Hyperliquid (HYPE) Price Prediction: Double Bottom Pattern Signals Potential Surge to $40–$50 as Market Rotation Fuels Recovery

HYPE bounces hard off a critical support level—traders are watching a textbook double bottom formation that could signal the start of a major move.

The Technical Setup

That double bottom isn't just a pretty chart pattern. It's a classic reversal signal, flashing after HYPE found a floor at a major historical support zone. The second bounce was stronger than the first, suggesting selling pressure is drying up. Now, the asset needs to break and hold above the neckline resistance to confirm the pattern's bullish target.

Market Winds Are Shifting

This isn't happening in a vacuum. A broader rotation is underway—capital is trickling out of overextended large-caps and searching for high-beta plays with clear narratives. HYPE, having been oversold, fits the bill. The recovery path toward the $40–$50 range aligns with a measured move calculation from the double bottom's depth, a favorite tool of chartists who prefer lines on screens to, say, actual fundamentals.

The Road Ahead

Watch for volume. A push higher on thin volume is a trap—a genuine breakout needs conviction behind it. The $40 level is the first major psychological and technical hurdle; clearing it opens the door to $50. Failure to hold the recent support, however, would invalidate the setup and likely trigger another leg down. In crypto, a 'potential recovery' is often just a pause before the next drop—unless the bids are real.

HYPE is showing its first signs of stabilization after weeks of persistent decline, with price rebounding from the heavily watched support zone near $31 to $33. The recovery attempt comes as broader crypto markets show mixed movement, but HYPE continues to attract attention due to its strong ecosystem development and the recent emergence of clearly defined reversal signals.

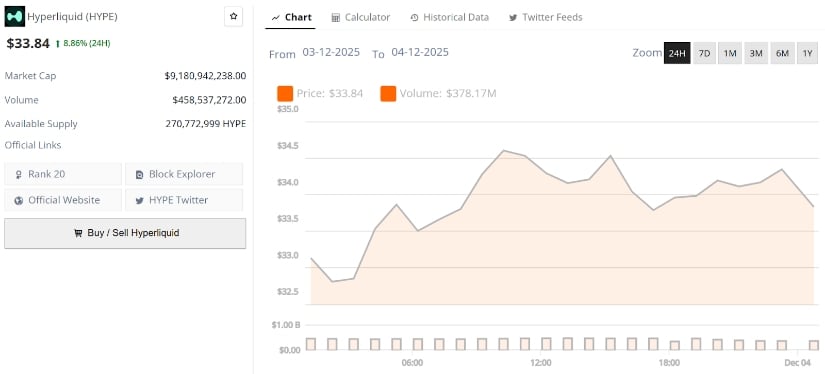

As of today, HYPE trades around $33.84, posting an 8.8% gain in the last 24 hours and re-entering a zone that many traders consider its “accumulation band.” With liquidity beginning to rotate back into mid-caps and several analysts identifying early bullish structures, market participants are now evaluating whether HYPE can sustain this bounce or whether overhead resistance will cap its momentum.

Hyperliquid’s current price is $33.84, up 8.86% in the last 24 hours. Source: Brave New Coin

HYPE Attempts First Meaningful Rebound

The most important development on the chart came from Crypto King, who highlighted that HYPE has “tapped a major support zone,” aligning with the broader confluence around $30–$32, a region that acted as the base during multiple previous cycles.

This zone has historically attracted aggressive buyers and has once again produced a clean bounce. Candlestick structure on low and mid-timeframes shows the first higher low forming, opening the door to a short-term shift in sentiment. Crypto King’s projection outlines a potential stair-step path back towards liquidity pockets at $38, $45, and $52, depending on how strongly volume expands

HYPE rebounds sharply from the $30–$32 support zone, signaling early recovery momentum as outlined in the chart. Source: Crypto King via X

The support defense is notable given the volatility across altcoins this week, and it reinforces the idea that HYPE’s market structure may be entering the early stages of a recovery phase.

$37 Resistance Zone Remains Key

A separate perspective came from Sjuul, who noted that HYPE is starting to “show some signs of life,” particularly after forming what resembles a double bottom across the $30 to $32 demand zone. Double bottoms are widely viewed as early reversal structures, especially when followed by immediate continuation.

HYPE tests the crucial $37 resistance after forming a clean double bottom across the $30–$32 demand zone. Source: Sjuul via X

However, Sjuul stressed caution around the $37 level, identifying it as HYPE’s most stubborn short-term resistance. This zone lines up with a failed breakdown in late November and has since acted as a strong supply block. A clean reclaim of $37 is required before bullish continuation becomes more realistic.

If HYPE closes above this threshold with solid momentum, the chart opens into a much more favorable structure that could accelerate directly towards $42–$45, where the next reaction area sits.

Market Rotation Discussion Adds Macro Context for HYPE

Macro commentary from Trader XO added an important higher-level angle. The analyst highlighted that Hyperliquid is “fundamentally good” and well-positioned in its category, suggesting that HYPE could outperform lower-quality assets in the next cycle.

XO emphasized that HYPE may eventually challenge half of Solana’s market cap under strong market conditions, especially during 2026–2027 if rotation into performant L1-adjacent ecosystems strengthens. Such commentary provides critical context for long-term investors evaluating HYPE’s relative strength versus other mid-cap tokens.

Bold Long-Term Targets Enter the Spotlight

Adding to the bullish conversation, Lotion_joe stated that after accurately calling HYPE’s bottom earlier this year, the next major target is $200 per HYPE in 2026. While deeply speculative, this target aligns with a macro expansion scenario in which Hyperliquid’s ecosystem continues to grow at an exponential rate and liquidity migrates toward highly efficient L1 systems.

Analyst highlights a bold long-term roadmap, projecting a potential MOVE towards $200 if HYPE secures major structural reclaim levels. Source: Lotion_joe via X

This projection also connects with broader market expectations that HYPE may become one of the standout performers in the next high-liquidity phase, assuming it can reclaim the key resistance level at $37.

HYPE Price Prediction: Outlook and Scenarios

The near-term outlook for HYPE depends heavily on how the price behaves around the critical $37 resistance zone. If HYPE successfully reclaims this level with expanding volume, the next targets fall between $42 to $45, followed by an extension into $50 to $52 where major historical supply resides. Breaking above these regions WOULD shift sentiment decisively, opening a potential mid-range move toward $60 and eventually testing the higher timeframe projection around $80 if broader market conditions remain supportive.

Conversely, if HYPE fails to clear $37, the price may retest the underlying support at $31 to $33, forming a deeper base before attempting another breakout. A loss of this structure could expose the $27 region, although analysts emphasize that such a move would likely require macro volatility or liquidity shocks.

Final Thoughts

Hyperliquid is at an important crossroads, with strong early signs suggesting that a potential reversal is underway. The combination of a defended support zone, double-bottom attempts, improving market rotation, and bold long-term analyst targets has placed HYPE back on the radar of active traders and long-term investors alike.

A reclaim of $37 remains the defining trigger for the next expansion phase. Until that happens, HYPE continues to trade within a constructive but unconfirmed recovery structure.