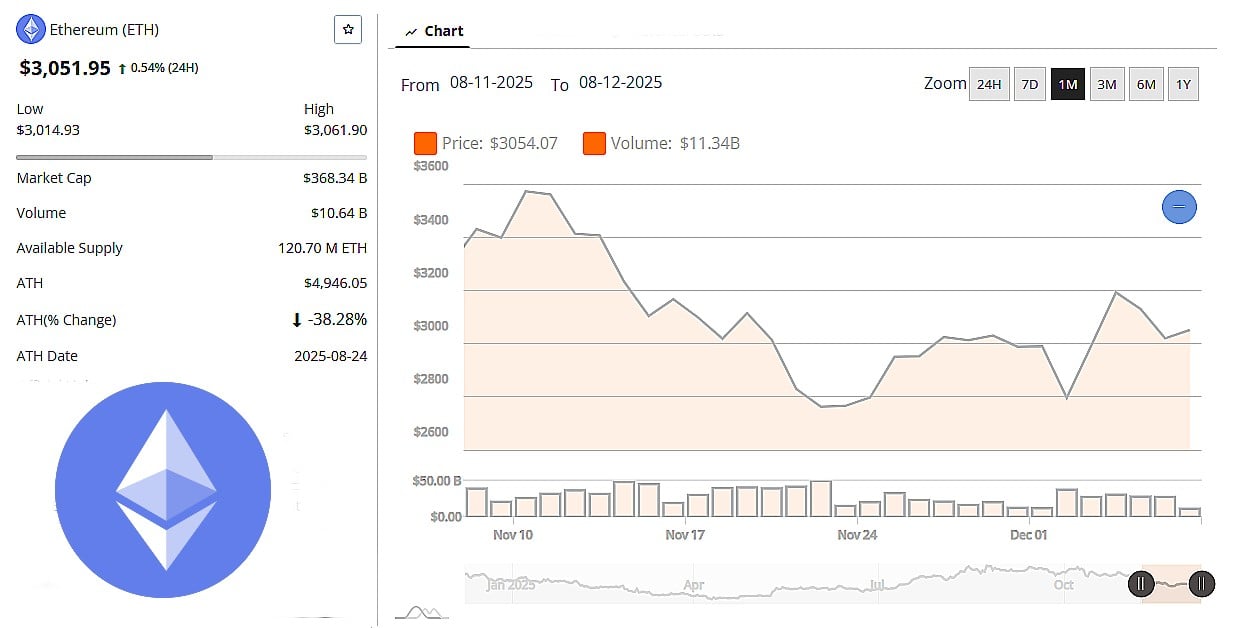

Ethereum Drops 8% in a Month as Digitap’s Presale Heats Up – Which High-Growth Presales Are Investors Flocking To?

Ethereum's recent dip has investors hunting for the next big thing. While the blue-chip asset cools off, a new wave of presales is capturing the market's attention and capital.

The Presale Gold Rush

Forget traditional IPOs—crypto's early-stage game is where fortunes get made overnight. When established giants like Ethereum show weakness, capital doesn't just sit idle. It pivots, aggressively seeking asymmetric returns in projects still on the drawing board. The math is simple: why chase a 10% gain on a top-ten coin when a presale can deliver 10x? It's a high-risk, high-reward calculus that defines the modern crypto playbook.

Beyond the Hype Cycle

Smart money isn't just chasing names; it's backing narratives with teeth. Look for projects solving real friction—scalability headaches, interoperability walls, or user experience nightmares that plague even the best chains. The winning presales offer more than a whitepaper; they present a clear, technical path to usurp incumbents. They're building the picks and shovels for the next wave of adoption, not just another meme coin waiting for its fifteen minutes of fame.

Shifting the Portfolio Calculus

This rotation isn't panic selling—it's strategic reallocation. A portion of every savvy investor's portfolio is earmarked for moonshots. Market downturns in major assets often act as a catalyst, freeing up liquidity for these precise, high-conviction bets. It's portfolio management with an edge, balancing the stability of proven assets with the explosive potential of pre-launch gems. After all, in a world of decentralized finance, sometimes the best trade is funding the project that aims to disrupt the very system you're trading in.

The momentum is clear. While analysts debate Ethereum's next support level, builders are coding the future, and investors are getting in on the ground floor. Just remember, for every presale that rockets, a dozen quietly fade into obscurity—the ultimate test of due diligence in a market that still loves a good story more than a solid balance sheet.

The new Fusaka update went live this week, bringing fresh scaling tools designed to increase data capacity and help lower transaction costs.

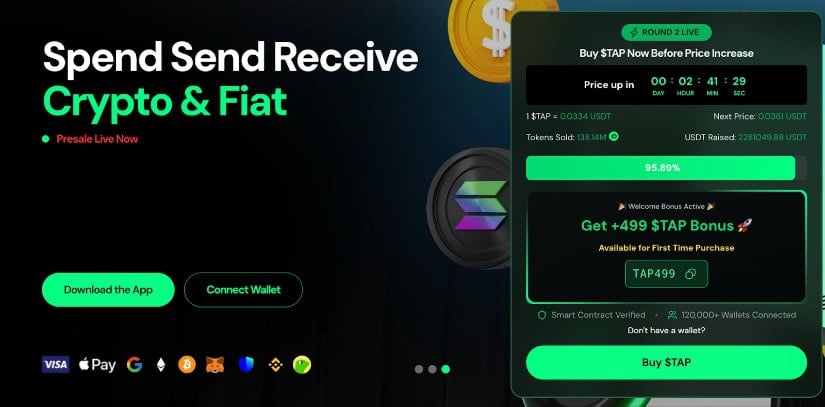

With large caps stalling, investors are increasingly redirecting capital toward early-stage opportunities such as Digitap ($TAP). This shift is reshaping conversations about the best altcoins to buy, especially in today’s crypto presale landscape.

What the Fusaka Upgrade Adds to Ethereum as Price Reaction Stalls

Ethereum’s drop this month comes at an interesting time for the network. The Fusaka upgrade (its second major update of 2025) went live at Epoch 411392, bringing bigger data capacity, lower transaction costs, and a few usability improvements. The main change, PeerDAS, is designed to handle data more efficiently across ethereum and Layer-2s, which should help with long-term scaling.

But despite the progress, ETH’s price hasn’t moved much. The broader market has been weak, and sentiment is still shaky, so the upgrade didn’t spark the reaction some might have expected. For now, most investors see Fusaka as a solid step forward, just not something that will lift prices in the short term.

ETH Technical Analysis

Ethereum is navigating a compression phase reminiscent of earlier market cycles marked by ETF outflows and macro uncertainty. With ETH above its the all-important $3000 support, analysts are watching how long this support can withstand rising volatility and reduced spot participation relative to derivatives activity. Independent analyst @TedPillows noted that a breakdown below this psychological level could expose the market to a decline toward $2,800, a scenario consistent with the 20–25% pullbacks observed during similar structural breaks in October 2023 and May 2024.

Despite a major upgrade and returning institutional interest Ethereum is down just over 8% in the last 30 days. ethereum price source: Brave New Coin ETH market data

Despite the risk-off backdrop, institutional appetite appears to be strengthening. Arkham Intelligence data confirmed that Bitmine, led by strategist Tom Lee, accumulated 64,622 ETH worth roughly $199 million within 24 hours, sourced from transactions moving through a verified BitGo hot wallet. Such accumulation historically signals long-term positioning and has often preceded volatility rebounds once liquidity normalizes.

Technical indicators paint a mixed picture. The daily MACD shows a bearish crossover while the RSI sits at 46, suggesting neutral-to-weak momentum but room for quick reversals. Should support weaken, liquidity models highlight downside zones around $2,950–$2,900 and deeper imbalance regions NEAR $2,880–$2,850, alongside a historically reactive level at $2,787 identified on long-term charts. Some quantitative models extend this risk toward $2,500 if ETF outflows accelerate or stablecoin inflows deteriorate.

For now, ETH remains in a tight consolidation range near $3,020. A daily close above $3,100 WOULD reinforce the bullish case, while a decisive break below $3,000 could redirect momentum toward the $2,800–$2,780 liquidity zones. As varying price predictions for 2025 reflect, Ethereum’s next major move will likely depend on whether this pivotal support continues to hold.

Why Utility and Access Help Digitap Outperform Recent Lows

Digitap is emerging as a standout option as investors seek projects with real-world utility rather than speculative narratives. Positioned as a live omni-bank superapp, Digitap merges fiat and crypto tools into a single, seamless account.

Users can make payments, store balances, automate savings, and MOVE money without switching between apps – a practical setup that’s especially appealing in regions underserved by traditional banking.

Digitap is available on both iOS and Android and offers zero-KYC onboarding, giving users instant global access with almost no friction. This ease of use, paired with everyday functionality, is driving early adoption and strengthening the project’s position as the best altcoin to buy in the market.

Digitap’s presale has advanced from its opening tier at $0.0125 to its current stage at $0.0361, highlighting steady progress through the project’s structured pricing model. With the token still positioned well below its targeted $0.14 listing level, early participants are engaging within a wide, clearly defined value window ahead of launch – helping to place Digitap among today’s best crypto presale categories.

What’s Next for Ethereum as Newcomers Build Early Momentum

Ethereum’s path forward will largely depend on whether the market steadies and investors start paying attention to what the Fusaka upgrade could mean long term. For now, caution still dominates. ETH must reclaim key resistance levels before a real recovery can begin.

Digitap has a different advantage in this market. The app already lets users hold stablecoins, make payments, and move money without switching platforms, and its fixed listing structure offers more certainty than most early-stage tokens. As Digitap expands to new regions, it also benefits from growth in the cross-border payments industry, which is valued at $212.55 billion and expected to reach $320.73 billion by 2030.

For investors scanning for the best crypto to buy now, the combination of real utility and discounted early-stage pricing makes Digitap one of the standout opportunities in the current cycle.

USE THE CODE “TAPPER20” FOR 20% OFF FIRST-TIME PURCHASES

Market Shows Capital Rotates Toward Best Crypto Presales

In a period when major networks are struggling to break resistance, high-growth presale Digitap is emerging as one of the best crypto investments of the moment. As capital rotates, this is a key moment for investors to explore early-stage opportunities and understand where genuine momentum is forming.

https://presale.digitap.app

https://digitap.app

https://linktr.ee/digitap.app

https://gleam.io/bfpzx/digitap-250000-giveaway