after buying 2,440 SOL — about $370,000 worth. It’s yet another sign that corporate crypto buying is evolving beyond Bitcoin, with Ethereum, Solana, and XRP now making up a growing part of the pie.

Still, not all altcoins are celebrating. SharpLink’s stock tanked after disclosing an ETH purchase, and a wave of token unlocks is coming, which could flood the market and pressure prices. According to LondonCryptoClub, the next 7 days will see large unlocks in tokens like FTN, ZK, ARB, MELANIA, and LISTA — and daily unlock pressure from heavyweights like SOL, DOGE, AVAX, and DOT.

MSTR Keeps Buying — No One’s Surprised

Over at Bitcoin’s largest corporate vault, MicroStrategy (MSTR) — or, as it’s been semi-rebranded, “Strategy” — added another 10,100 BTC, funded largely by a $979.7 million STRD preferred stock offering and ATM sales of STRK and STRF shares.

That takes their total stash to 592,100 BTC, worth over $63.3 billion at current prices, and pushes their average purchase price to $70,666. This is not a meme number. It’s a long-term bet on Bitcoin as digital Gold — and so far, it’s working.

Michael Saylor announced an eye-watering buy of 10,100 Bitcoin, over 1 billion worth, Source: X

Bollinger Bands Say Boom Incoming?

Lastly, a key indicator suggests volatility is about to spike, potentially leading to Bitcoin’s next big MOVE and a new Bitcoin all-time high. When Bollinger Bands (volatility bands around a moving average) widen, it typically signals something big is coming. And now the MACD histogram tied to the band spread has flipped positive, which has historically preceded major runs — including late 2020 and late 2024.

Volatility is a double-edged sword — it doesn’t promise upside — but in a structurally bullish market, a volatility breakout often spells rally.

The Bottom Line

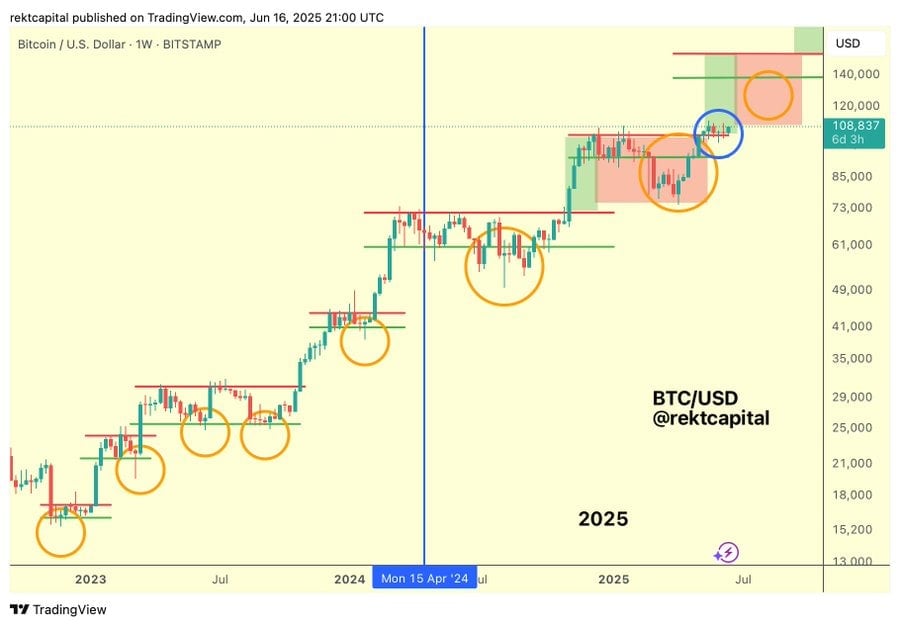

Once again, Bitcoin continues to defy the naysayers. BlackRock is winning the ETF war, Trump wants in with his own BTC-ETH hybrid product, Ethereum is flexing in the options market, and MicroStrategy just bought another mountain of BTC. All of this while Bitcoin calmly holds the line amid geopolitical chaos. Bitcoin is just 2% away from new all-time highs. If you’ve been asking yourself if now is a good time to buy Bitcoin, the chances are likely that months from now, the price will be higher. Bitcoin’s volatility may be sleeping for now, but it’s stirring — and the next move might be big. Don’t forget, the Bitwise Bitcoin price prediction for 2025 is $200,000. It’s looking more and more likely. As Rekt Capital suggests, a new phase of Bitcoin Price Discovery could be on the horizon. The analyst wrote on X that, “Bitcoin continues to successfully retest its reaccumulation range and has done so for six straight weeks as it attempts to transition into a new price discovery uptrend.

Bitcoin is attempting to transition into a new price discovery uptrend, Source: X