Solana Price Prediction: SOL Holds Critical Support as Falling Wedge Breakout Eyes $140 Target

Solana isn't asking for permission—it's taking back ground. The network just defended a long-term support level that traders have watched for months, and now a textbook technical pattern suggests the next move could be explosive.

The Wedge That Could Unlock Momentum

For weeks, SOL's price action has been coiling inside a classic falling wedge pattern on the charts. That's typically a bullish continuation signal, and the recent breakout above its upper trendline is the first confirmation that the squeeze might be over. The immediate target? Analysts are pointing squarely at the $140 zone, a level that would represent a significant reclaim of territory lost during the last market downdraft.

Why This Support Level Matters

This isn't just any random line on a chart. The support level SOL just bounced from has been a major battleground, acting as both a springboard for rallies and a last line of defense during sell-offs. Holding it now signals that the foundational bid for the asset remains strong—despite whatever macro fears the traditional finance crowd is currently hyperventilating about.

The Road Ahead

Breaking through $140 won't be a walk in the park. It's likely to face liquidity pools and resistance from earlier buyers looking to exit at breakeven. But the combination of a solid technical setup and resilient on-chain activity paints a constructive picture. A clean hold above that level could open the path toward higher highs, while a failure might see it retest the very support it just celebrated defending. One thing's for sure—in crypto, the only 'long-term support' that truly matters is whether the network keeps processing transactions while everyone else argues about interest rates.

Solana price after extended pullback from its 2025 highs is now trading in a tight range, with traders closely monitoring whether the current structure marks a base for recovery or a continuation of consolidation.

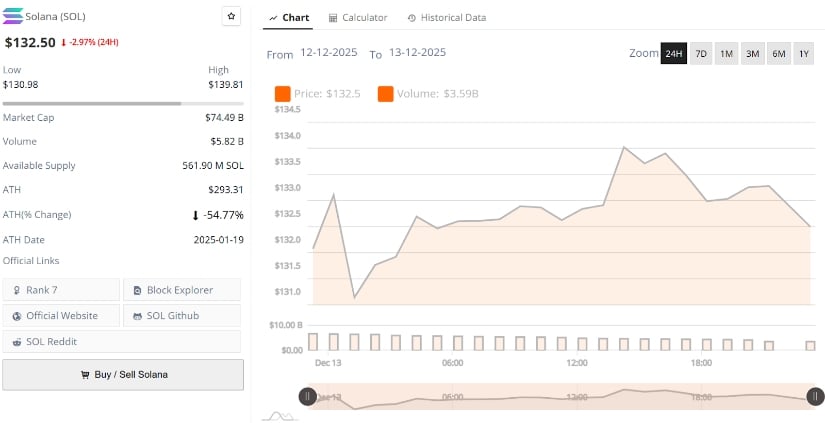

Solana current price is $132.50, down 2.97% in the last 24 hours. Source: Brave New Coin

Recent data from Brave New Coin shows solana trading near $132.50, reflecting modest intraday weakness but continued defense of a broader demand region. While short-term momentum remains mixed, market watchers note that SOL has yet to lose its most important higher-timeframe support, keeping both bullish and bearish scenarios in play as the market waits for confirmation.

Solana Trades Sideways as Market Searches for Direction

Solana’s recent decline pushed price back into the $125–$130 range, an area that has increasingly acted as a short-term balance zone rather than a confirmed breakdown region. While SOL is no longer testing the lower extremes of its macro support, price remains capped within this band, reflecting a market that is consolidating rather than choosing direction.

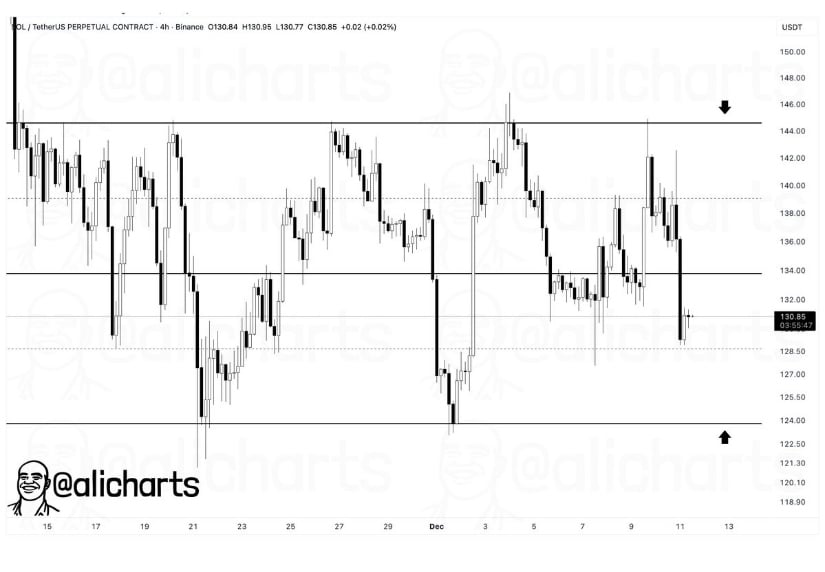

Solana’s range-bound structure signals a decisive MOVE ahead. Source: Ali Martinez via X

A widely shared chart from Ali Martinez highlights the importance of nearby levels, noting that a move above $145 flips the trend bullish, while a loss of $125 WOULD shift the structure lower. His analysis frames the current price action as a neutral compression phase, suggesting that SOL is effectively in wait-and-see mode rather than signaling either continuation or reversal.

Technical Structure Signals Early Reversal Potential

From a pure chart-structure perspective, Solana price is beginning to show signs of reversal. Bitcoinsensus recently highlighted a falling wedge breakout on the daily chart. While the breakout has technically occurred, the analyst emphasized that follow-through remains limited, with price still struggling to reclaim the $140 region. Until a daily close above that level is achieved, the structure remains early rather than confirmed.

Solana breaks out of a falling wedge as compression tightens. Source: Bitcoinsensus via X

Support & Resistance Levels

Another perspective comes from CryptoGerla, who frames Solana’s current structure through clearly defined support and resistance zones rather than short-term momentum. His chart highlights $120–$125 as a major long-term demand area, a region that has repeatedly absorbed sell pressure since the sharp correction from the $200 region. On the upside, resistance is layered between $150 and $185, where previous rallies have stalled, and supply has consistently emerged.

Solana consolidates above long-term demand as key levels define the range. Source: CryptoGerla via X

Within this framework, SOL is not showing signs of structural breakdown. Instead, price action continues to base above support, suggesting absorption rather than aggressive distribution. As long as Solana holds above the $120–$125 band, the broader structure remains constructive, with any sustained push through the $150 zone likely to act as the first signal that a larger recovery phase is starting to take shape.

Market Sentiment and Analyst Outlook

Market sentiment around solana price remains cautiously constructive. While short-term traders remain hesitant due to lack of momentum, longer-term analysts continue to point toward structural resilience rather than trend failure.

Solana’s macro structure hints at recovery if support holds. Source: Nehal via X

Nehal’s higher-timeframe chart places SOL Solana price inside a broad basing structure following a nearly 78% retracement from its peak, a magnitude historically associated with late-stage corrections rather than early bear phases. His projected recovery path outlines a gradual reclaim of $185, followed by potential expansion towards the $230–$240 region if momentum returns.

Final Thoughts

Solana price sits at a familiar crossroads. Price continues to respect a long-standing support zone while volatility compresses, suggesting that the market is preparing for a larger move rather than drifting aimlessly. The absence of panic selling, combined with repeated defenses of the $120 region, points towards structural stability rather than breakdown risk.

From a solana price prediction standpoint, the coming weeks are likely to be decisive. A reclaim of key resistance would shift sentiment rapidly, while failure would extend consolidation.