XRP Price Today: XRP Defends Multi-Month Support at $2.16, Forms Potential Double Bottom

XRP is holding the line. The digital asset is trading around the $2.16 mark, a critical level that has served as a multi-month support floor. More importantly, the price action is sketching out a potential double-bottom pattern—a classic technical setup that often signals a reversal from a downtrend.

The Technical Battlefield

For traders, this isn't just another price point. The $2.16 zone has been tested repeatedly, absorbing selling pressure and refusing to break. That resilience is what builds a foundation. Now, with the potential double bottom forming, the chart is whispering about a shift in momentum. It suggests the bears are exhausting themselves at this level, setting the stage for the bulls to mount a counter-offensive.

A Pattern of Promise (and Peril)

Double bottoms are beloved by chartists for a reason—when they confirm, they can launch significant rallies. The key is the neckline, the resistance level that caps the pattern. A decisive break above it, especially on high volume, would be the green light many are waiting for. Until then, it remains a compelling *potential*, the kind of setup that has portfolio managers leaning forward in their chairs while traditional finance still debates if crypto is 'real.'

What's Next for XRP?

All eyes are on that $2.16 support. Holding here is paramount. A breakdown could see a swift retreat to lower levels, invalidating the bullish pattern. But if the support continues to defend and the double bottom completes, the narrative flips from defense to attack. The market is poised, waiting to see if this is the moment XRP gathers its strength for the next leg up—proving once again that in crypto, the most interesting action often happens away from the mainstream headlines, in the quiet battle over a few cents on a chart.

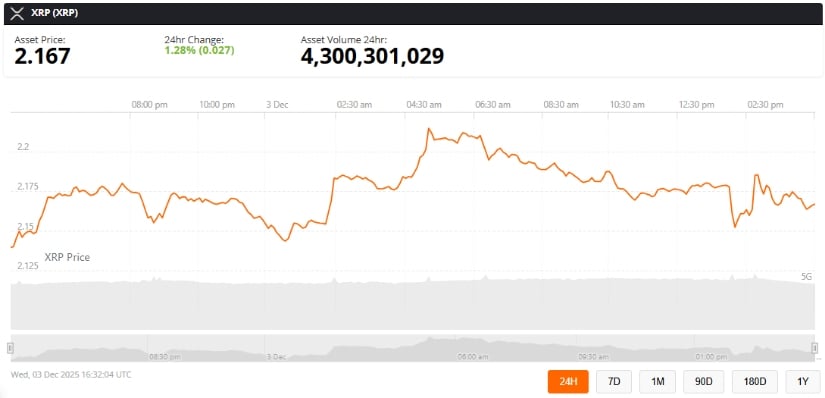

Fresh market data from Brave New Coin and TradingView shows XRP stabilizing after weeks of pressure, with more than $4.3 billion in 24-hour volume signaling strong participation across global markets. This key price zone has repeatedly influenced XRP’s medium-term trend, setting the stage for a potentially decisive MOVE as analysts monitor buyer strength along the $1.90–$2.10 demand region.

XRP Holds Steady at Multi-Month Support

The XRP price today shows the cryptocurrency holding a key technical level as it trades near $2.16, modestly higher on the day with a 1.28% gain, according to Brave New Coin data. XRP also recorded more than $4.3 billion in 24-hour trading volume, highlighting elevated participation across global markets.

XRP Defends Multi-Month Support as Traders Watch for a Potential Double-Bottom Reversal. Source: @ChartNerdTA via X

XRP—originally designed as a fast, low-cost settlement asset for cross-border payments—often reacts strongly around long-term support zones. Maintaining these levels is crucial for avoiding deeper corrections and for preserving bullish patterns on higher timeframes.

Technical analyst ChartNerd (@ChartNerdTA) emphasized the significance of the current structure in a post on X. “Hold the multi-month support line, and we may see a double bottom FORM before a break to the upside. Failing to hold, we resort back to the reaccumulation spring,” the analyst noted.

TradingView data supports this view, showing multi-month support positioned around $1.90, a zone that has influenced market sentiment from late 2025 into early 2026. The price has stabilized after pulling back from September’s $2.85 peak, and despite volatility, XRP remains above the $1.90 demand region—preserving a constructive structure

Community Reaction and Long-Term Sentiment

XRP investor sentiment remains divided. Some traders argue a previous double bottom already formed NEAR $1.80, while others point to persistent macro uncertainty and claim market manipulation. This kind of debate regularly surfaces within the XRP community due to its large retail following and years-long legal backdrop.

XRP Movement Could Trigger a Market-Wide Rush as Investors Scramble to Catch Up. Source: @amonbuy via X

Analyst Amonyx (@amonbuy) added to the long-term bullish commentary on X, encouraging patience: “The day XRP starts moving… the entire timeline will panic trying to catch up. You, on the other hand… You were here early.”

In an attached TradingView chart, the analyst highlighted a long-term descending wedge extending from 2014 to 2026 with speculative targets ranging from $27.58 to $589. These community-driven projections reflect long-standing XRP narratives but remain highly speculative and should not be interpreted as financial forecasts. Large multi-year projections are common in crypto communities and often symbolize sentiment rather than analytical probability.

Technical Outlook: A Critical Decision Point

Additional analysis from TradingView contributor SpyOnGems shows XRP trading inside a broad descending triangle on the 3-day chart—a structure often associated with continuation patterns but not guarantees. According to the shared post, XRP is currently “hovering near $2.17, just above the main demand region,” with the EMA-9 trending downward, signaling short-term caution.

XRP sits at a major decision zone as it trades inside a descending triangle, testing the $2.00–$2.10 support while facing heavy resistance from the $3.20 trendline. Source: SpyOnGems on TradingView

Key levels based on TradingView data:

-

Immediate support: $2.00–$2.10

-

Primary support: $1.90

-

Deep support: $1.80–$1.70

-

Resistance: $2.28–$2.40

-

Major trendline resistance: near $3.20

If XRP maintains support above $2.00, analysts expect potential moves toward $2.28–$2.40. A confirmed breakout above the descending trendline could open the path toward $2.80–$3.00, aligning with broader accumulation patterns.

However, technical patterns—such as double bottoms, wedges, and triangles—can fail during periods of high volatility, especially if broader market sentiment weakens. A daily close below $2.00 WOULD increase downside risk toward the $1.80–$1.70 range.

Market Context and Broader Outlook

XRP continues to operate under the shadow of the long-running Ripple vs. SEC case, a regulatory battle that has shaped investor behavior since 2020. While no major case updates accompanied the latest price action, the legal outcome remains a key factor for institutional sentiment and XRP adoption in U.S. markets.

XRP was trading at around 2.16, up 1.28% in the last 24 hours at press time. Source: xrp price via Brave New Coin

The XRP Ledger (XRPL) ecosystem is also expanding, with new token projects, AMM integrations, and ongoing developer activity. Institutional analysts note that XRPL’s technological upgrades could support future utility-driven demand, though adoption will depend on both regulatory clarity and broader market conditions.

For many traders, XRP’s present structure represents a transition phase. Strong historical support, repeated engagements with demand zones, and the possibility of a new double bottom pattern keep the cryptocurrency firmly in focus within the current XRP crypto news cycle.

While long-term projections should be viewed cautiously, XRP’s technical structure suggests a market seeking direction. The coming sessions may determine whether the cryptocurrency strengthens its support base or revisits lower ranges before attempting a broader recovery.