Solana Price Prediction: SOL Risks Deeper Decline as $120 Support Faces Mounting Pressure - Is This The Breaking Point?

Solana's critical $120 support line is trembling—and the charts are screaming a warning.

The Technical Breakdown

Forget the hype. The price action tells a different story. SOL isn't just testing a level; it's grinding against a barrier that's absorbed multiple assaults. Each bounce grows weaker, each sell-off more aggressive. The mounting pressure isn't subtle—it's a slow, technical squeeze that often precedes a capitulation event.

What Happens If $120 Fails?

A clean break below that line doesn't mean a gentle slide. It triggers stop-losses, algorithmic selling, and a rush for the exits that could accelerate the decline. The next major support zones sit much lower, and in crypto, air pockets between levels are common—prices can fall fast when there's no immediate floor to catch them. It's the market's version of finding out your 'stable' investment was leveraged three times over by a fund you've never heard of.

The Bull Case's Last Stand

The optimists point to network resilience and developer activity. They're not wrong about the fundamentals, but in the short term, price is a sentiment machine fueled by fear and greed. Right now, fear has the microphone. A reclaim of $120 with strong volume changes the narrative, but without it, the path of least resistance points down.

Watch that $120 level. It's more than a number—it's the line between a healthy correction and a trend reversal. The market's about to cast its vote.

Solana price is consolidating NEAR a critical demand zone after an extended corrective phase, with price action showing increasing compression around the $120–$130 range.

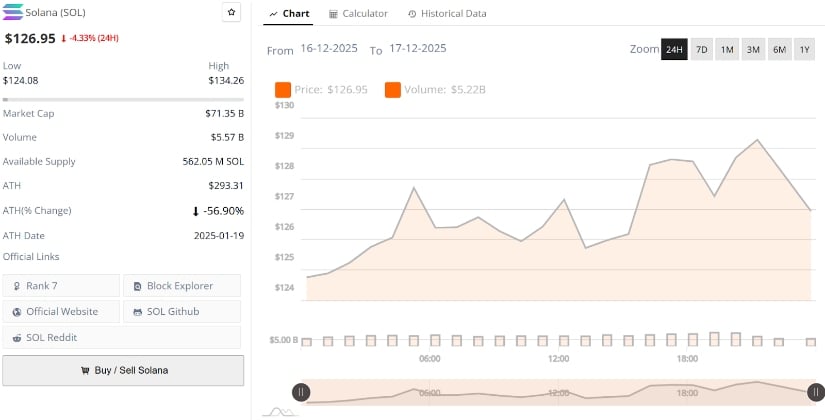

Solana current price is $126.95, down -4.33% in the last 24 hours. Source: Brave New Coin

According to Brave New Coin data, solana is trading near $126.95, down modestly on the day but still holding above a long-standing support band that has repeatedly defined medium-term market structure. As price tightens within this range, traders are increasingly focused on whether SOL can continue to hold its key support levels.

Range Compression Keeps $120–$130 in Focus

A chart from ChiefraT shows Solana continuing to respect a clearly defined horizontal range, with $120–$125 acting as demand and $145–$146 capping upside. Price has revisited the lower boundary multiple times in recent weeks without follow-through selling, reinforcing this zone as a decisive support level.

Solana continues to trade within a well-defined range as volatility compresses. Source: ChiefraT via X

This repeated defense suggests that sellers are struggling to gain momentum below $120, while buyers remain active enough to prevent a clean breakdown. Until SOL decisively exits this range, the market remains in a neutral holding pattern.

Fake-Out Risk Grows as Head-and-Shoulders Becomes Obvious

Elja Boom highlighted a key behavioral dynamic developing on Solana’s chart: the emergence of a widely visible bearish head-and-shoulders structure. Rather than viewing this as a guaranteed breakdown signal, Elja argues that overly obvious patterns often lead to fake-outs designed to flush late sellers.

Obvious bearish structures increase the probability of a shakeout rather than continuation. Source: Elja Boom via X

His outlook suggests that any brief MOVE below the neckline could serve as a liquidity grab, potentially setting the stage for a sharp reversal once selling pressure exhausts. This aligns with SOL’s repeated failure to extend losses despite multiple tests of the same demand region.

Short-Term Rejection Risk Builds Near $129–$132

From a short-term trading perspective, crypto Tony maintains a bearish outlook on Solana as long as the price fails to reclaim the $129–$132 resistance band. His chart highlights this zone as a key rejection area, where previous bounce attempts have repeatedly stalled.

According to Tony, a clean rejection from this level keeps downside pressure active, with $120–$122 remaining the primary downside target. A breakdown below this support WOULD likely accelerate selling toward the $112–$108 liquidity pocket, which aligns with prior consolidation lows. Until SOL can flip $132 into support, his bias remains firmly tilted toward continuation rather than recovery.

SOL faces repeated rejection risk near $129, keeping downside targets active. Source: Crypto Tony via X

Weekly Structure Weakens as SOL Trades Below EMA200

On higher timeframes, Trader Koala’s analysis reinforces a structurally bearish outlook. His weekly chart shows Solana closing below the weekly EMA200, a level that historically acts as a dividing line between bull and bear phases.

SOL remains structurally weak below the weekly EMA200. Source: Trader Koala via X

Solana chart identifies $120–$118 as the last meaningful weekly support before price risks sliding into the $89–$101 macro demand zone, which he labels as the next major landing area if selling pressure persists. In his broader projection, Koala suggests that a full market reset could eventually drag SOL into the $30–$50 region, though he emphasizes that such levels would likely only come into play under sustained macro weakness.

Solana Price Prediction: Key Levels to Watch

With bearish pressure dominating higher and lower timeframes, solana price prediction scenarios hinge on a narrow set of technical levels:

Immediate resistance:

-

Short-term support at $129–$132

-

Medium-term support at $145–$146

Key supports:

-

$120–$118 remains the primary demand zone.

-

$112–$108 is the next downside liquidity pocket.

-

$101–$89 is the weekly macro support.

As long as the Solana price remains capped below $132, downside risk continues to outweigh upside potential. Bulls would need a decisive reclaim of $145+ to invalidate the bearish structures.

Final Thoughts

Solana price is no longer in a neutral zone; it is sitting at a technical inflection point under bearish control. Repeated failures near resistance, combined with weekly closes below the EMA200, suggest that sellers still dictate the broader trend.

Unless SOL can reclaim key resistance levels with conviction, Solana price prediction models favor further downside exploration, particularly if $120 fails to hold. For now, Solana remains in a defensive posture, with rallies viewed as reactive rather than trend-shifting.