Bitcoin Battles at $93K-$94K Resistance Wall as Analysts Spot Surging Institutional Liquidity Clusters

Bitcoin is pushing against a major technical barrier. The $93,000 to $94,000 zone is the line in the sand, and a breakout could signal the next leg up.

The Institutional Tide Rises

Forget the retail frenzy of cycles past. The real story is unfolding in the order books of major exchanges and OTC desks. Analysts are tracking what they call 'liquidity clusters'—large blocks of capital sitting at key price levels, ready to be deployed. This isn't speculative money; it's strategic positioning.

These clusters act as both support and acceleration points. When price approaches, they can absorb sell pressure or provide the fuel for a rapid move higher. Their growing presence between $90K and $95K suggests institutions aren't just watching—they're building a foundation.

What a Breakout Means

A clean move above $94,000 changes the game. It would invalidate a significant supply zone and likely trigger algorithmic buying from trend-following funds—the kind of move that makes traditional portfolio managers suddenly remember they have a 'digital assets' allocation to fill.

Of course, failure here would mean a consolidation back into the high $80,000s. But the building pressure from these liquidity pools makes a bullish case hard to ignore. It’s the quiet, boring accumulation that often precedes the explosive, headline-grabbing rallies.

The market's patience is being tested. But while pundits debate the short-term noise, smart money is quietly laying the pipes for the next wave—proving once again that in finance, the loudest talk is often the cheapest commodity.

The benchmark cryptocurrency is struggling to secure a decisive move above this level as traders track rising institutional liquidity clusters, elevated ETF flows, and the broader recovery attempt following Bitcoin’s steep correction from its all-time high. With volatility gradually tightening, market participants are closely assessing whether BTC can finally break through or face another rejection.

BTC Price Struggles at a Crucial Resistance Zone

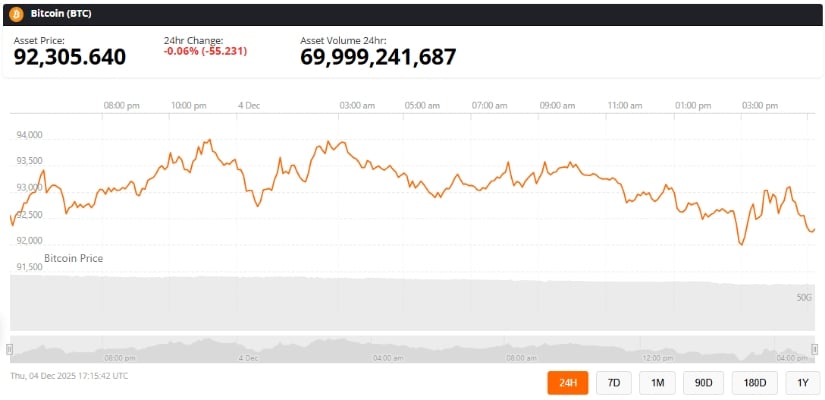

Bitcoin (BTC) continues to trade just below the $93,000–$94,000 resistance band, a level that traders widely regard as a major decision point for the market. According to data from Brave New Coin, Bitcoin is priced at $92,305, reflecting a modest 24-hour decline of 0.06%, while daily trading volumes remain elevated at nearly $70 billion.

Bitcoin battles the stubborn $93K–$94K resistance zone, with a breakout eyeing $100K and a rejection risking a drop below $90K. Source: @TedPillows via X

Market sentiment remains cautious as BTC hovers at a zone that has repeatedly triggered reversals throughout the past two weeks. Analyst Ted (@TedPillows) notes, “Bitcoin is still stuck in the $93,000–$94,000 level. A reclaim of this level will open the doors toward $100,000, while a rejection may push bitcoin below the $90,000 level.”

This range has acted as a resistance shelf since Bitcoin’s sharp 30% pullback from its $126,000 all-time high, and traders are monitoring whether BTC can reclaim momentum following November’s DEEP correction.

Institutional Liquidity Clusters Add Pressure

A growing narrative in the market is the presence of institutional liquidity clusters around the $93K–$95K area. Multiple on-chain tools, including the BTC liquidation heatmap, show stacked short positions sitting right above the current price—an area where upside breakouts tend to accelerate sharply.

Bitcoin approaches a critical resistance zone, where a clean breakout and retest could trigger its next major bullish leg. Source: @Karman_1s via X

Recent market data indicates that $400 million in short liquidations contributed to Bitcoin’s 11% rebound from November’s lows, highlighting increased participation from institutional traders and Bitcoin ETF-linked flows.

Analyst Kamran Asghar (@Karman_1s) explains the significance of the resistance zone: “Bitcoin is testing a key resistance zone—a breakout and successful retest could ignite the next strong bullish leg.”

Many analysts agree that Bitcoin must secure multiple daily closes above $95,000 to confirm a sustainable bullish continuation. Until then, the market remains caught between accumulation and hesitation, especially as investors watch for inflow signals from vehicles like the Fidelity Bitcoin ETF, BlackRock BTC ETF, and the Grayscale Bitcoin Trust.

Technical Indicators Signal a Potential Turning Point

Technically, Bitcoin’s price action on the 4-hour Binance chart shows a steady climb supported by an ascending trendline from late-November lows. This structure suggests a tightening momentum pattern where price compression may lead to a significant breakout.

Bitcoin hovers around the crucial 50-week EMA, where a rejection risks a drop to $85–92K, while a breakout could fuel a run toward $120–128K. Source: FlorinCharts on Tradingview

TradingView analyst FlorinCharts highlights the importance of the 50-week EMA, a long-term trend indicator that many institutional traders track.

He outlines two possible scenarios:

Scenario 1: Rejection and Short-Term Decline

If Bitcoin turns away from the EMA 50, the price could retreat into the $85,000–$92,000 region. A “weekly close below $99,553” WOULD indicate a weakening market structure. Lower highs on the daily timeframe would reinforce bearish short-term pressure, a pattern consistent with past cyclical consolidations.

Scenario 2: Breakout Toward $120K–$128K

A strong MOVE above the EMA 50—supported by volume—could re-establish Bitcoin’s broader uptrend. “If price closes above the EMA 50 with strength, Bitcoin could continue toward $120,000–$128,000,” the analyst notes. Higher lows forming on daily charts would add further confirmation.

FlorinCharts estimates a 70% probability that Bitcoin will experience a brief corrective dip before a medium-term breakout, suggesting the current resistance is only a temporary barrier.

Market Outlook: Volatility Expected as BTC Nears Decision Point

With Bitcoin hovering just below its most contested zone, traders remain divided. Some expect a bullish continuation fueled by ETF inflows, improving macro sentiment, and a rise in global crypto adoption—including countries like El Salvador, which continues to expand its Bitcoin strategy.

Bitcoin was trading at around 92,305, down 0.06% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

Others warn that if liquidity thins and risk assets weaken, Bitcoin may revisit lower support levels. Short-term traders are also watching the Bitcoin RSI, the BTC market cap trajectory, and broader crypto market volatility for clues about whether Bitcoin is preparing for a deeper correction or an attempt to reclaim the $100,000 psychological level.

Despite the uncertainty, long-term conviction remains strong among institutional participants such as MicroStrategy, whose large Bitcoin holdings continue to influence market confidence during corrections.